Stocks Weaken As Bond Yields Rise

By Colin Twiggs

June 12, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

If you haven't already done so, please help us to improve our newsletter and charting services by completing this quick one-minute survey.

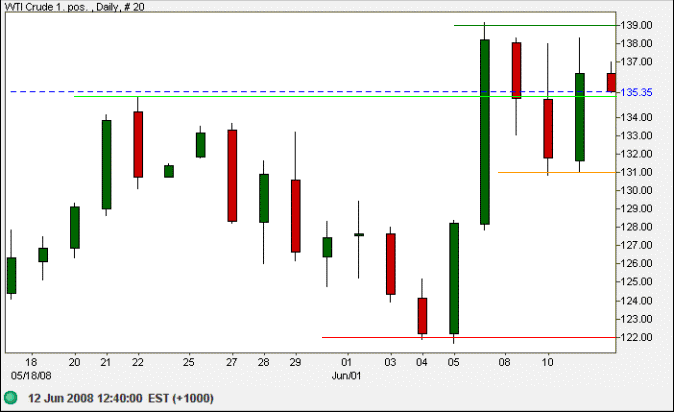

Crude Oil

West Texas Intermediate crude is consolidating between $131 and $139. Reversal below $131 would warn of a test of $122, while breakout above $139 would offer a target of $135+(135-122)=148. A retracement that respects support at $135 would also be a bullish sign.

Oil prices are predominantly driven by rising world demand, as China and India increase their energy consumption. Considering that we have a static or shrinking supply, higher prices are inevitable. Rather than accept blame for failing to respond to a threat which has been on the horizon for some years, politicos are looking for a convenient scapegoat. Either oil companies or commodities index funds will do.

The only way to cut oil prices is to reduce demand. That means a recession in the short term — and an accelerated alternative fuels program in the long-term.

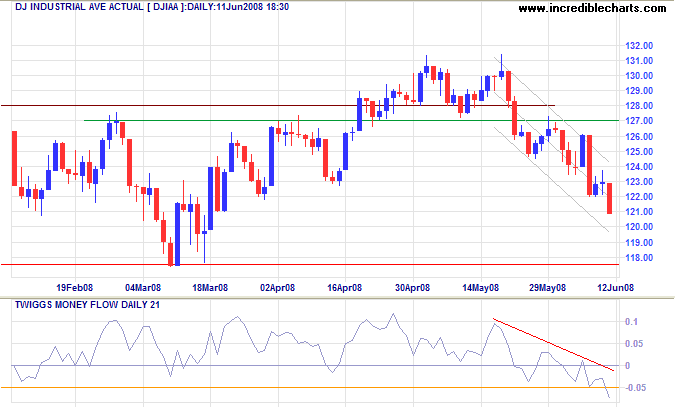

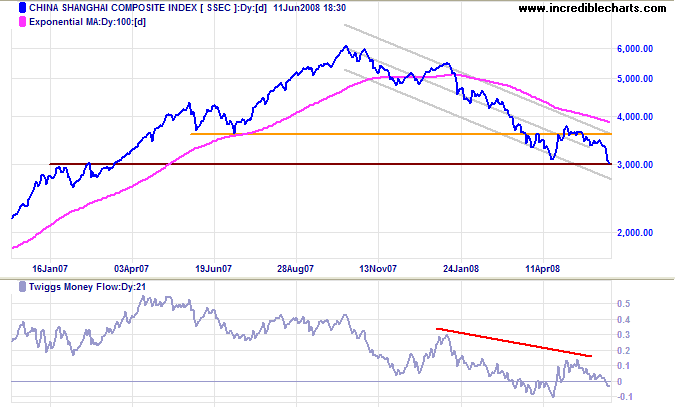

Stocks

The Dow broke through short-term support at 12200 and is headed for a test of primary support at 11750. Twiggs Money Flow fell below -0.05 warning of abnormal selling pressure. Failure of support would offer a target of 11000.

The Shanghai Composite is already testing primary support at 3000. Failure would offer a target of 3000-(3750-3000)=2250, possibly 2000.

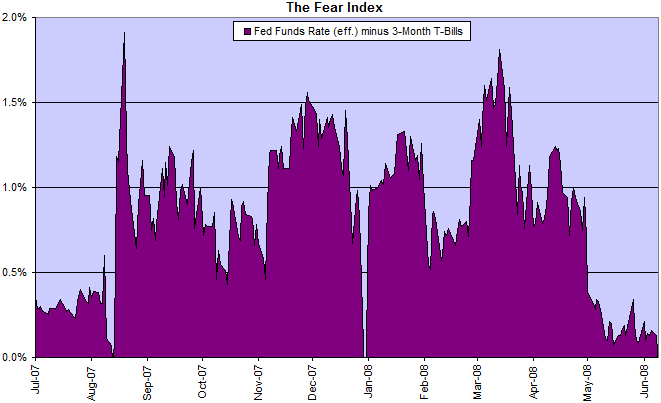

The Fear Index

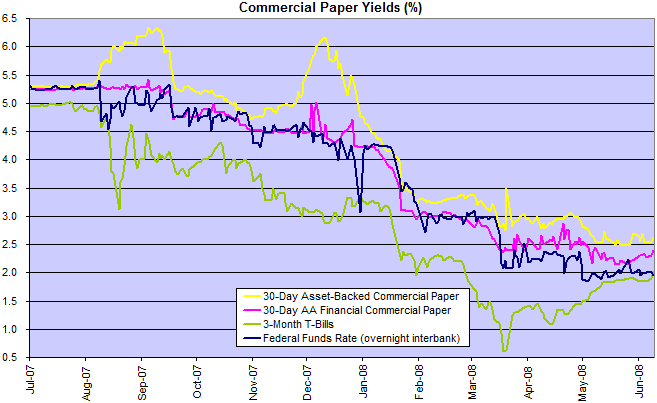

Financial markets remain relatively stable, thanks to some decisive action by the Fed. The spread between the fed funds rate and 3-month T-bills remains below 0.50 percent.

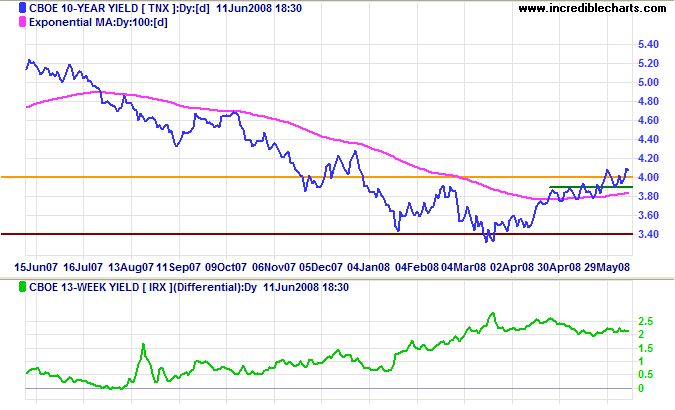

Treasury Yields

Ten-year treasury yields respected short-term support at 3.90% before reversing above resistance at 4.00 percent to signal an up-trend. While this is a positive long-term sign for the economy, rising mortgage rates will expose banks to further losses from falling house prices.

Financial Markets — Commercial Paper

The Fed has indicated that further rate cuts are unlikely but continued dips of the fed funds rate its 2.00% target would warn that they are under pressure. Rising commercial paper yields warn that funding costs for some financial instutions, and most off-balance sheet strucures, are increasing. This will impact on both profitability and credit growth.

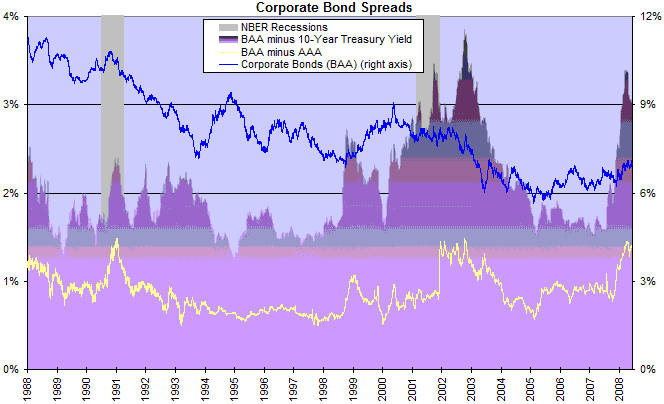

Corporate Bonds

Corporate bond spreads remain high, reflecting the liquidity squeeze. Expect bond rates to rise in line with treasury yields, slowing new investment.

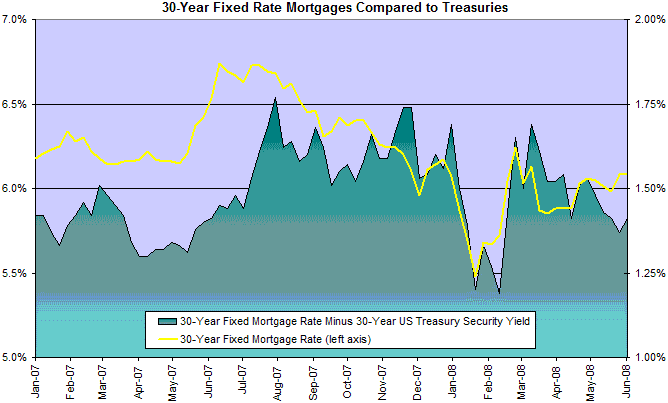

Housing

Expect fixed mortgage rates to rise in response to treasury yields, causing further pain in the housing market.

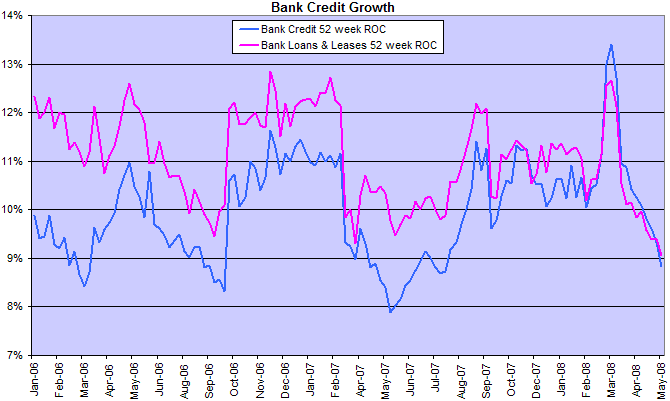

Bank Credit

Bank credit growth is expected to fall as banks attempt to shore up their balance sheets.

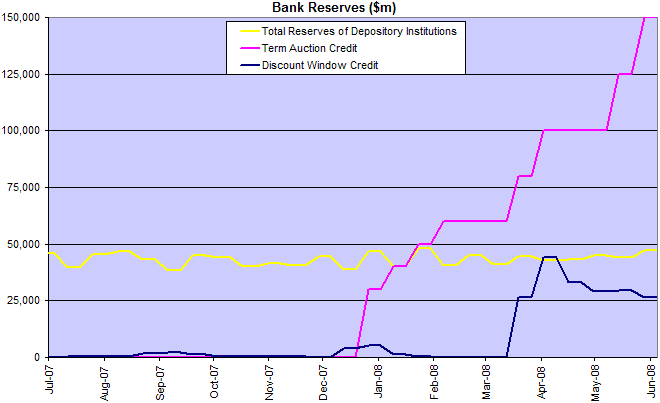

The Fed increased term auction credit by a further $25 billion, reflecting the severity of the credit squeeze in financial markets. With discount window credit above $25 billion, that brings total Fed support to more than $175 billion.

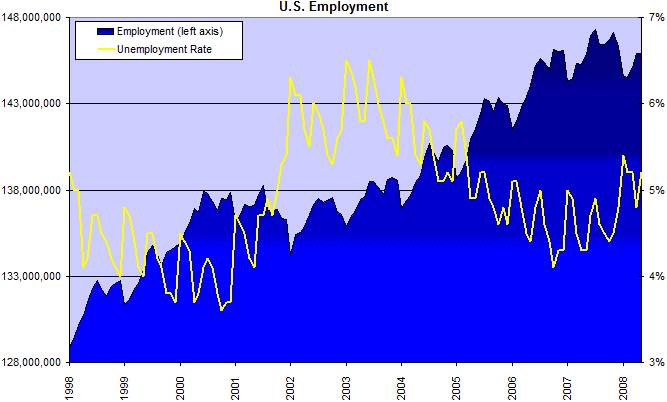

Employment

Unemployment is rising but has not yet spiked upwards as in 2001.

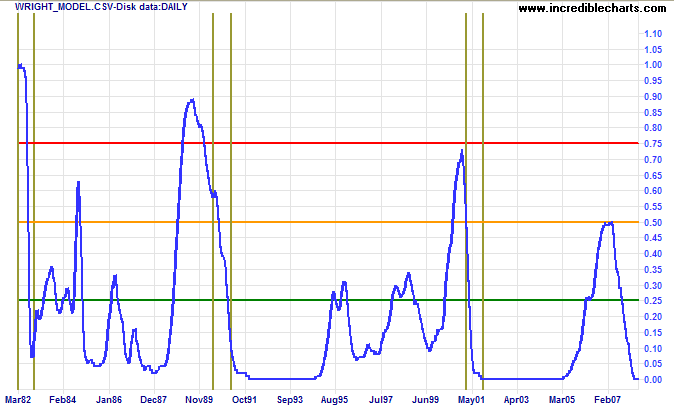

Wright Model

Jonathan Wright's recession prediction model remains at zero. Because it looks four quarters ahead, it does not reflect that we are currently in (or about to enter) a recession.

There has been a bubble in the US housing market, but the current crisis is not merely the bursting of the housing bubble.

It is bigger than the periodic financial crises we have experienced in our lifetime.

All those crises are part of what I call a super-bubble....... which has evolved over the last 25 years or so.

It consists of a prevailing trend, credit expansion, and a prevailing misconception,

market fundamentalism, which holds that markets should be given free rein.

~ George Soros:

The New Paradigm For Financial Markets

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.