Trading Diary

June 4, 2005

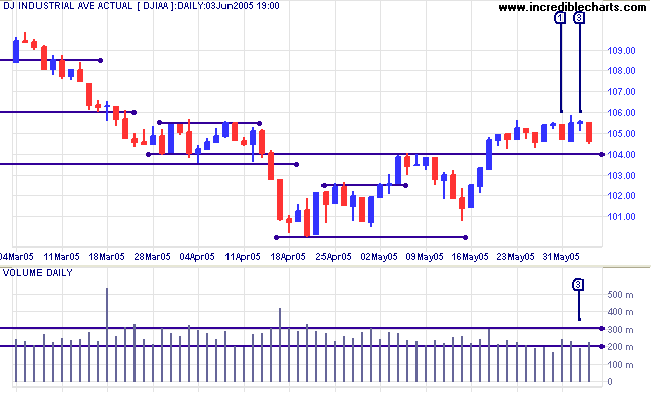

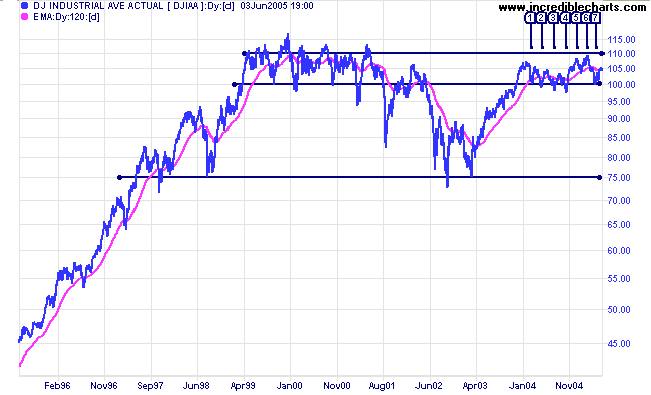

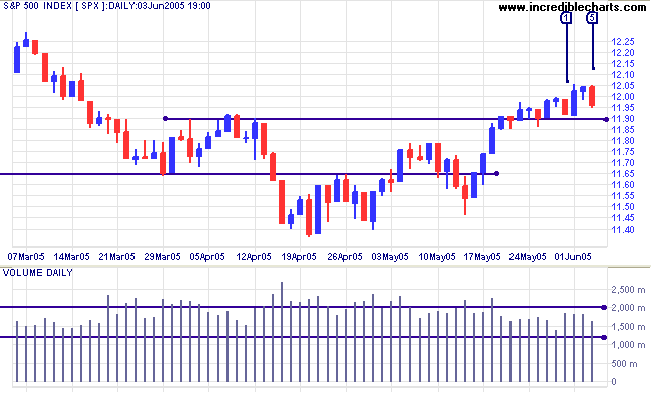

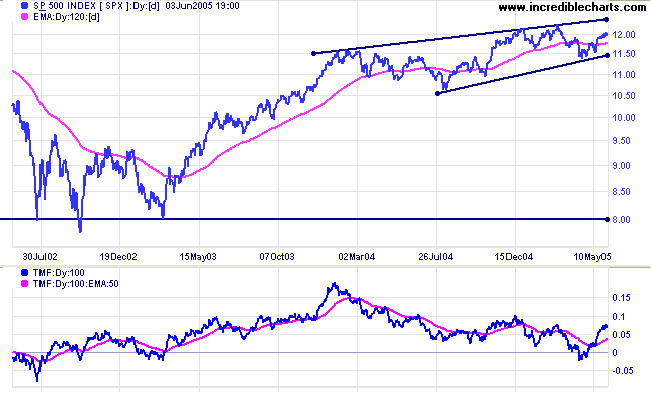

The Dow Industrial Average has consolidated in a narrow range above 10400 over the last two weeks. Volume does not yet give a clear indication of a potential breakout, although higher volume on Tuesday [1] and low volume at [3] could both be said to favor the downside. A close above 10560 would signal a test of resistance at 10900/11000; while a close below 10400 is also a reasonable possibility and would signal a re-test of support at 10000.

If resistance holds, then a re-test of support at 1900 is likely.

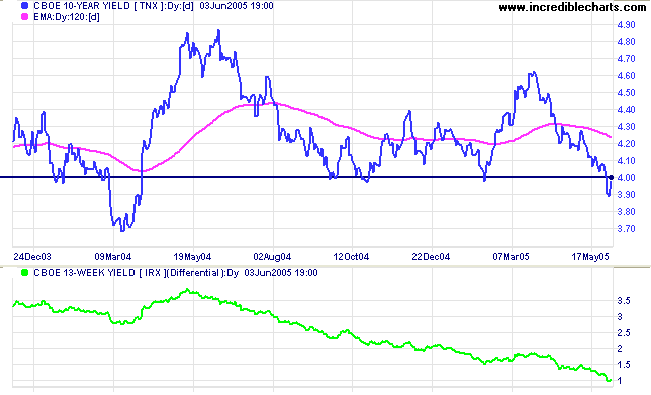

The yield on 10-year treasury notes fell below support at 4.0%. Friday pulled back to test resistance at the new level. A successful test will signal further weakness, while failure would signal a rally back to 4.5%. T-bills (13-week), on the other hand have climbed to 2.9% and the yield differential (10-year T-notes minus 13-week T-bills) has fallen to 1.0%. Further falls would be a long-term bear signal for equities.

New York: Spot gold is whipsawing around the $420 level, closing at $423.10 on Friday, in a gradual down-trend.

The primary trend will reverse downward if price falls below support at the February low of $410.

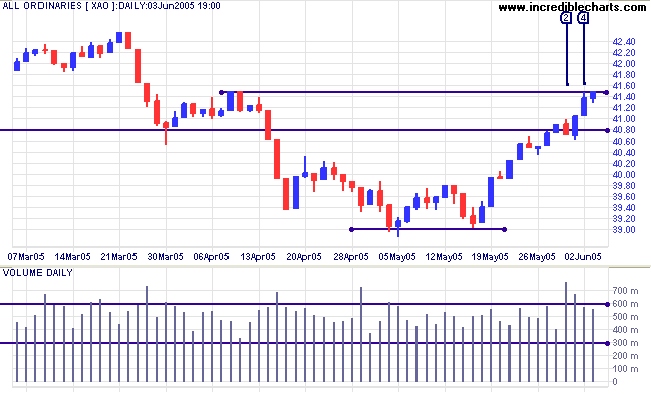

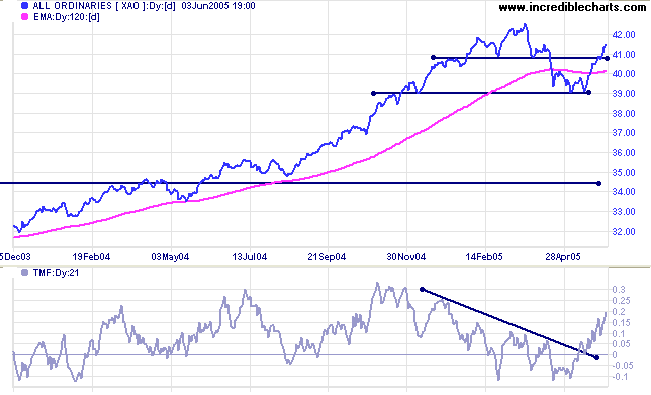

The All Ordinaries is testing resistance at 4140, while the ASX 200 has already broken through and is headed for the March highs. Strong volume and a narrow range at [2] signaled that a strong breakout was to be expected.

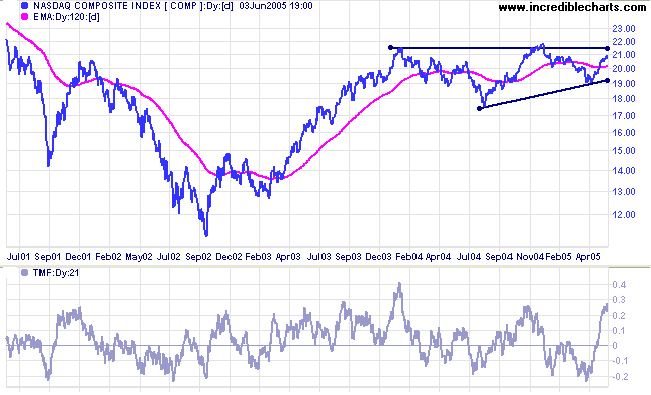

Twiggs Money Flow (21-day) signals strong accumulation in the intermediate term.

If resistance at 4255 holds then expect another test of support at 3900. My warning about 3450 remains. I still see more downside than upside and this could well be a stage 3 top. Failure of support at 3900 would signal that a test of support at 3450 is likely; amounting to roughly a 50% retracement of the previous up-trend. A review of the All Ords over the past 25 years shows that the index regularly cuts back to test support at previous highs.

but if we begin with doubts, and are patient in them,

we shall end in certainties.

~ Francis Bacon

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.