Naked Shorts Run For Cover

By Colin Twiggs

July 17, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Stocks

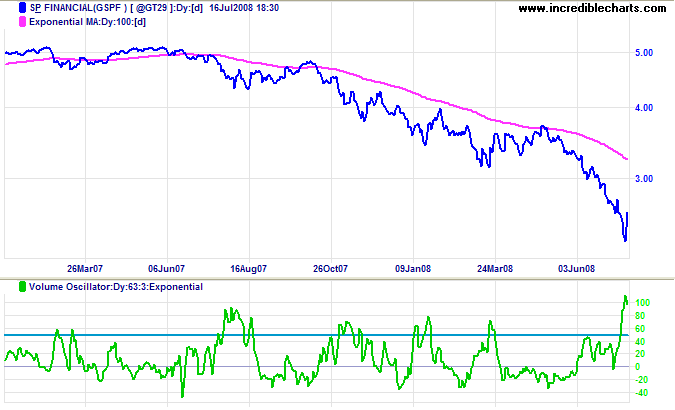

The Securities and Exchange Commission introduced an emergency order preventing naked short sales of securities in Fannie Mae, Freddie Mac and primary dealers such as Citigroup, Lehman Brothers, Merrill Lynch and Morgan Stanley (DSnews). Exposed traders were forced to cover their shorts, causing a rally in the financial sector.

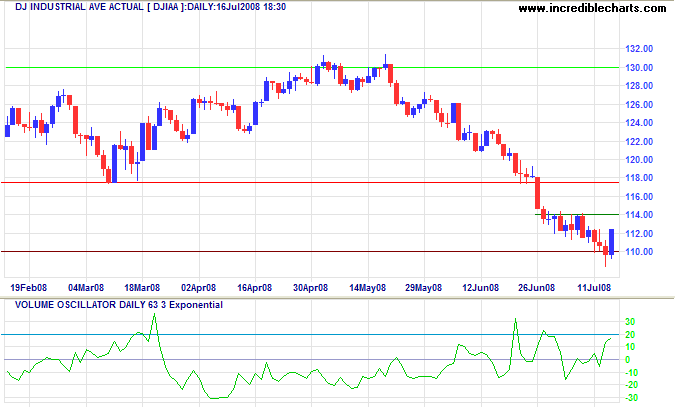

The Dow recovered above 11000, strong volume indicating the depth of support. Expect short-term resistance at 11400, with stronger levels at 11750. Reversal below 11000 would warn of a decline to 10700.

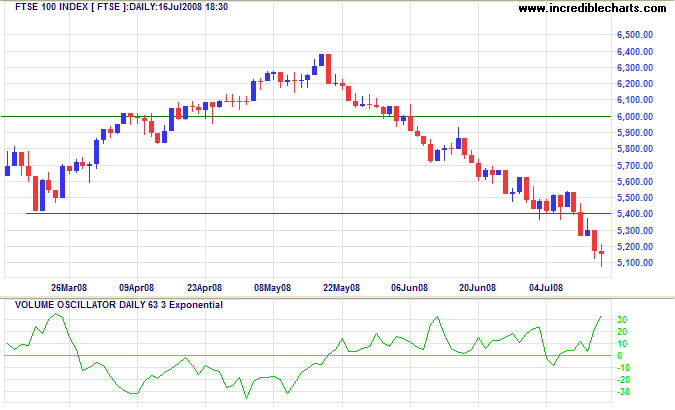

The FTSE 100 displays long tails and strong volume, indicating short-term support. Expect a retracement to test resistance at 5400.

Crude Oil

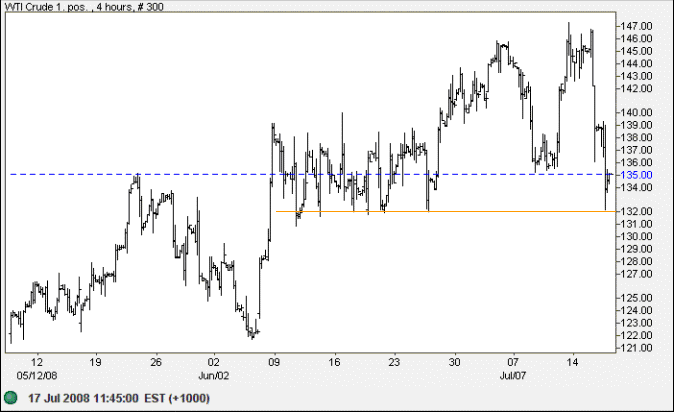

West Texas Intermediate Crude fell sharply, breaking short-term support at $135 and warning of a secondary correction. A fall through the next support level at $131/$132 would confirm the signal. Primary support remains at $100.

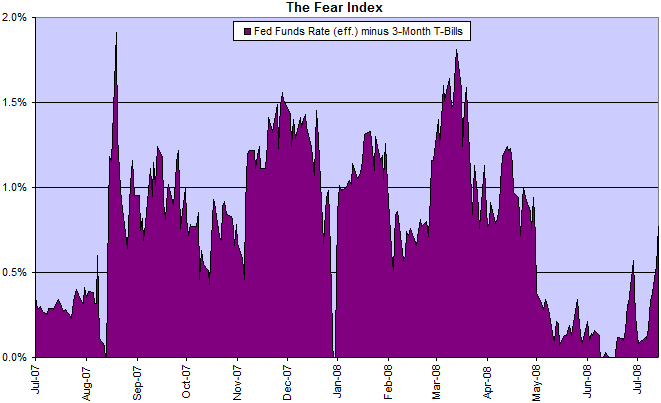

The Fear Index

The spread between the fed funds rate and 3-month T-bills widened, warning of rising uncertainty in financial markets.

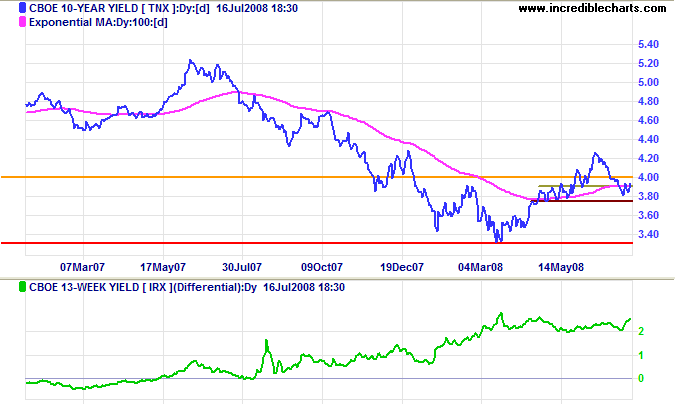

Treasury Yields

Ten-year treasury yields have so far respected support at 3.75 percent. Failure would warn of a test of 3.30 percent, while recovery above 4.00 percent would signal another advance. The yield differential (with 13-week treasury bills) remains healthy at above 2.0 percent.

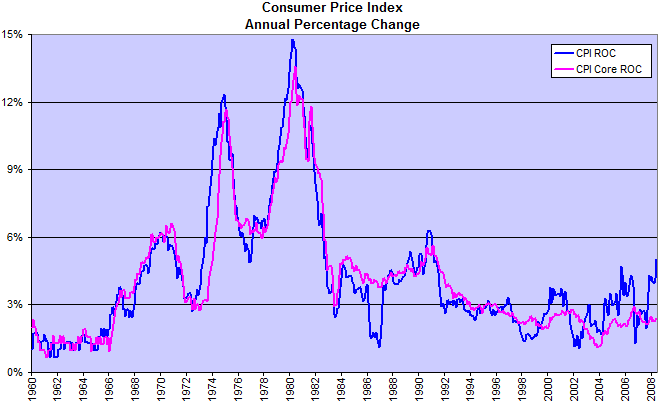

Inflation

The consumer price index made a new high, confirming the up-trend. Expect core CPI, which excludes food and gas, to follow.

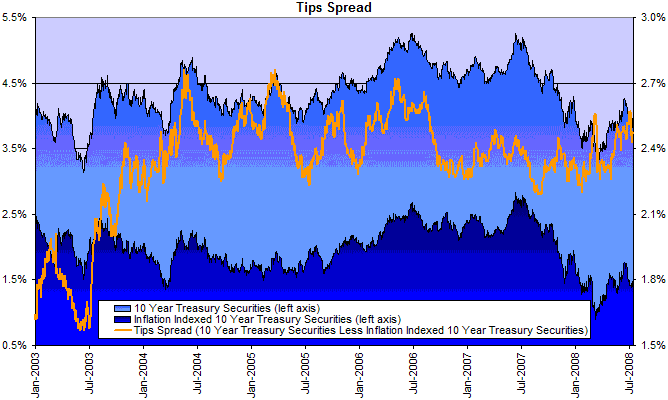

The spread between 10-year treasurys and the equivalent TIPS rate is edging upwards, but there are no signs of a strong trend as in 2003 to 2004. Breakout above the recent 2008 highs would confirm that inflation expectations are rising.

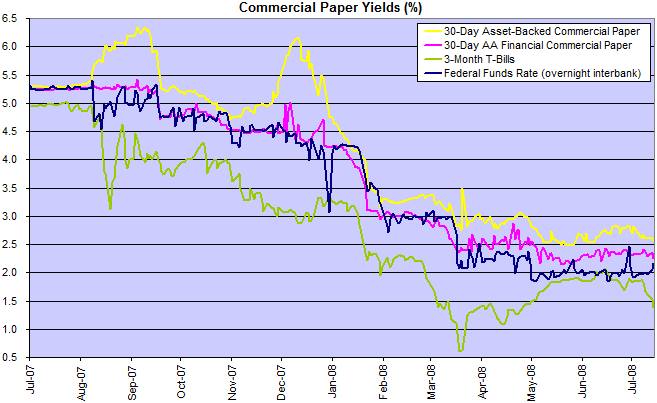

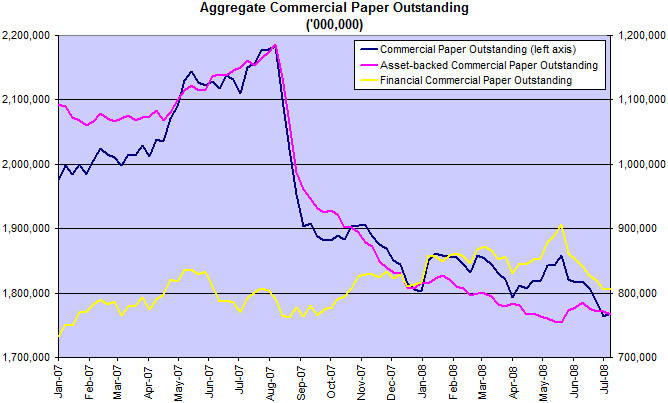

Financial Markets — Commercial Paper

Falling 3-month treasury bill yields reveal increasing concerns regarding bank stability, with investors prepared to accept lower rates in exchange for the relative safety of treasurys. The credit squeeze is far from over.

Declining commercial paper in issue aggravates the credit squeeze.

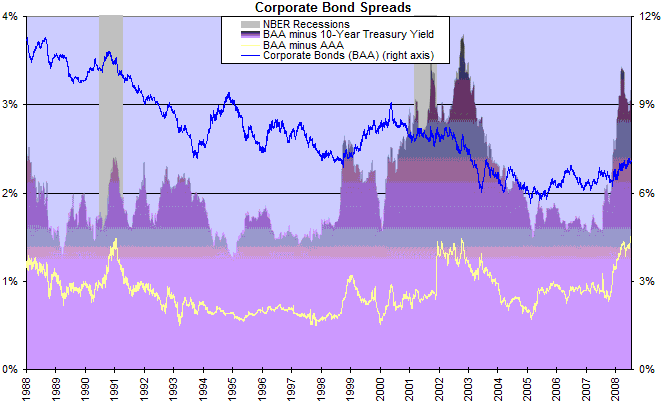

Corporate Bonds

Corporate bond spreads remain at levels last seen in 2003: further confirmation of the credit squeeze.

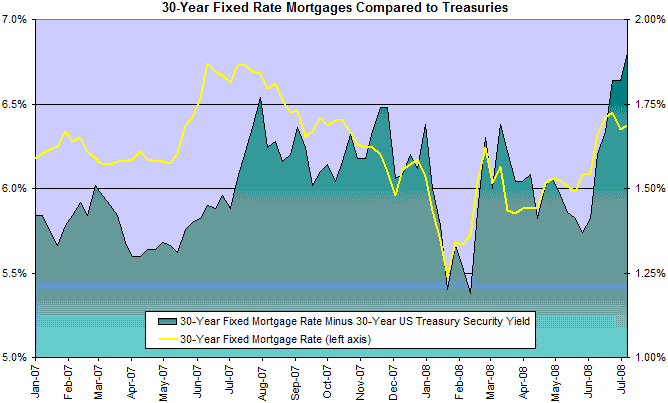

Housing

Rising spreads between fixed mortgage rates and equivalent treasury yields reflect banks' reluctance to lend, maintaining downward pressure on house prices.

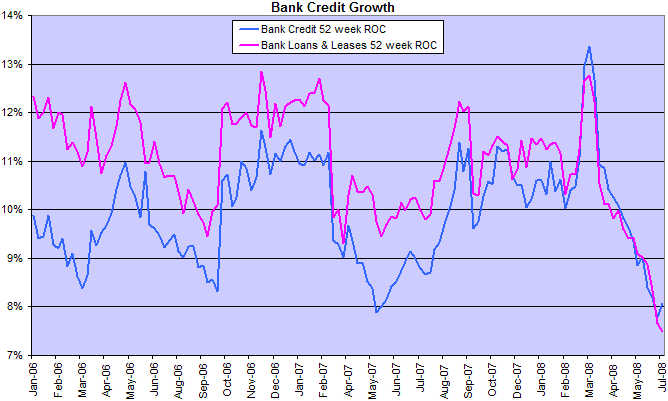

Bank Credit

Declining credit growth, as banks attempt to shore up their balance sheets, will slow consumption and new investment.

The Fed continues to support the financial system with record levels of credit. Discount window credits and primary dealer credit facilities are declining, but term auction credit remains at $150 billion. And a new item appears on the Fed balance sheet: $29 billion net holdings in Maiden Lane LLC — the conduit used for the Bear Stearns bailout.

Wright Model

Jonathan Wright's recession prediction model remains at zero. In future I will only report on this when there is a significant change.

Life, if well lived, is long enough.

~

Seneca (5 BC - 65 AD).

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.