Stock Indexes

September 30, 2006 0:30 a.m. ET (2:30 p.m. AET)

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Gold is testing resistance at $600 and failure of this level could signal another (intermediate) rally. Crude oil prices are testing support at $60, while the dollar remains uncertain. The probability of recession in the next four quarters is rising, according to the Wright model, and is currently at 37 per cent.

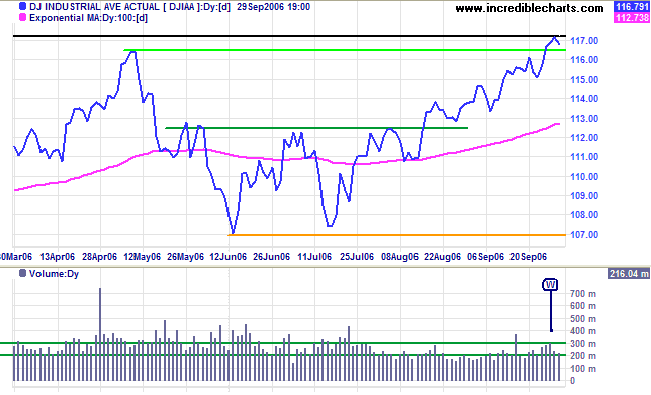

Long Term: The Dow remains in a primary up-trend, with support at 10700.

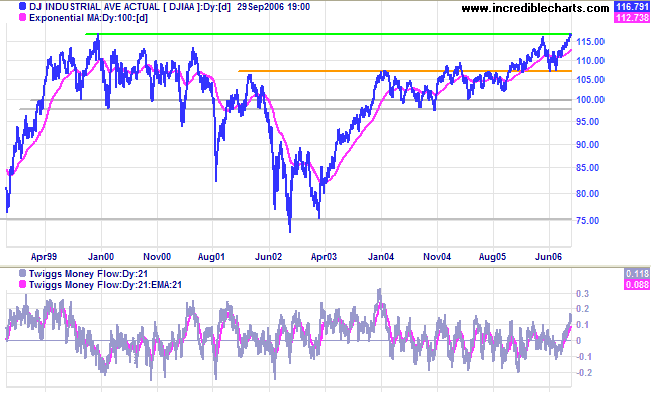

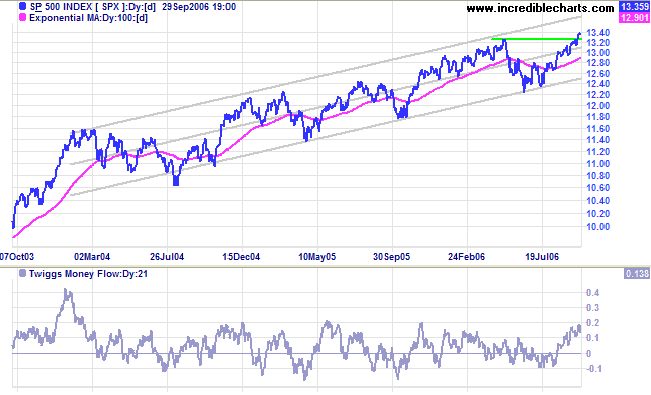

Long Term: The S&P 500 continues in a slow primary up-trend, with support at 1220.

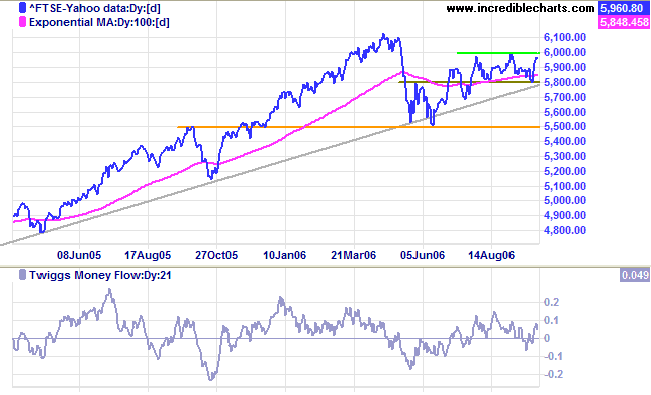

The FTSE 100 is consolidating between 6000 and 5800, with Twiggs Money Flow (21-day) whipsawing around the zero line, signaling indecision.

Medium Term: Continuation of the up-trend is likely, with a close above 6000 signaling resumption of the primary trend move. A break above 6100 would have a target close to the highs of 1999/2000. The target of 6700 is calculated as 6100 + {6100 - 5500}.

Penetration of support at 5800, however, would signal another test of support at 5500 -- and a break of the long-term trendline would warn of a primary trend reversal.

Long Term: The primary up-trend continues, with support at 5500.

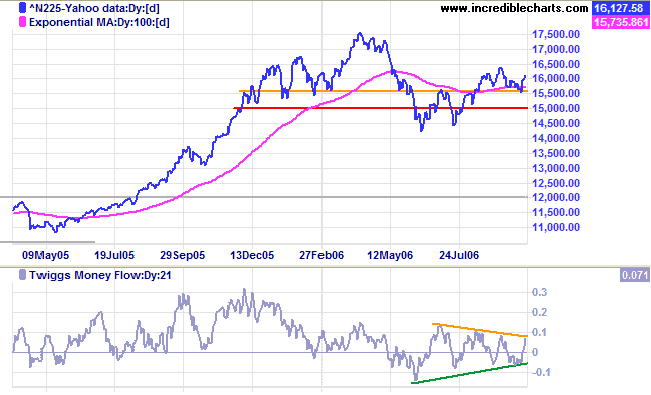

After a brief dip below support at 15700 the Nikkei 225 recovered and is rallying strongly. This is a bullish sign and a break through intermediate resistance at 16400 would confirm the strong up-trend.

Medium Term: Twiggs Money Flow (21-day) continues to oscillate around the zero line, signaling uncertainty. The next target for the up-trend is the April high of 17500, but we would need an improvement in TMF to achieve this.

Long Term: The primary up-trend remains up, with support at 14200.

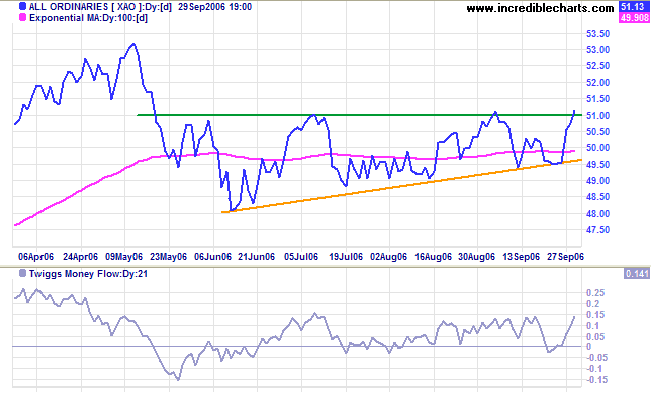

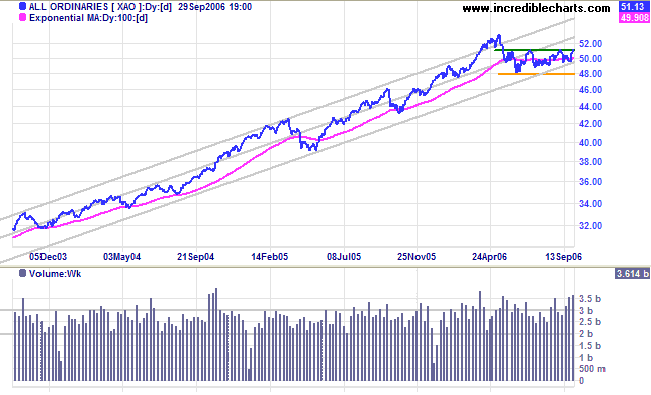

The All Ordinaries formed a double bottom at 4940 followed by a strong rally to break through resistance at 5100. Tall blue candles and exceptionally high volume indicate that buyers have regained control from sellers. Look for confirmation of the breakout from a pull-back that respects the new support level at 5100.

Long Term: The All Ordinaries continues in a primary up-trend with support at 4800.

~ Jesse Livermore

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.