Oil Softens

By Colin Twiggs

June 5, 2008 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

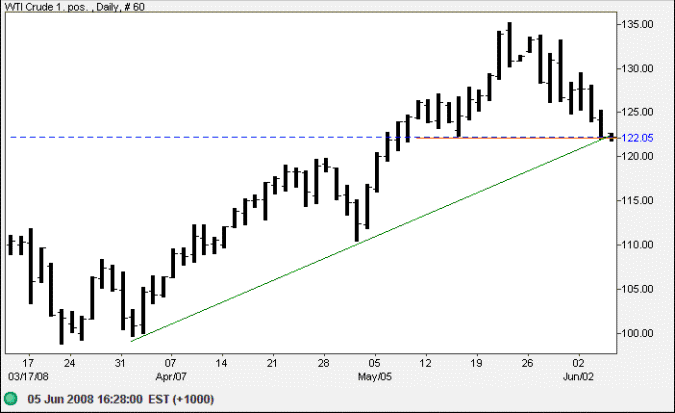

Crude Oil

West Texas Intermediate crude is testing support at $123/$122. A fall below this level would signal a secondary correction that would test support at $110 (the 50% retracement level) and possibly $100 (70% retracement of the advance from $85 to $135). Respect of support at $122 remains as likely, however, and reversal above $130 would signal another rally.

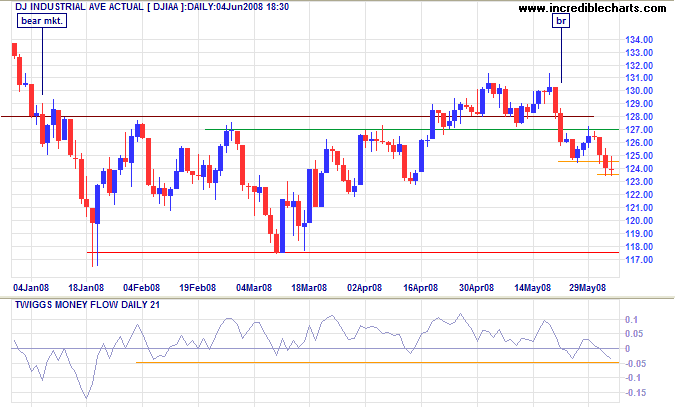

Stocks

The Dow continues in a secondary correction, headed for a test of primary support at 11750. Declining volumes over the last few months reflect investor uneasiness. A Twiggs Money Flow fall below -0.05 would warn of abnormal selling pressure.

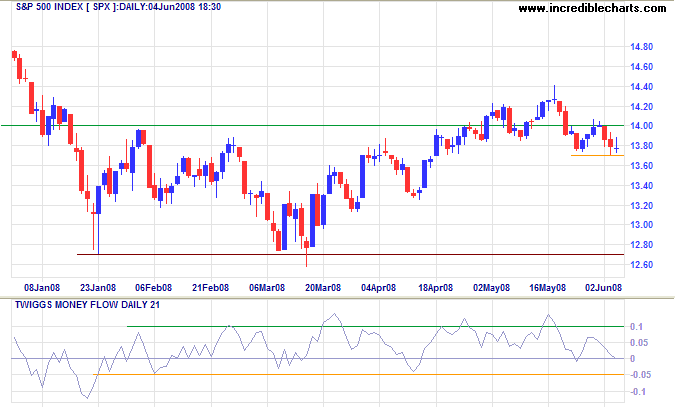

An S&P 500 fall below 1370 would confirm the Dow signal.

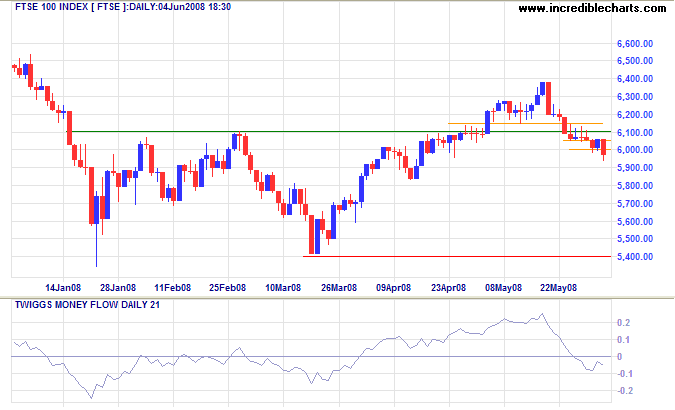

The FTSE 100 broke through support at 6000, echoing the Dow warning. Expect a test of primary support at 5400. Twiggs Money Flow declining steeply to below zero reflects unusual selling pressure.

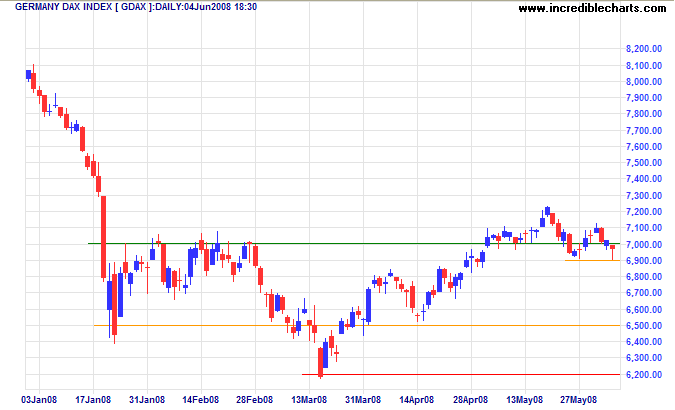

The German Dax is hesitating, like the S&P 500. Failure of support at 6900 would warn of a test of 6500 — and possibly primary support at 6200.

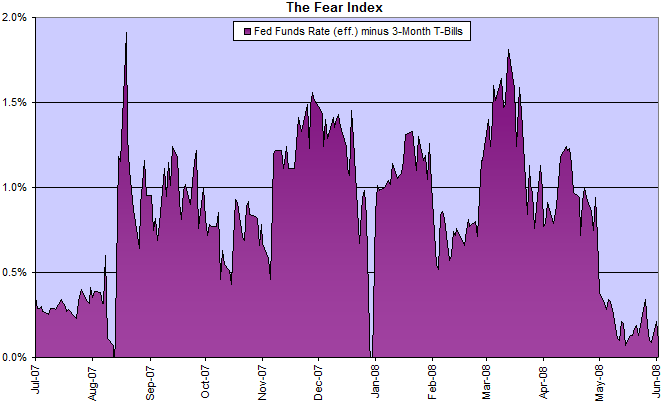

The Fear Index

Financial markets remain relatively stable — with the spread between the fed funds rate and 3-month T-bills below 0.50 percent.

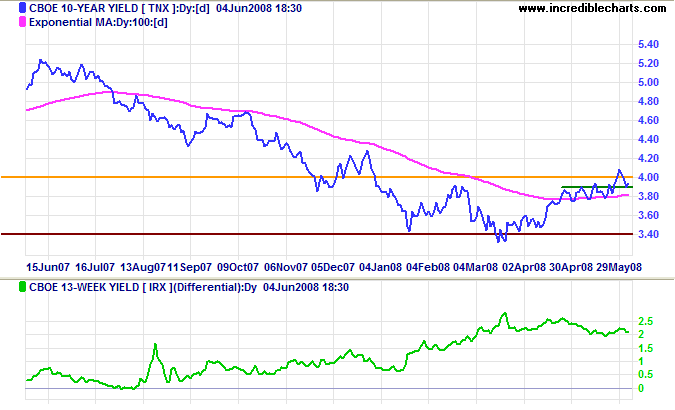

Treasury Yields

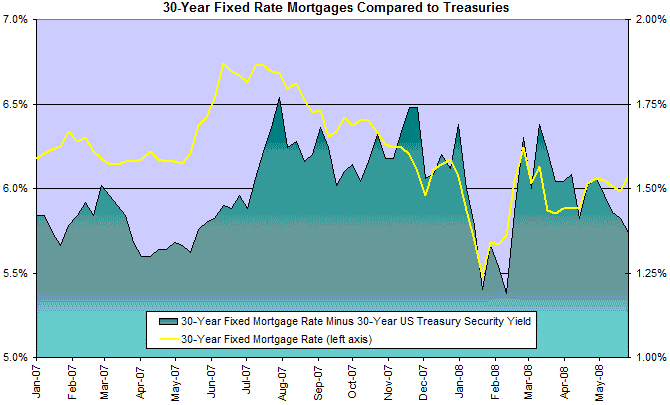

Ten-year treasury yields are testing resistance at 4.00 percent. Respect of short-term support at 3.90% would be a bullish sign. Breakout would signal the start of a primary up-trend — a positive long-term sign for the economy, allowing the Fed some leeway to raise short-term rates without risking a negative yield curve. Expect immediate pain, however, with rising mortgage rates exposing banks to further housing losses.

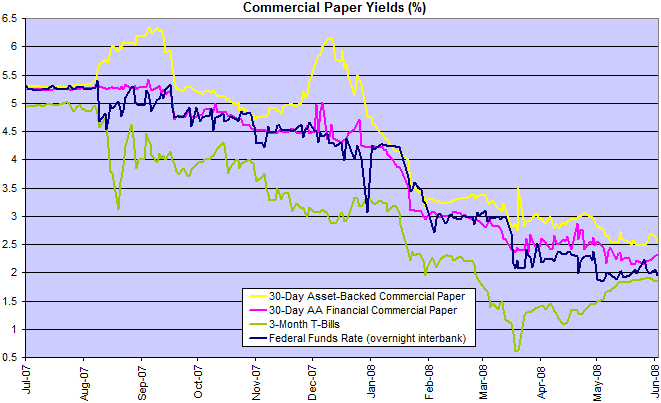

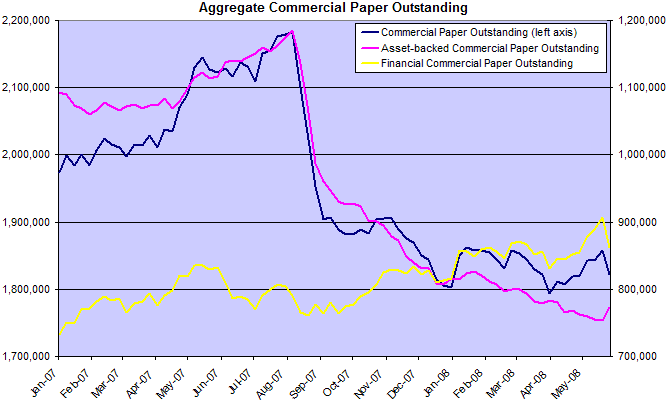

Financial Markets — Commercial Paper

The Fed has indicated that further rate cuts are unlikely. The effective fed funds rate holding firm at the target rate would confirm this, while further dips below 2.00% would warn that banks remain under pressure.

Asset-backed commercial paper ticked up, offering short-term relief, but the primary down-trend continues.

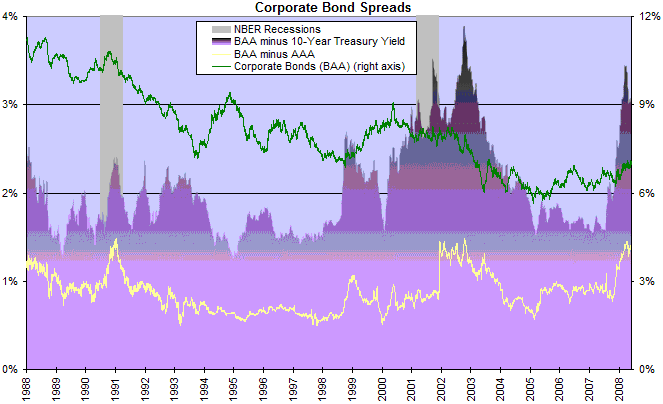

Corporate Bonds

Corporate bond spreads remain high, reflecting the continuing liquidity squeeze.

Housing

Thirty-year fixed mortgage rates have started to rise in response to long-term yields, warning of further pain in the housing market.

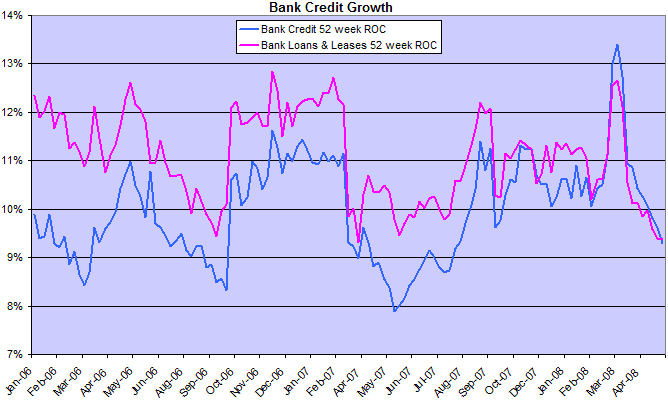

Bank Credit

Bank credit growth is likely to fall sharply when the distortion from unraveling off-balance sheet items clears. FDIC statistics show zero growth in total loans for the last quarter. Net interest margins remain steady at 3.3%, but profitability (average return on assets) has halved in the last 12 months — due to rising default rates.

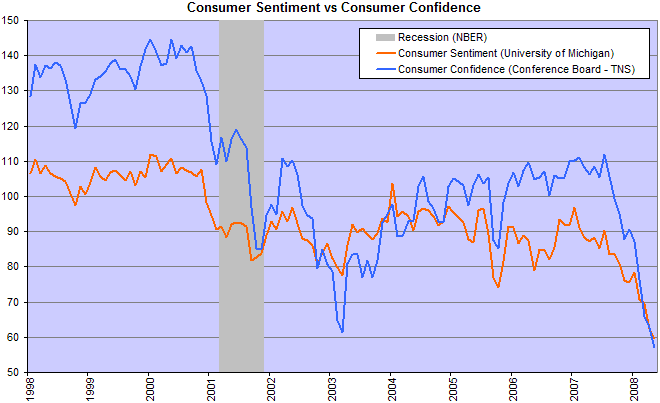

Consumers

Consumer confidence fell below its 2003 low. Consumers are likely to tighten their belts and cut back on spending, further slowing the economy.

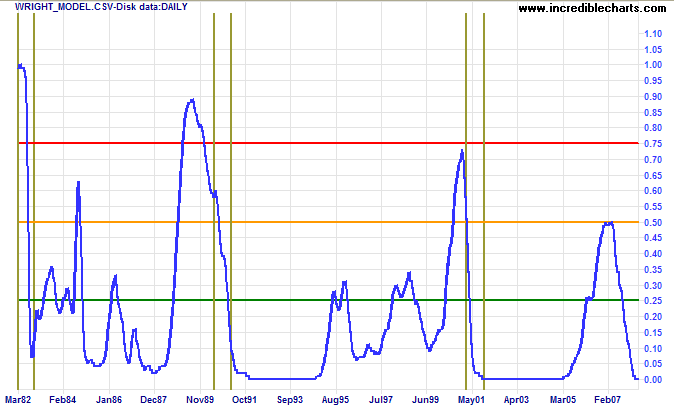

Wright Model

Jonathan Wright's recession prediction model (looking four quarters ahead) remains at zero. It does not, however, reflect that we are most likely already in a recession.

Eventually the US government will have to use taxpayers' money to arrest the decline in house prices.........

markets can be self-reinforcing on the downside as well as the upside.

They are waiting for the housing market to find a bottom on its own, but it is further away than they think.

~ George Soros:

The New Paradigm For Financial Markets

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.