Rising Oil Prices And Treasury Yields

By Colin Twiggs

May 29, 2008 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Stocks

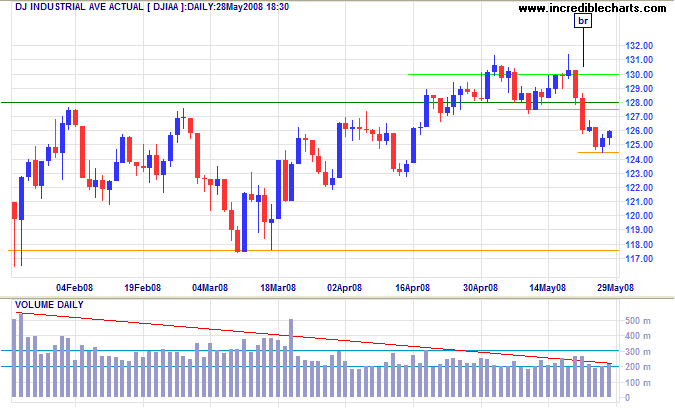

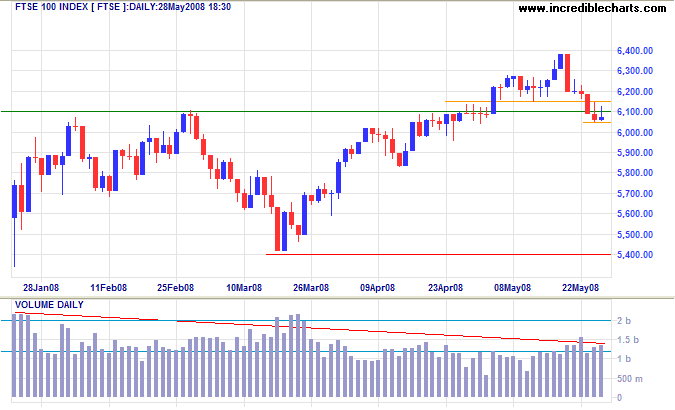

Recent oil price hikes have sapped any remaining buying pressure from the markets. Declining volumes on the Dow and FTSE signal growing investor wariness and we are likely to see a re-test of primary support levels in the weeks ahead.

The Dow completed a small double top, warning of a test of primary support at 11750. Reversal below 12450 would strengthen the signal. Declining volumes over the last few months reflect investor uneasiness.

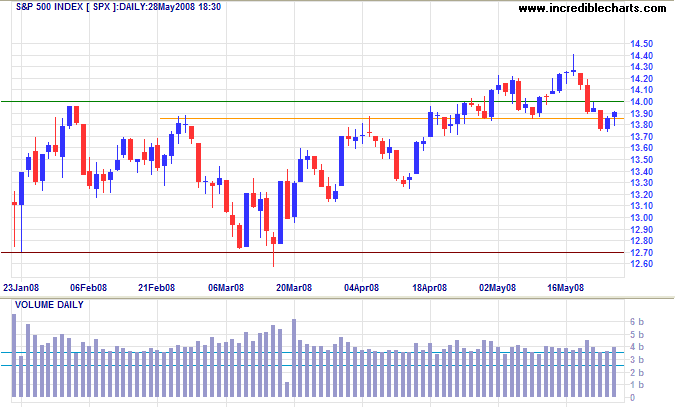

The S&P 500 index confirmed the Dow signal with a fall below 1385.

The FTSE 100 broke through short-term support at 6150. Tall shadows on the last two candles warn that failure of 6050 is likely, signaling a test of primary support at 5400. Declining volumes indicate similar wariness to the Dow.

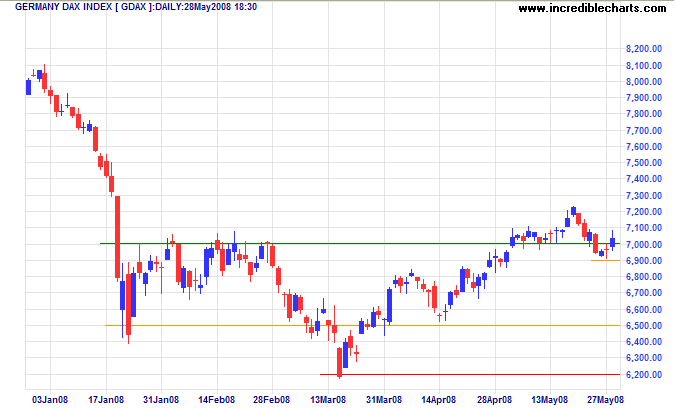

The German Dax shows a similar pattern, whipsawing around support at 7000. Failure of support at 6900 would warn of a test of 6500.

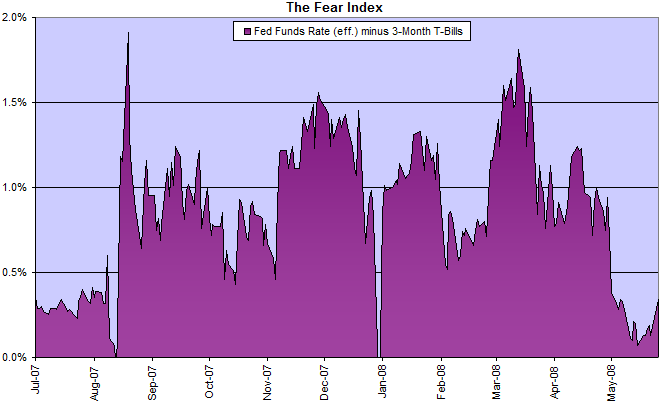

The Fear Index

Financial markets remain relatively stable, with the spread between the fed funds rate and 3-month T-bills below 0.50 percent.

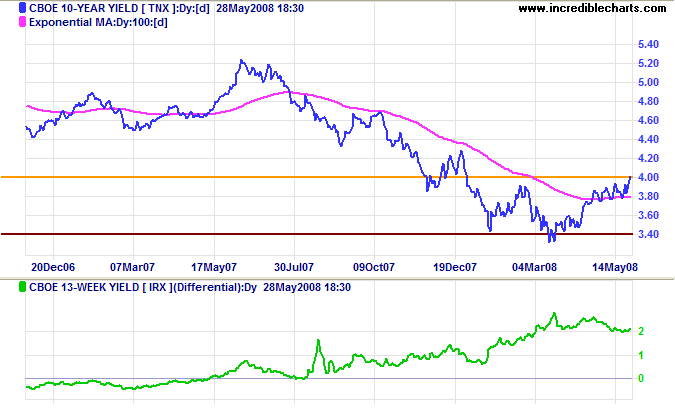

Treasury Yields

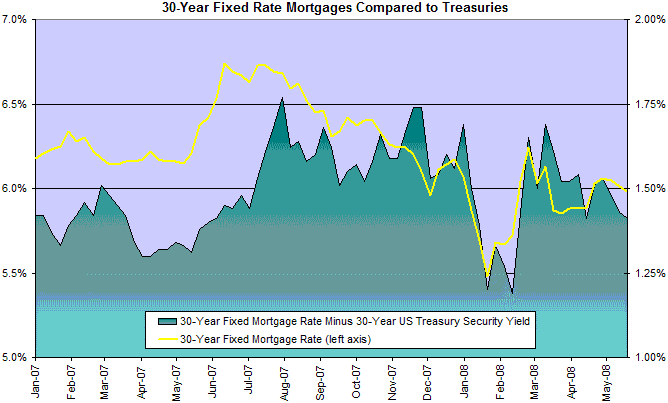

Ten-year treasury yields are testing 4.0 percent after consolidating in a narrow band above the long-term moving average. Breakout would signal the start of a primary up-trend. The yield differential remains a healthy 2.0%. Rising long-bond yields would be a positive long-term sign for the economy, allowing the Fed some leeway to raise short-term rates without risking a negative yield curve. Expect immediate pain, however, with rising mortgage rates depressing the housing market — exposing banks to further losses.

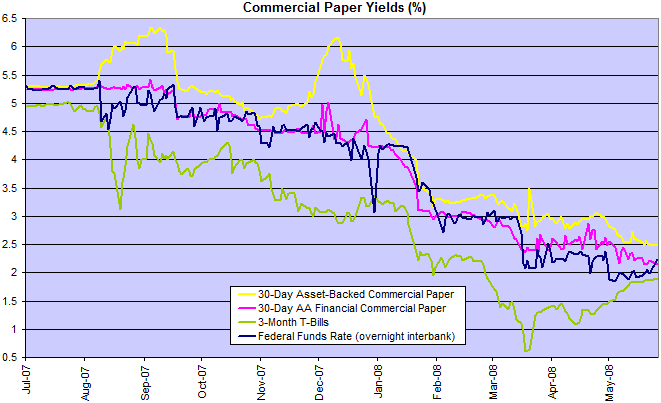

Financial Markets — Commercial Paper

The effective fed funds rate recovered above its target rate of 2.0%, but this is misleading as the Fed increased term auction facilities by a further $25 billion. The liquidity squeeze is far from over.

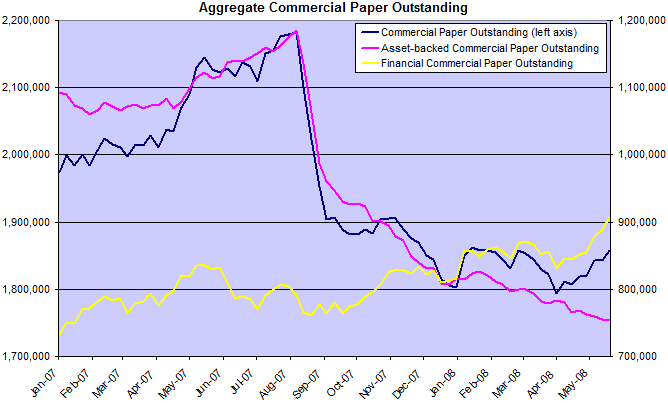

Financial commercial paper surged over April-May as banks look to offset the continuing decline in off-balance sheet funding, reflected by falling asset-backed CP.

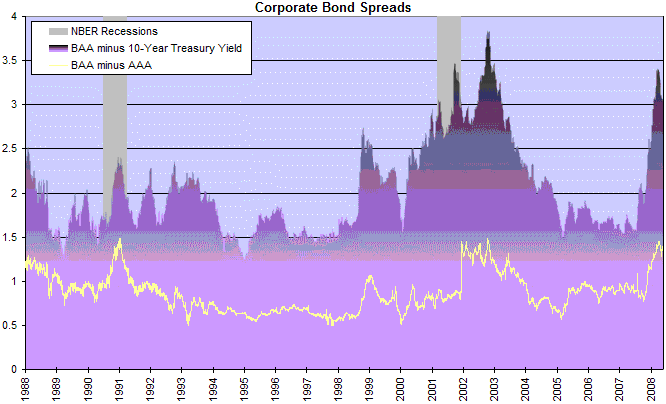

Corporate Bonds

Spreads on corporate bonds turned down slightly, but this is more a result of rising treasury yields than lower corporate bond yields. New private-sector investment is likely to remain low.

Housing

Thirty-year Fixed Mortgage rates remain at 6.0%. Rising treasury yields, however, would increase upward pressure on mortgage rates, suggesting the decline in housing prices is far from over.

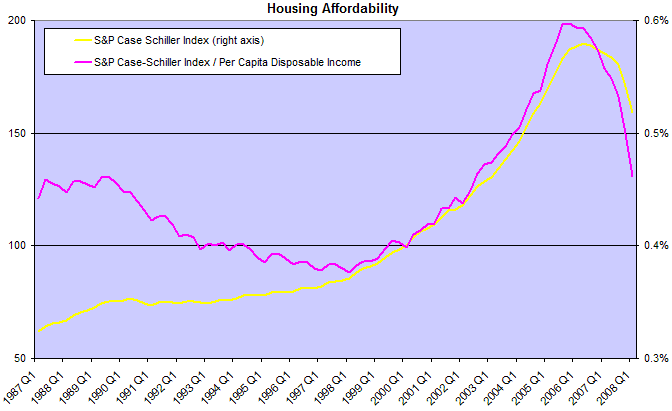

I normally measure housing affordability by the ratio of the S&P Case-Shiller Composite Housing Index to Disposable Income per capita (before adjustment for inflation). There is a sharp fall to nearly 0.45%, the high from the late 1980s, but the index remains well above the 0.40% level normally needed to motivate home-buyers.

Bear in mind that the above does not even allow for the bite that higher fuel/gas prices have taken out of disposable incomes — nor the depressing effect they will have on house prices in outlying suburbs with longer commutes.

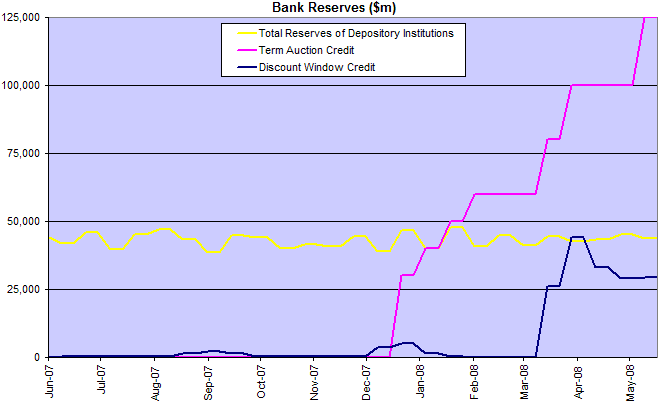

Bank Credit

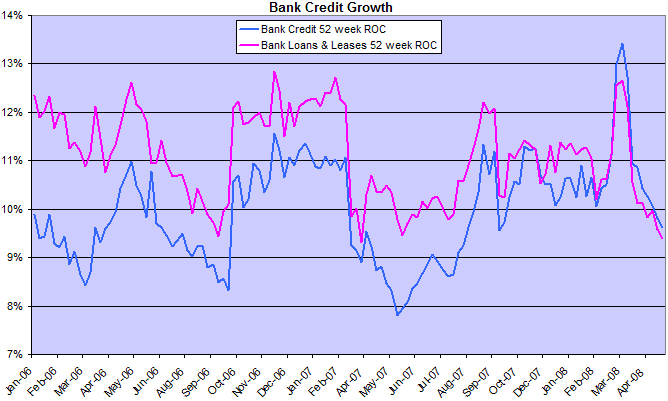

Bank credit growth, inflated over the past 6 months by the sharp reduction in off-balance sheet funding, is now starting to fall. This is a critical figure as a decline in credit growth impacts both consumer spending and new investment.

The Fed continues is aware of this and has advanced a further $25 billion through the term auction facility to maintain liquidity. Short-term discount window credit has leveled off at around $30 billion, bring total Fed support to more than $150 billion. It may take some time before this can be withdrawn without upward pressure on interest rates.

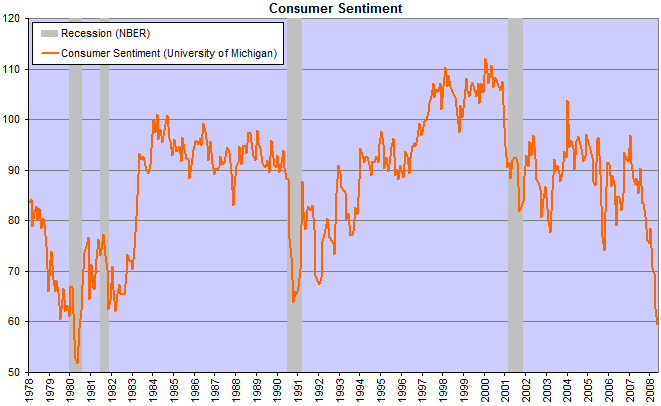

Consumers

Rising oil prices are also reflected in negative consumer sentiment, with the University of Michigan recording the lowest readings (59.5) since 1980 — warning of a recession.

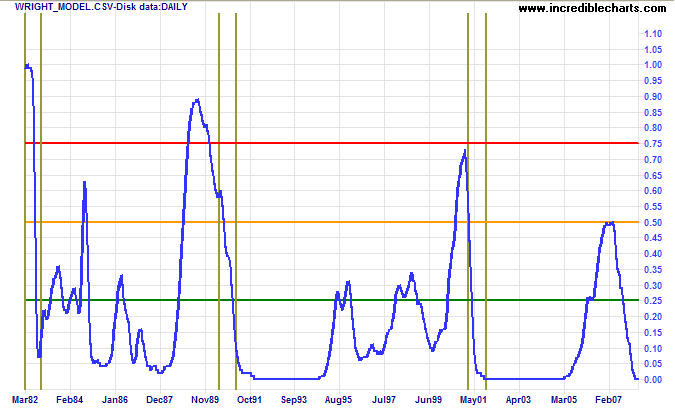

Wright Model

Jonathan Wright's recession prediction model (looking four quarters ahead) remains at zero. It does not, however, reflect that we are most likely already in a recession at present.

Highly leveraged institutions, such as banks, are by their nature periodically subject to seizing up

as difficulties in funding leverage inevitably arise.

The classic problem of bank risk management is to achieve an always elusive degree of leverage

that creates an adequate return on equity without threatening default.

The success rate has never approached 100 percent......

~ Alan Greenspan.

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.