Dow Double Top

By Colin Twiggs

May 22, 2008 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

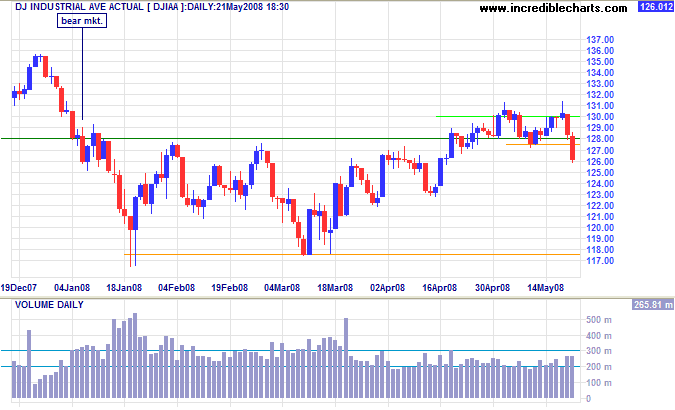

Dow Jones Industrials

The Dow reversed sharply below support at 12750, completing a small double top and warning of a bull trap — and a test of 11750.

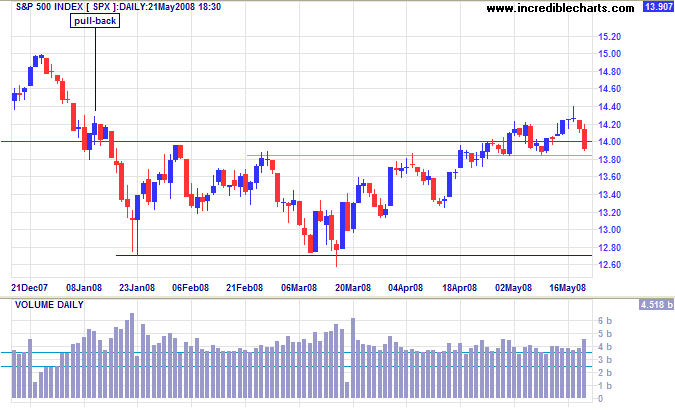

The S&P 500 index falling below 1385 would confirm the signal.

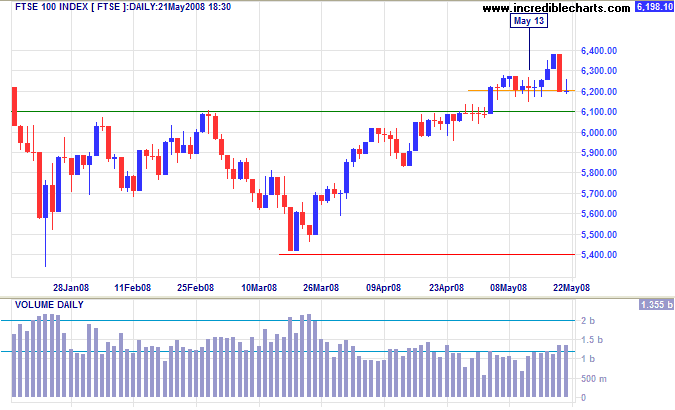

An FTSE 100 close below the May 13 low of 6150 would be a further bear signal.

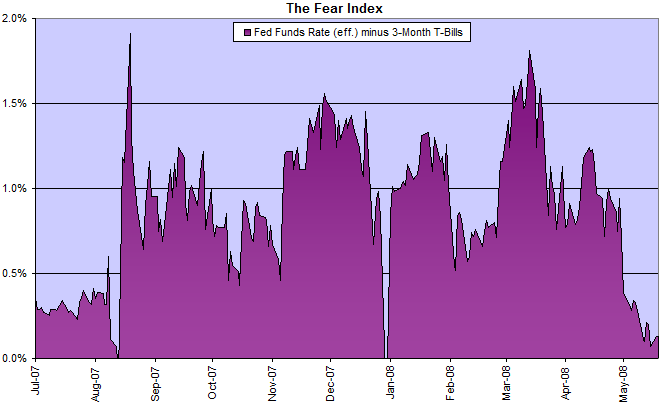

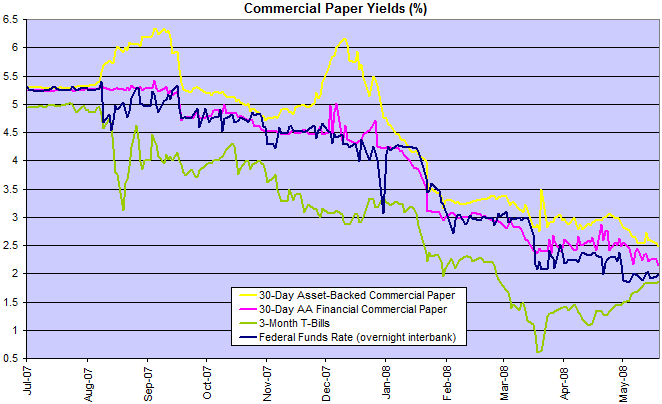

The Fear Index

Financial markets remain stable, with the spread between the fed funds rate and 3-month T-bills close to zero.

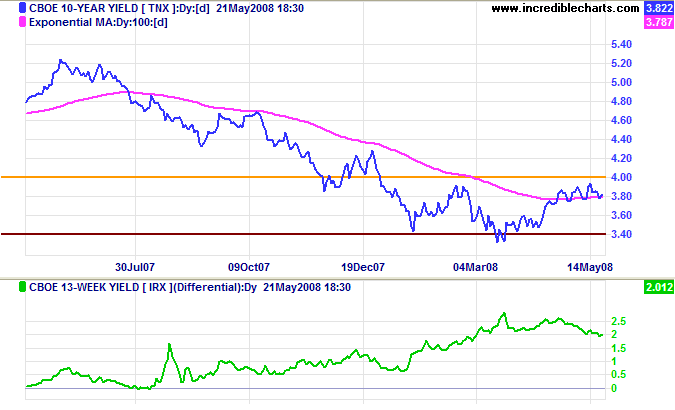

Treasury Yields

Ten-year treasury yields are consolidating in a narrow band above the long-term moving average. Breakout above 4.0% would signal the start of a primary up-trend. The yield differential remains at a healthy 2.0%. Bank margins have recovered but financial markets will continue to suffer the after effects of the housing market collapse for the rest of 2008 — probably even longer.

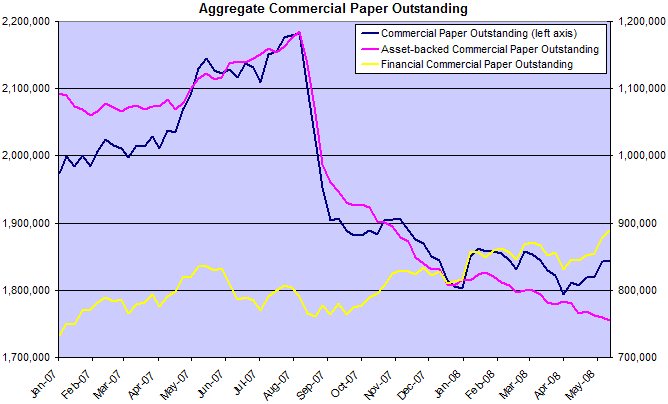

Financial Markets — Commercial Paper

The effective fed funds rate is dipping below the target rate of 2.0%, indicating that the liquidity squeeze has not abated.

Asset-backed commercial paper remains under pressure, commanding a premium of 50 basis points over the target fed funds rate (above) and 30 points over the financial CP yield. Commercial paper investors continue to shun asset-backed paper or demand sizable premiums. Total asset-backed commercial paper fell by close to $50 billion since March — increasing the credit squeeze as corporate clients look to banks for replacement finance.

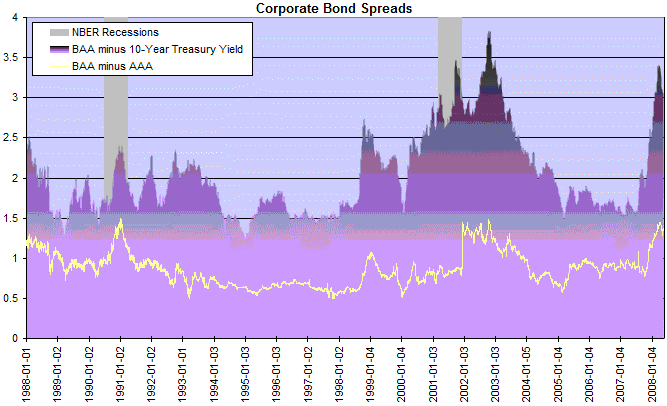

Corporate Bonds

Spreads on corporate bonds remain high, restricting new investment.

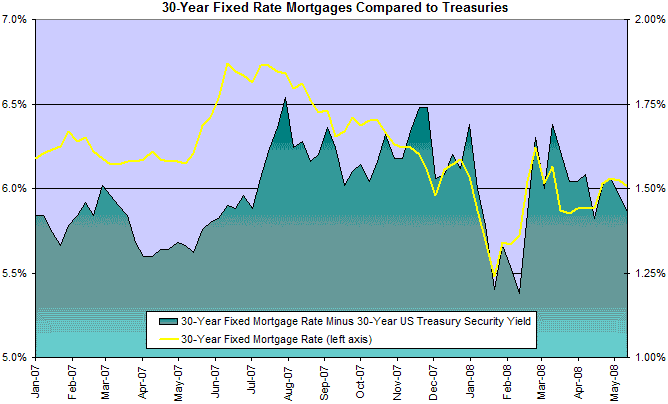

Housing

Thirty-year Fixed Mortgage rates remain at 6.0%, maintaining pressure on the housing market. A decline would indicate that the fall in housing prices is close to an end.

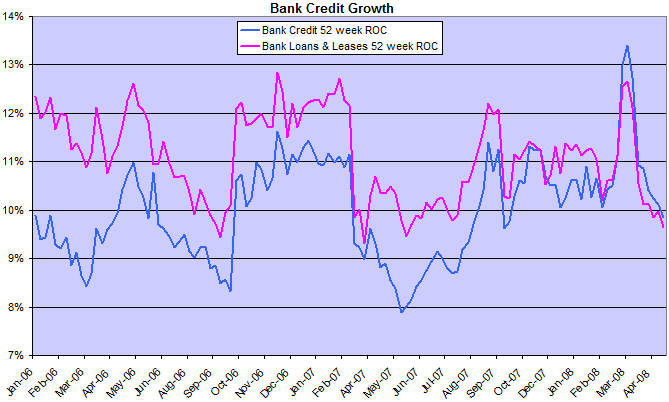

Bank Credit

Bank credit growth is inflated as it does not reflect the sharp reduction in off-balance sheet funding.

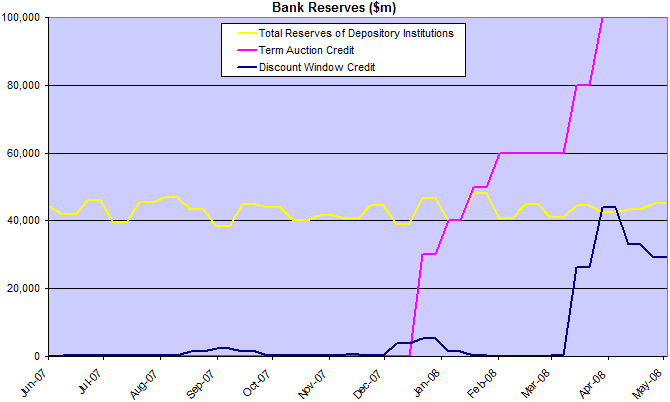

The Fed continues to prop up the banks, with $100 billion advanced through the term auction facility and a further $30 billion in discount window credit. While down by more than $10 billion from its April peak, Fed support remains high and it may take some time before this can be withdrawn without placing upward pressure on interest rates.

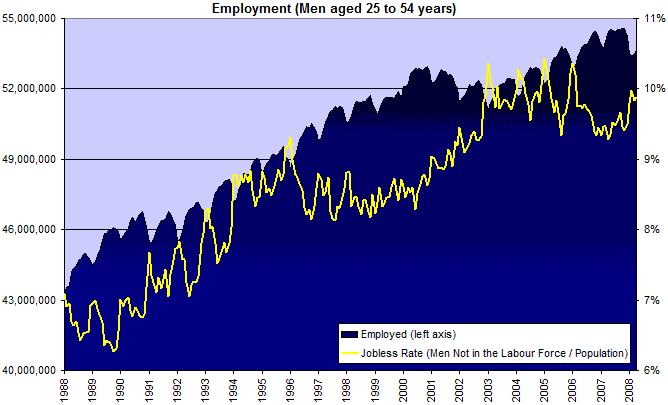

Employment

Employment is holding up reasonably well compared to the 2001 recession, with no down-trend visible as yet. Unemployment figures are at times distorted as they exclude those who have given up looking for work. Of long-term concern is the rising percentage of the total population who are not in jobs: an increase from 6% - 7% in the late 1980s to between 9% and 10% in recent years. They can't all be retired hedge fund managers.

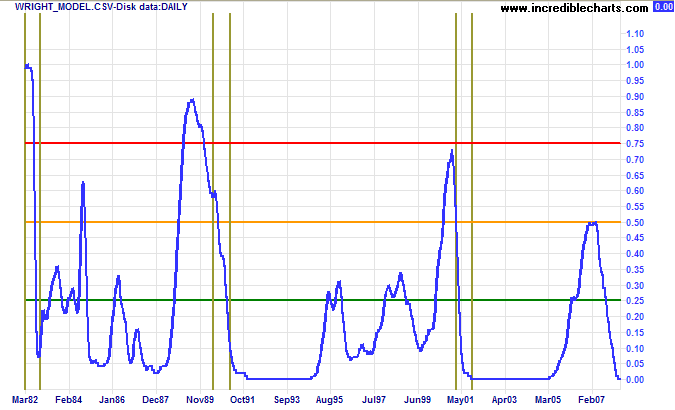

Wright Model

Jonathan Wright's recession prediction model (four quarters) remains at zero.

I was gratified to be able to answer promptly, and I did.

I said I didn't know.

~ Samuel Clemens (Mark Twain).

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.