Dow Breaks Primary Support, Gold Rising

By Colin Twiggs

November 26, 2007 9:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

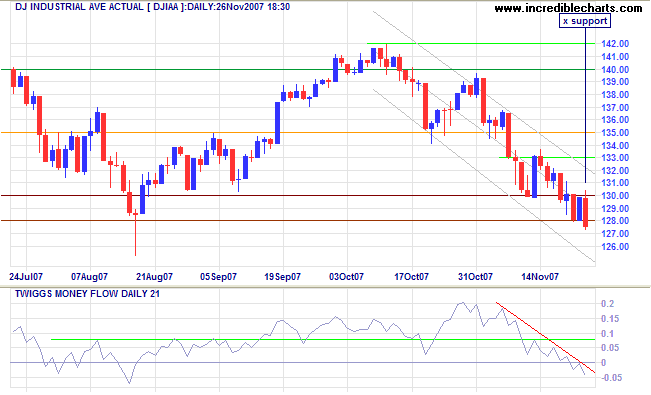

Dow Jones Industrials

The Dow broke through primary support at 12800 (the August 2007 low), signaling the start of a primary down-trend.

As discussed in Saturday's newsletter, the US economy is at risk of entering a prolonged recession if the public's faith in the security/stability of the banking system is shaken.

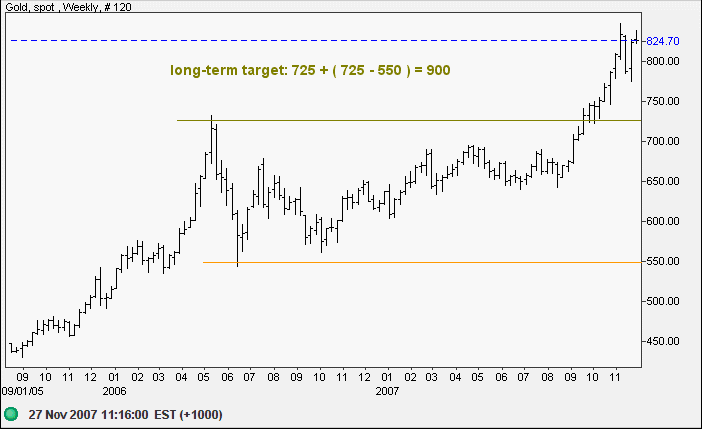

Gold

Gold is a safe harbor in times of financial upheaval and I expect the metal to continue its primary up-trend for the foreseeable future. The long-term target is $900.

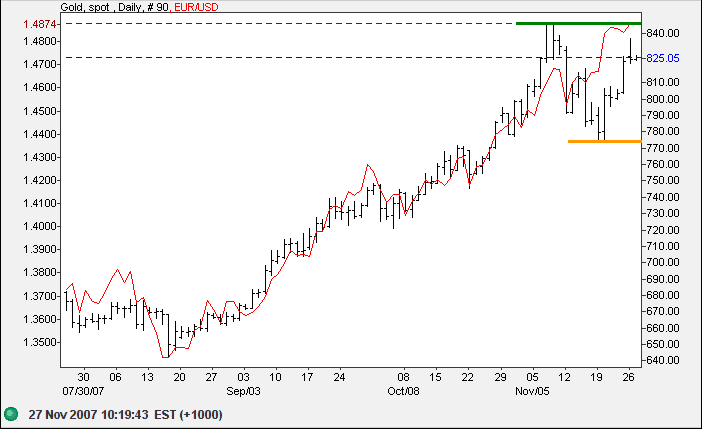

The euro and gold are advancing side-by-side against the dollar. A gold breakout above $845 is likely — and would offer a short/medium-term target similar to the long-term target of $900: 845+(845-775)=915.

Source: Netdania

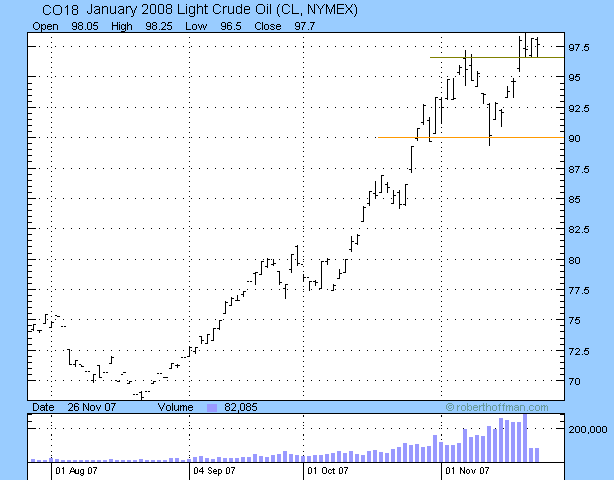

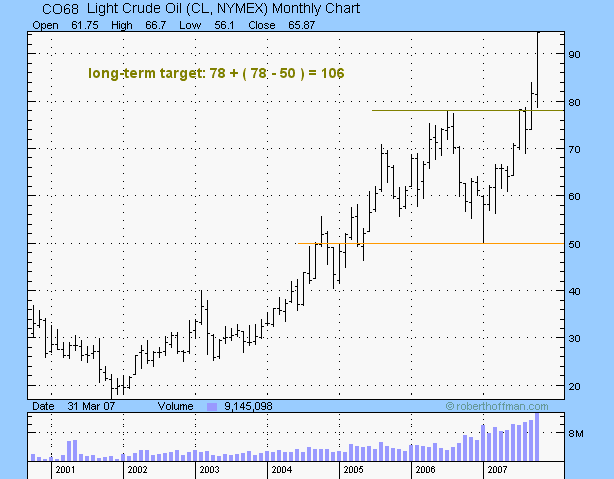

Crude Oil

January 2008 Light Crude displays a bullish narrow consolidation above the new support level of $96.5. Expect resistance at the $100 barrier, but the calculated target is higher at $103: 96.5 + ( 96.5 - 90 ).

June 2008 Light Crude presents a similar long-term target above $100/barrel.

Currencies

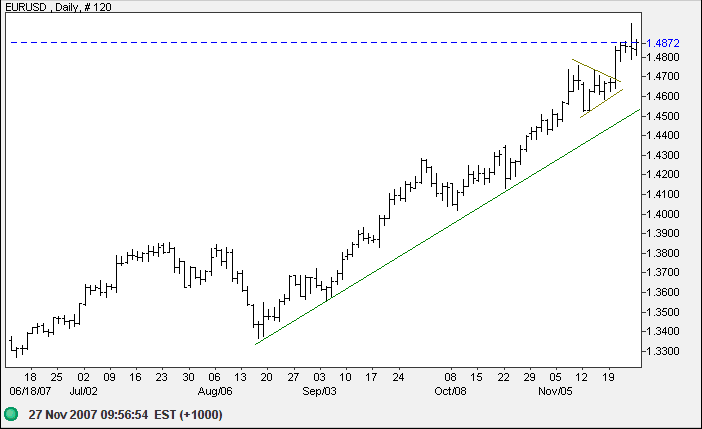

The euro is headed for a test of $1.50 after completing a short-term pennant. Breakout below the rising (green) trendline is not expected — and would warn of a secondary correction.

Source: Netdania

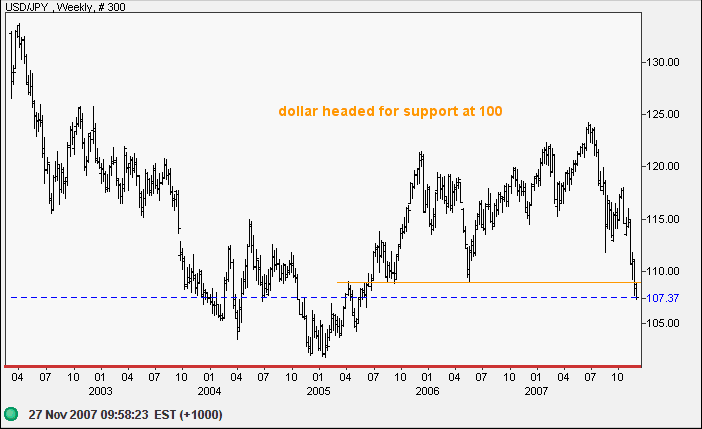

The dollar broke through support at 109 against the yen and is headed for a test of long-term support at 100.

Source: Netdania

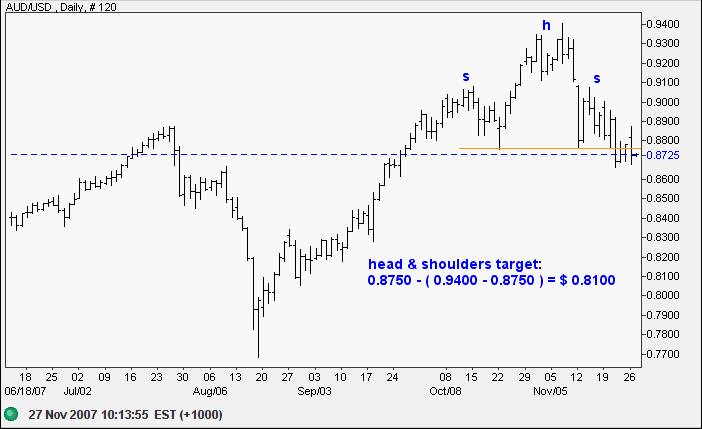

The Australian dollar broke through support at $0.8750, completing a head and shoulders reversal with a target of $0.8100. Recovery above $0.9100 is not expected — and would indicate another test of $0.9400.

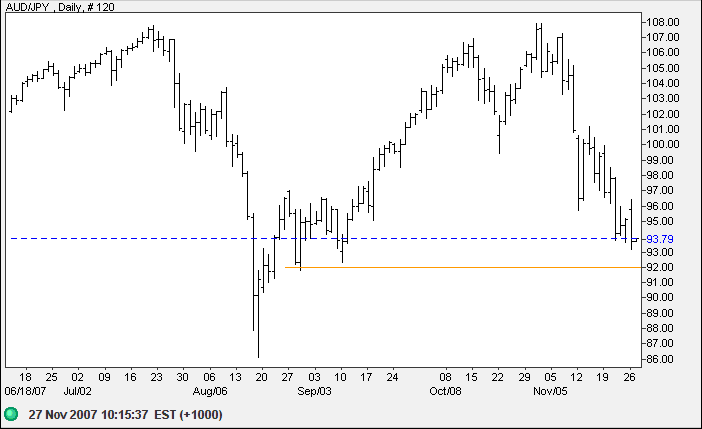

Unwinding carry trades continue to weaken the Aussie dollar. The cross-rate with the yen broke through short-term support at 96 and is headed for a target of 92 [96-(100-96)]. Failure of support at 92 would signal a test of long-term support at 86 (and further weakness against the USD).

Source: Netdania

The first requisite of a sound monetary system is that it put

the least possible power over the quantity or quality of money

in the hands of the politicians.

~ Henry Hazlitt.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.