Trading Diary

December 11, 2004

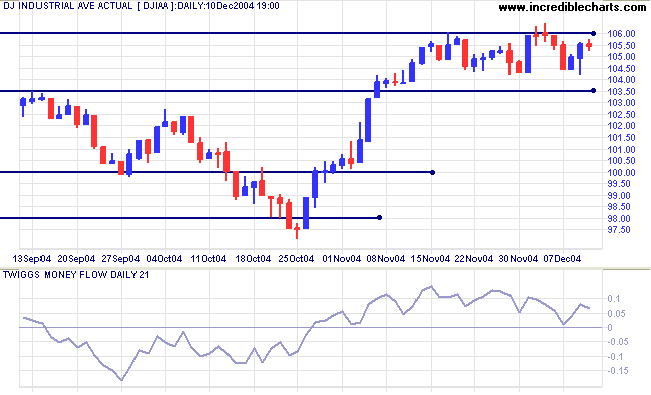

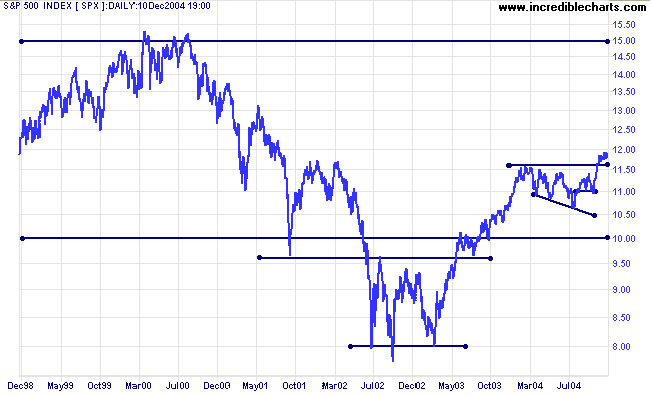

The Dow Industrial Average is consolidating in a narrow band between 10600 and 10450.

Twiggs Money Flow (21-day) has so far held above zero, signaling accumulation.

A fall below 10450 is likely to test 10350. A fall through that level would test the major 10000 support level; as long as that holds we are still in a bull-trend.

A fall below 10000 would be a (long-term) bear signal.

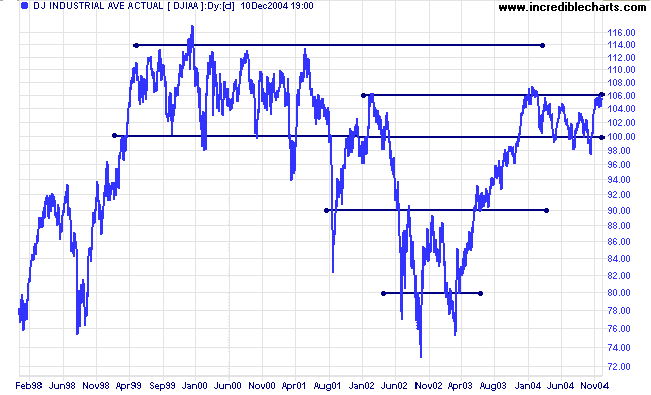

The primary trend is up. With no major resistance levels overhead we can expect good (long-term) gains.

|

|

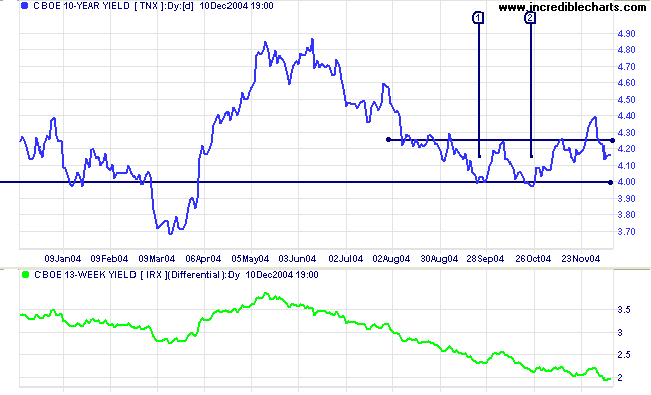

The breakout above 4.25% failed to live up to expectations, retreating back below the new support level. We could see another test of support at 4.00%. Soft long-term yields indicate that there is no major outflow from the bond market (into equities).

The yield differential (10-year T-notes minus 13-week T-bills) has declined below 2.0%. A steep rise in short-term yields reflects recent rate hikes by the Fed. A differentials below 1.0% would be bearish.

New York: Spot gold failed to hold above $450 and has retreated to test support at $430, closing at $433.40. A successful test would be a bullish sign, signaling another attempt to break above $450.

|

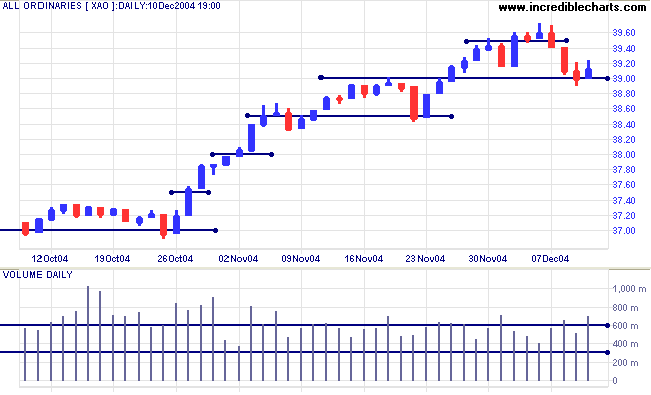

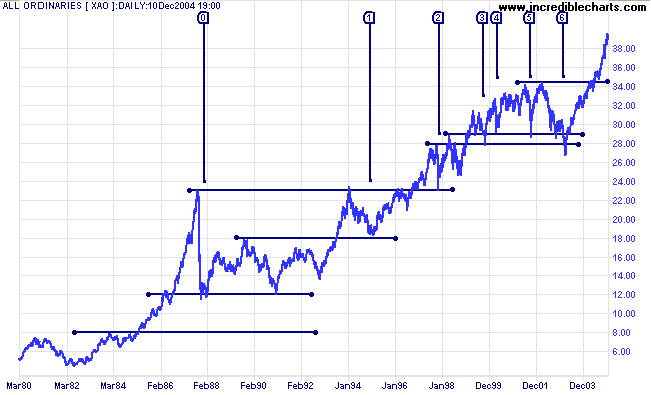

The All Ordinaries (and ASX 200) made only marginal gains before retreating to test support at 3900 (xjo: 3880). Strong volumes on Friday signal buying support but the weak close reveals committed sellers. The index is experiencing increased resistance as it approaches 4000. Marginal new highs and strong volumes on corrections will increase the likelihood of a major secondary correction.

The primary up-trend is strong. The latest rally is steep and at some stage (perhaps 4000) increased profit-taking will force a correction.

~ Sigmund Freud

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.