Housing Woes Continue

By Colin Twiggs

June 26, 2008 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Stocks

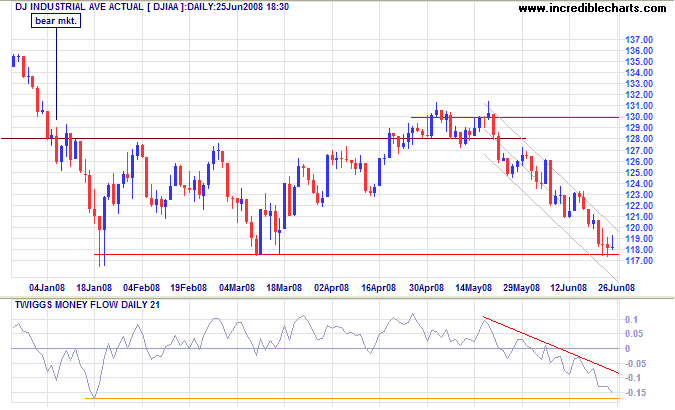

The Dow is testing primary support at 11750. Volume is light and Twiggs Money Flow falling — both warning of weak support. Expect primary support to fail, offering a target of 11000.

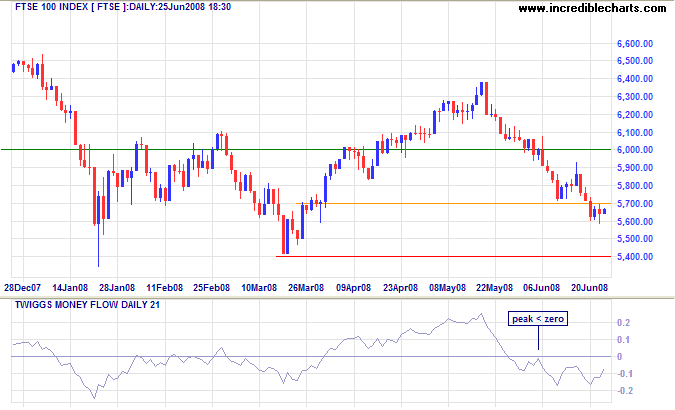

The FTSE 100 index is consolidating between 5700 and 5600; a continuation signal. A fall below 5600 would test primary support at 5400. Twiggs Money Flow holding below zero signals selling pressure. In the longer term, failure of primary support would offer a target of 5400-(6400-5400)=4400.

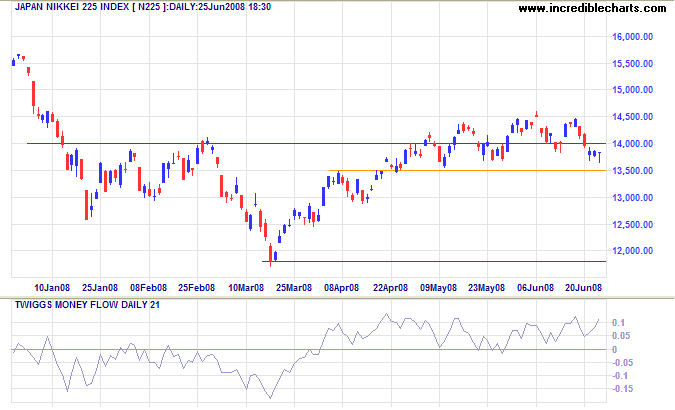

The Nikkei 225 index is the most bullish of the indices reviewed, with Twiggs Money Flow holding above zero to signal buying pressure. A word of caution: despite the accumulation, losses in other major markets could drag the Nikkei lower.

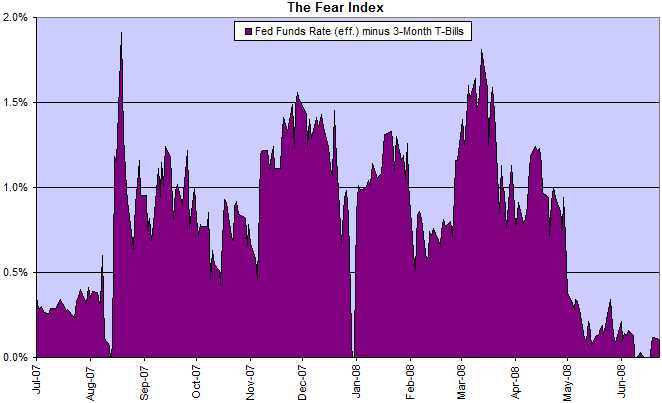

The Fear Index

Financial markets remain relatively stable, with the spread between the fed funds rate and 3-month T-bills close to zero. The gap would widen if institutional investors become fearful of lending to banks and resort to the safety of treasury-bills, driving the yield lower.

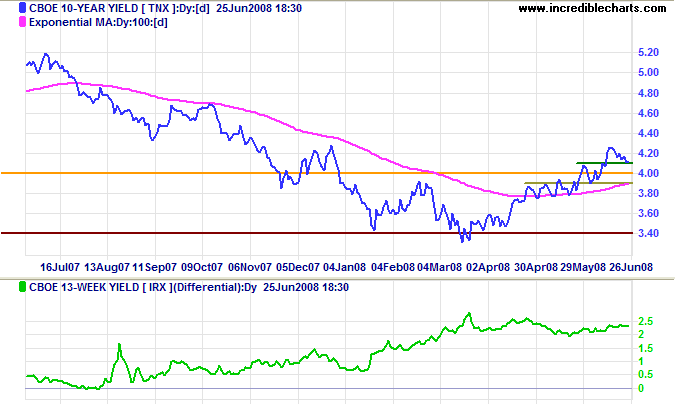

Treasury Yields

Ten-year treasury yields have started a primary up-trend. Respect of the first (short-term) support level at 4.10 percent would signal trend strength; failure of the second level at 3.90 percent would indicate weakness. The yield differential shows that bank margins are relatively healthy (their troubles lie elsewhere: rising default rates and falling collateral values).

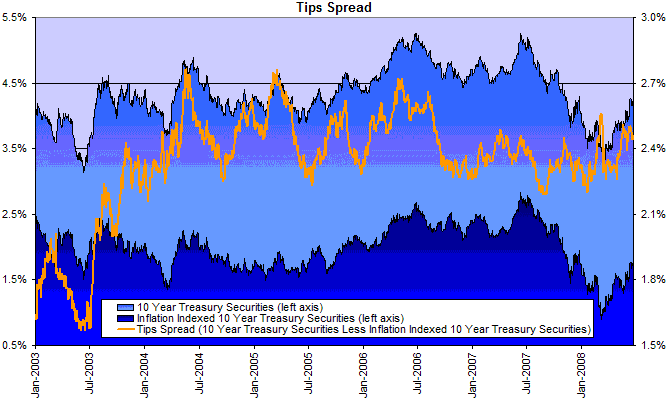

Inflation

Inflation expectations (as indicated by the spread between 10-year treasurys and the equivalent TIPS rate) remain subdued. A rise above 2.7% (right scale) would be cause for concern.

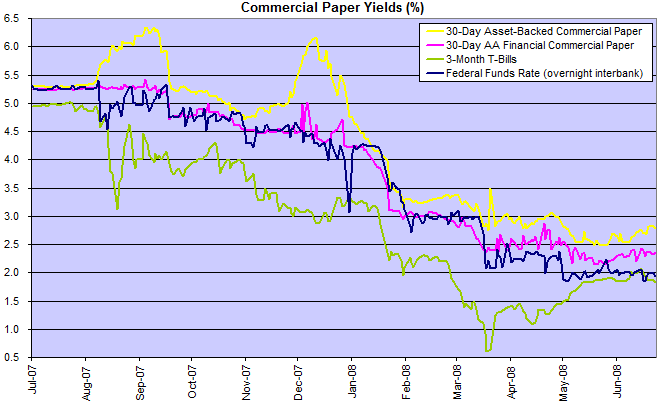

Financial Markets — Commercial Paper

The Fed kept rates on hold at the latest FOMC meeting. Continuing dips of the effective fed funds rate below its 2 percent target indicate that downside pressure remains and a rate hike is not imminent. Rising yields on asset-backed commercial paper indicate continued pressure on banks off-balance sheet funding. Citigroup banking analysts estimate that banks will have to restore up to $5 trillion of assets to their balance sheets, according to the WSJ, exacerbating the existing credit squeeze.

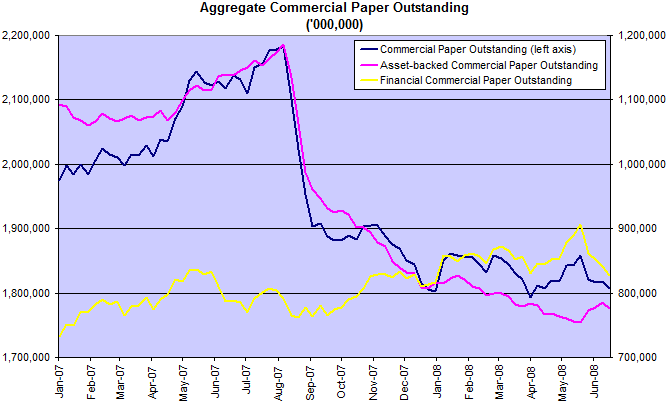

Total asset-backed commercial paper in issue continues to shrink.

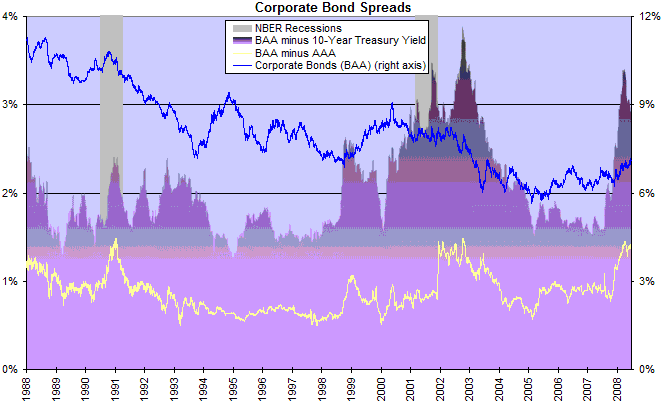

Corporate Bonds

Corporate bond yields are rising in line with long-term treasury yields, slowing new investment.

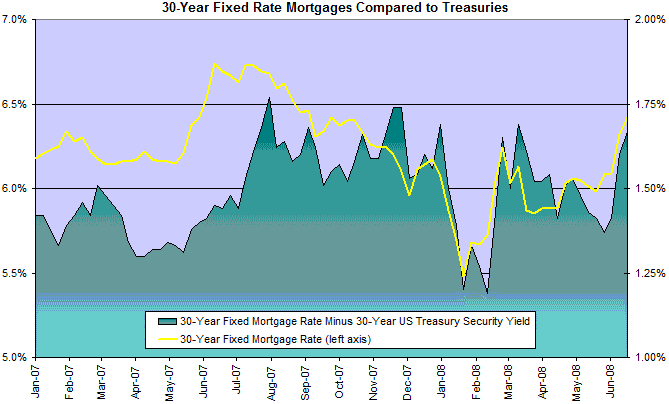

Housing

Fixed mortgage rates are rising in sympathy with long-term treasury yields, increasing downward pressure on the housing market.

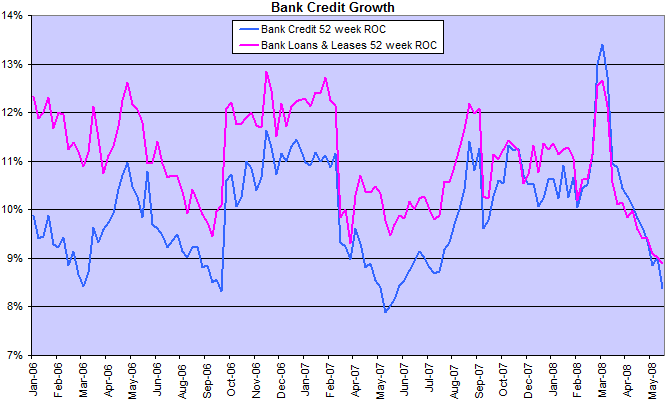

Bank Credit

Credit growth continues to fall as banks shore up their balance sheets. This will in turn affect consumption and new investment, slowing the economy.

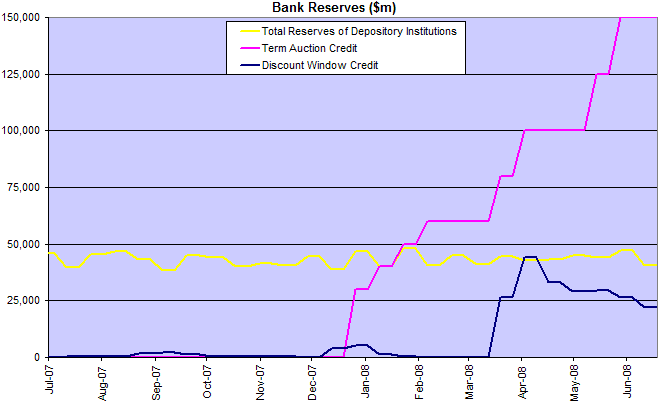

Fed term auction credit facilities total $150 billion. A fall in this figure would indicate that the credit squeeze is easing, but don't hold your breath. I expect facilities to increase over the next 6 to 12 months.

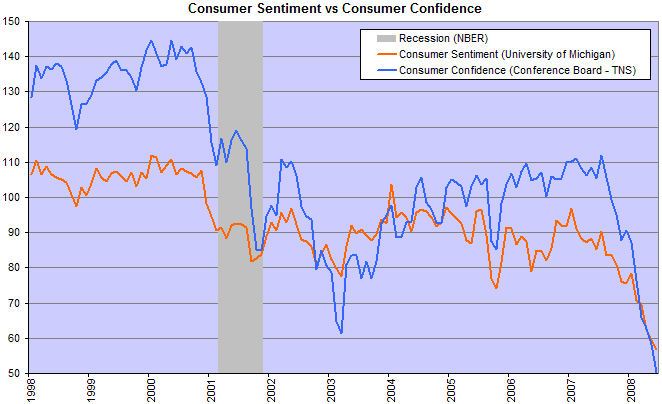

Consumers

Consumer confidence is taking a pounding from falling housing prices and rising crude oil prices. Expect a cut back in spending, further slowing the economy.

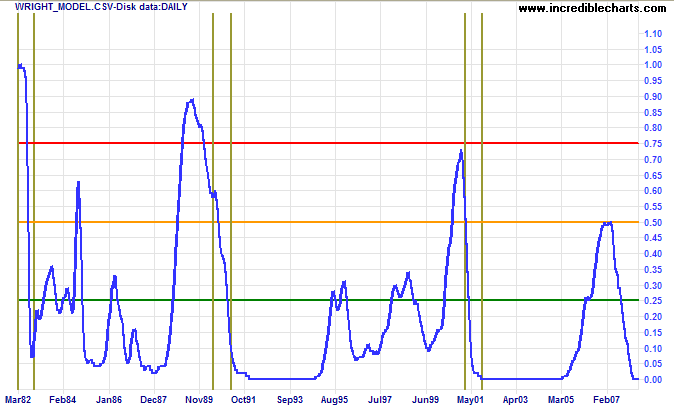

Wright Model

Jonathan Wright's recession prediction model remains at zero. The model looks four quarters ahead and does not reflect that we are currently in (or about to enter) a recession.

About 40 percent of the 7 million subprime loans outstanding will default in the next two years.

The defaults of option-adjustable-rate mortgages and other mortgages subject to rate reset will be of the same order of magnitude

but over a somewhat longer period of time.

This will maintain the downward pressure on house prices.

~ George Soros:

The New Paradigm For Financial Markets:

The Credit Crisis Of 2008 And What It Means

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.