Trading Diary

June 11, 2005

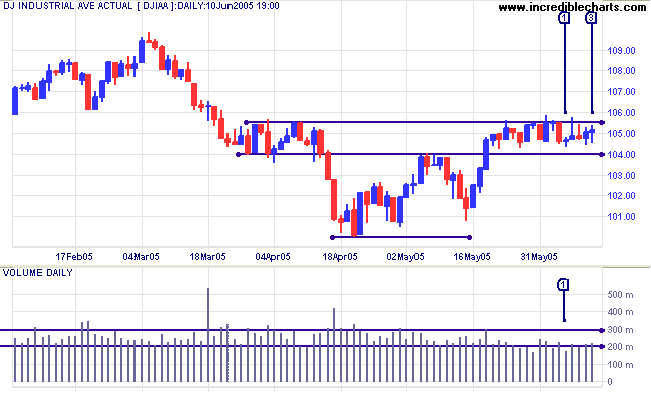

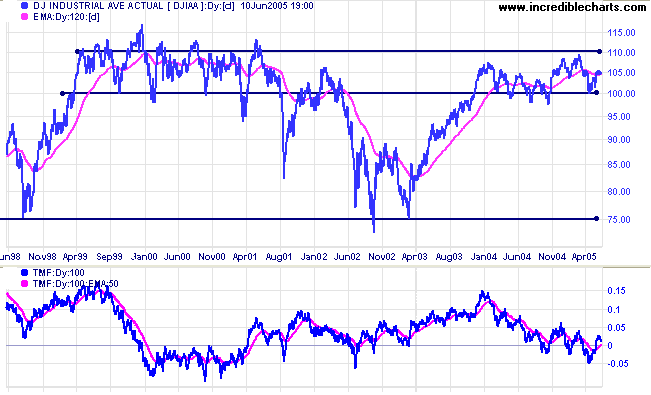

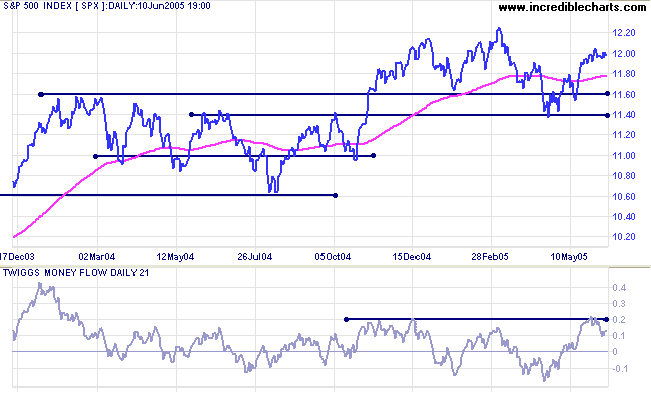

The Dow Industrial Average continues to consolidate in a narrow range between 10400 and 10550, signaling hesitancy. There is lack of both buying and selling pressure, with no trend movement and low trading volumes. An upside breakout is most likely, with a close above 10560 signaling a test of resistance at 10900/11000; while a close below 10400 is still a reasonable possibility and would signal a re-test of support at 10000.

Twiggs Money Flow (100-day) signals short term accumulation, with a strong rise above the signal line, but the long-term outlook is bearish.

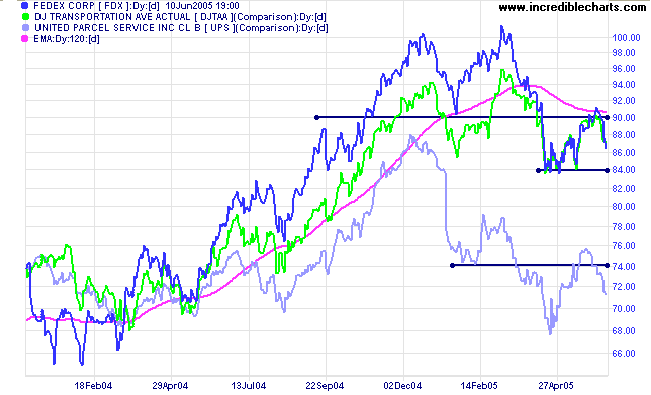

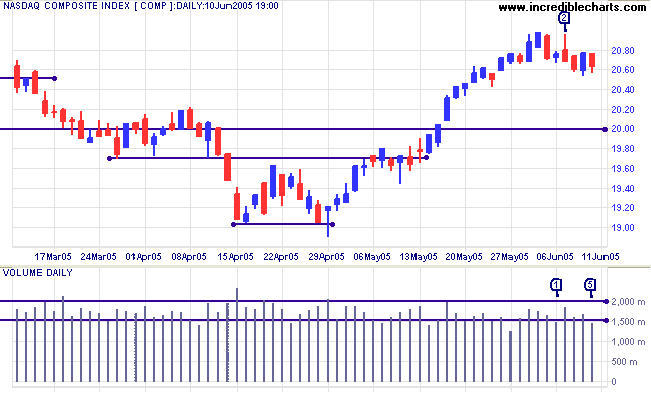

The more speculative end of the market appears to be waiting for direction from the heavyweights.

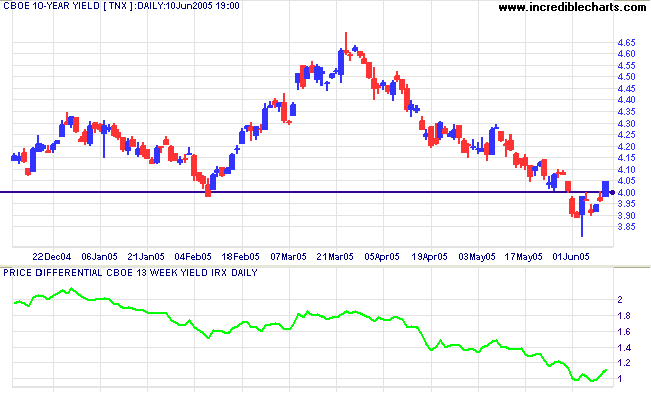

The yield on 10-year treasury notes rallied strongly on Friday, to above 4.0%, after a marginal break. If the new support level holds over the next few days, expect a test of resistance at 4.60%. T-bills (13-week) are testing resistance at 3.0%; so the yield differential (10-year T-notes minus 13-week T-bills) is just over 1.0% -- a further decline would be a long-term bear signal for equities.

New York: Spot gold has started an intermediate up-trend, rallying to $426.90 on Friday. Expect a test of resistance at the April high of $435.70. Failure to breach this would be a bearish sign; confirmed if the metal then falls below support at $415.

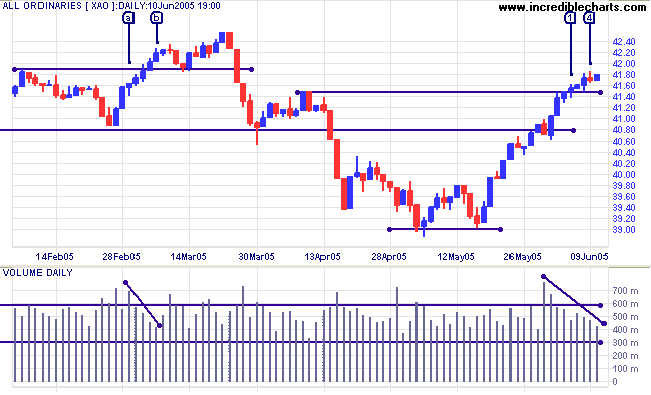

The All Ordinaries broke through resistance at 4140/4150 but the rally is running out of steam, with declining volume and a similar ascending flag pattern to early March 2005: [a] to [b]. This is where it gets interesting.

- If the index fails to break through resistance at 4255, we may see a sharp downward correction. One strong red candle could trigger a spate of selling.

- If the index breaks above 4255 and then retreats within a day or two (a false/marginal break), that would be an even stronger bear signal.

- The least likely scenario is a breakout followed by a pull-back that respects the new support level: a bullish signal.

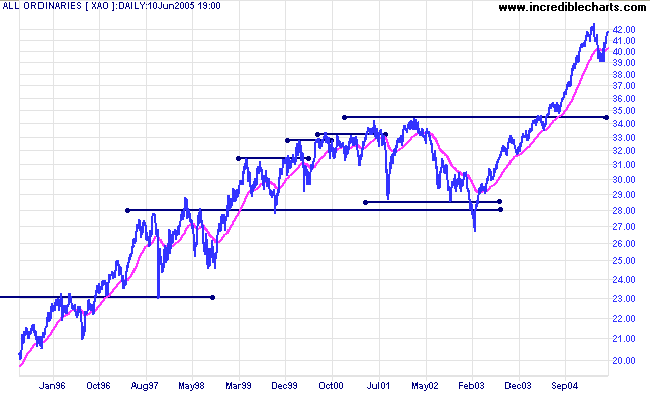

The most likely scenario is that we are at, or close to, a stage 3 top. My view is strongly influenced by two factors:

- the shape and extent of the previous rally, which resembles a spike; and

- the index is well above its previous support base.

we try desperately to invent ways out,

plan how to avoid

the obvious danger that threatens us so terribly.

Yet we're mistaken, that's not the danger ahead:

Another disaster, one we never imagined,

suddenly, violently, descends upon us,

and finding us unprepared - there's no time now -

sweeps us away.

~ C. P. Cavafy: Things Ended

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.