Mortgage Rates Rise

By Colin Twiggs

June 19, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

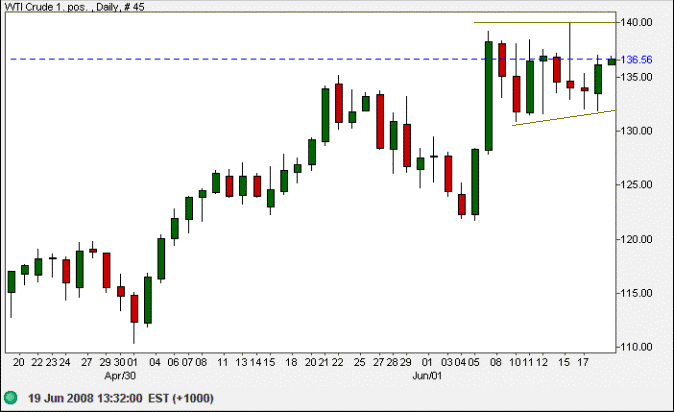

Crude Oil

West Texas Intermediate crude is consolidating below $140. Short, narrow consolidations are typically continuation patterns — and breakout above $140 would offer a target of $135+(135-122)=148. Retracement below $132 is less likely and would test support at $120/122.

In the longer term, failure of support at $120 would signal a test of $100.

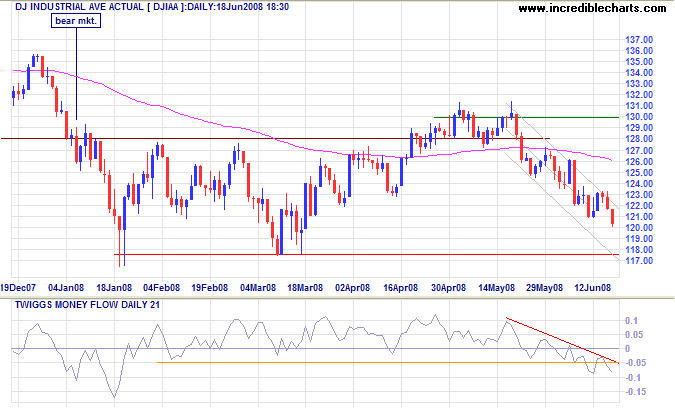

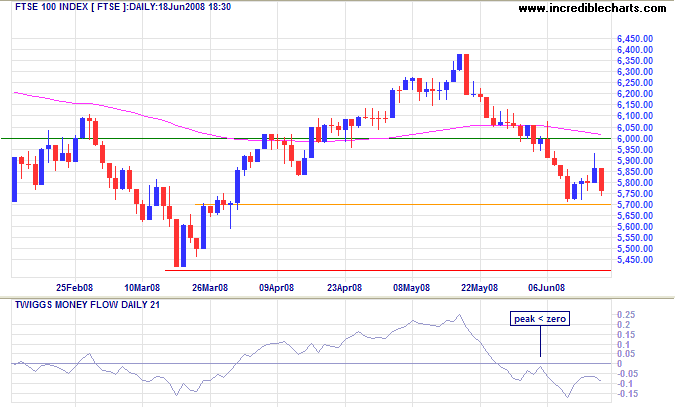

Stocks

The Dow broke short-term support at 12100 and is headed for a test of primary support at 11750. Twiggs Money Flow below -0.05 warns of abnormal selling pressure. Failure of primary support would offer a target of 11000.

The FTSE 100 index is testing support at 5700. Failure is likely, because of the down-trend, and would test primary support at 5400. In the longer term, failure of primary support would offer a target of 5400-(6400-5400)=4400.

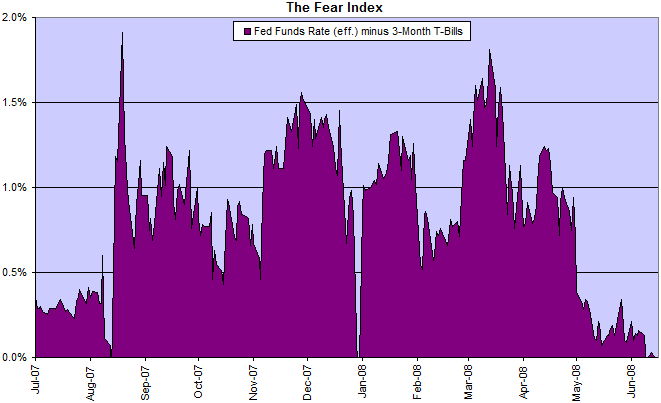

The Fear Index

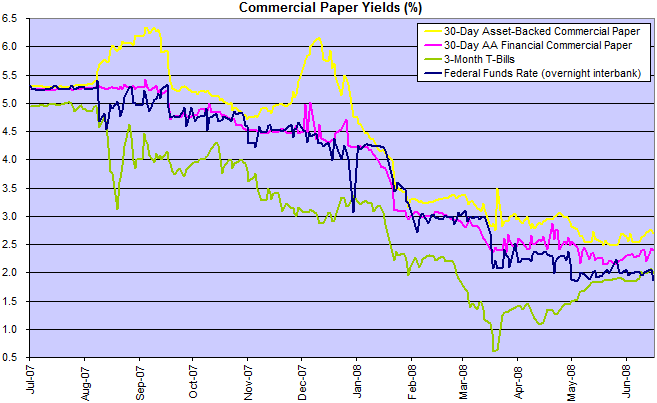

Stability is returning to financial markets, with the spread between the fed funds rate and 3-month T-bills close to zero.

There is some talk of phase 2 of the credit crunch (CNN), resulting from defaults on commercial and industrial loans, but this is unlikely to be as spectacular as phase 1. A greater threat to the financial system is further write-offs resulting from the continuing fall of housing prices. (John Hussman)

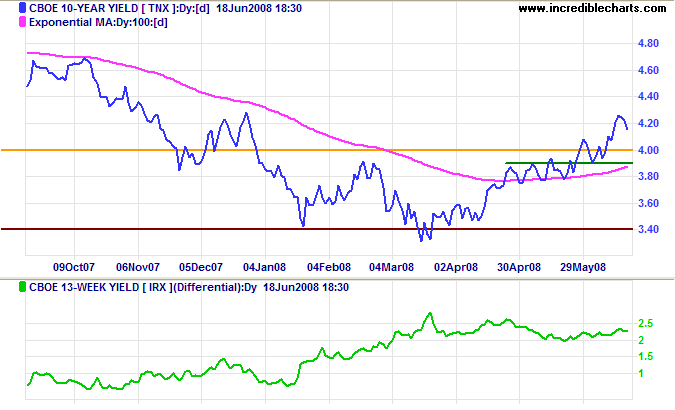

Treasury Yields

Ten-year treasury yields have started a primary up-trend. Expect a retracement to test the new support level at 4.00 percent to confirm the up-trend. Rising mortgage rates will expose banks to further losses from falling house prices.

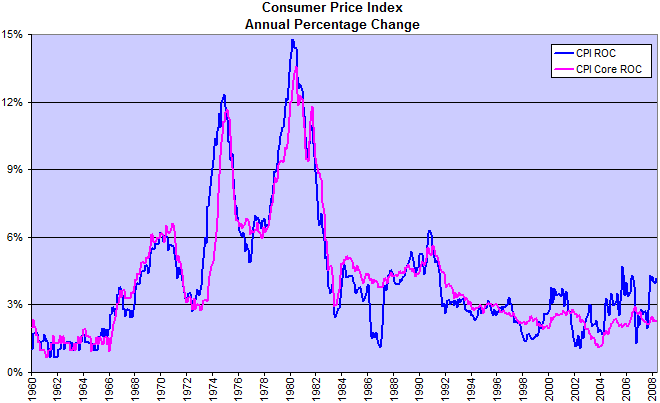

Inflation

The consumer price index is edging upwards, but core CPI, excluding food and gas, remains low.

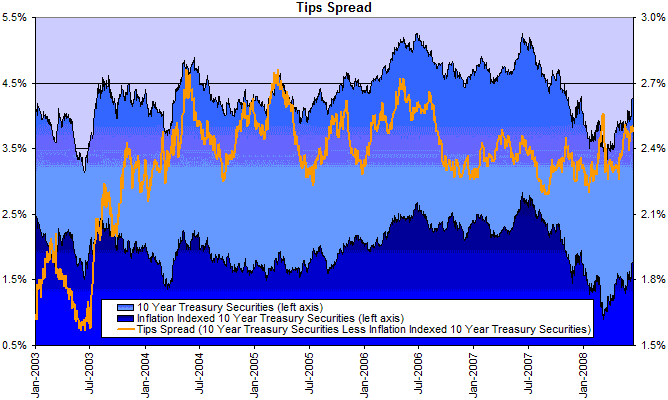

Inflation expectations (as indicated by the spread between 10-year treasurys and the equivalent TIPS rate) ticked up slightly, but only a rise above 2.7% (on the right scale) would be cause for alarm.

Financial Markets — Commercial Paper

The Fed funds rate dipped below its 2.00% target, indicating that further rate cuts remain a higher probability than a rate hike. Rising commercial paper yields warn that marginal funding costs for financial institutions are high, reducing credit growth.

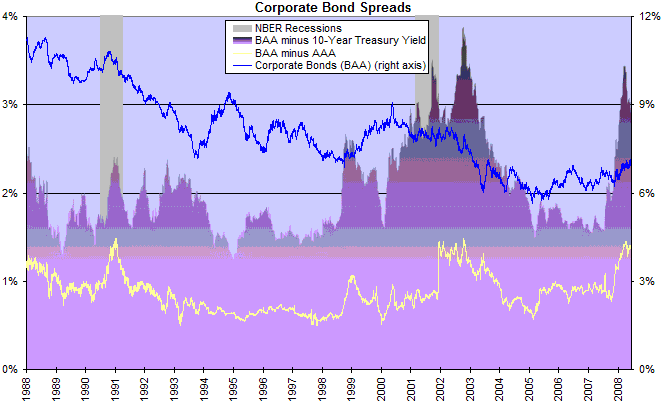

Corporate Bonds

Corporate bond yields are rising in line with treasury yields, slowing new investment.

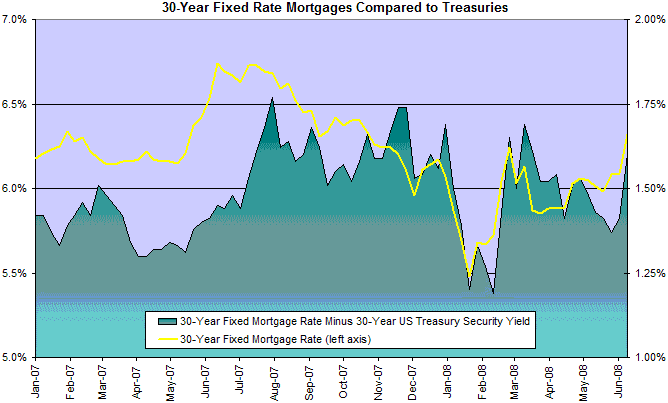

Housing

Rising fixed mortgage rates are expected to cause further pain in the housing market.

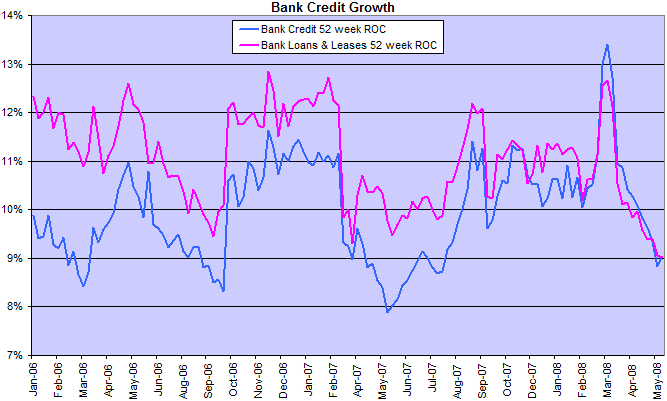

Bank Credit

Credit growth is likely to fall as banks shore up their balance sheets. This will in turn affect consumption and new investment, slowing the economy.

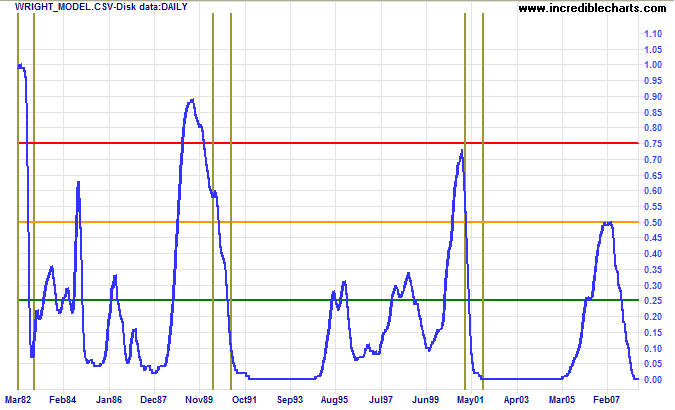

Wright Model

Jonathan Wright's recession prediction model remains at zero. The model looks four quarters ahead — and does not reflect that we are currently in (or about to enter) a recession.

The excellence of the old-fashioned big family was that no child got an undue amount of attention.

The antique idea that the child must work for his parents until the day he was twenty-one

was a deal better for the youth than to let him get it into his head

that his parents must work for him.

~ Elbert Hubbard (1856 - 1915)

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.