Gold , Oil & the Dollar

September 22, 2006 3:25 a.m. ET (5:25 p.m. AET)

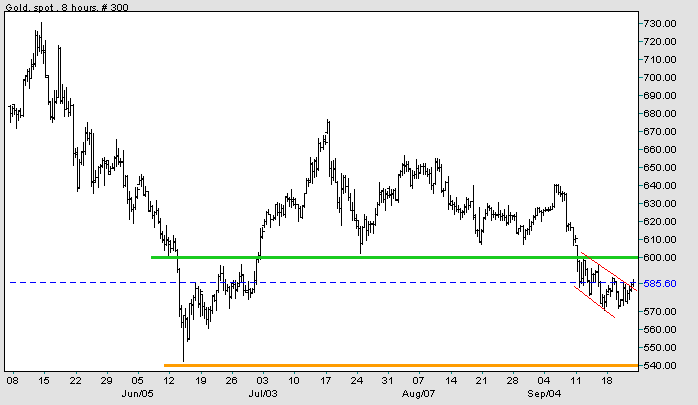

Spot gold broke upwards from the descending flag formed over the last week. Expect another test of resistance at $600.

Medium Term: Falling crude oil prices should weaken gold and strengthen the dollar. Expect gold to test primary support at $540.

Long Term: The dollar is likely to weaken and gold to rise -- unless there is a fall below $540 (signaling a primary down-trend).

Light Crude has fallen to $61.59 per barrel. Expect major support between $55 and $60. A fall through this band would signal a sharp down-trend, but we are just as likely to witness a consolidation -- followed by continuation of the long-term up-trend which began in 2002.

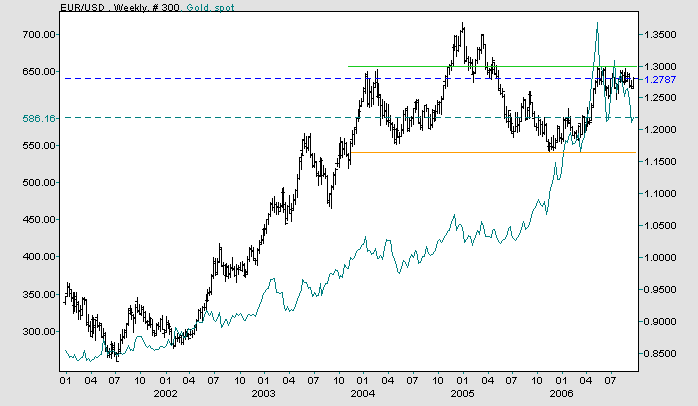

The euro is consolidating below resistance at 1.30/dollar. This is a bullish sign, warning of an upward breakout.

We can see from the weekly chart that the euro/dollar and dollar price of gold tend to rise or fall together -- with the euro leading. If the euro strengthens, expect gold to follow.

Though unlikely at present, a downward breakout (from the consolidation) would test support at 1.16/1.17. A breakout below that would complete a major head and shoulders reversal.

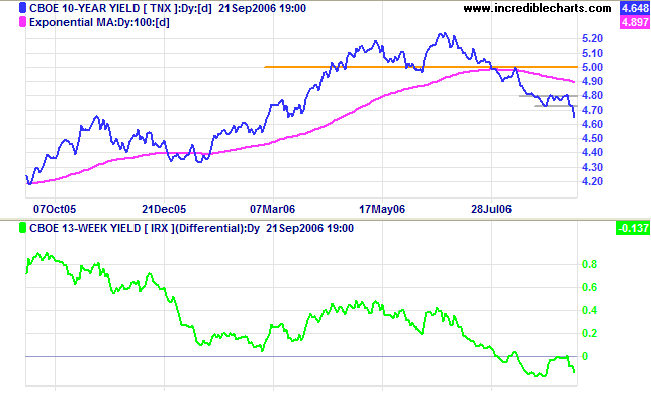

Another major influence on the dollar is interest rates. Falling long-term rates are likely to weaken the dollar.

Ten-year Treasury note yields broke below their recent consolidation, after interest rates were left unchanged at this week's FOMC meeting, and appear headed for 4.55%.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) retreated well below zero. However, the primary cause is falling long-term yields rather than rising short-term yields -- reducing the significance.

~ Kevin Costner on the death of Steve Irwin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.