Trading Diary

March 5, 2005

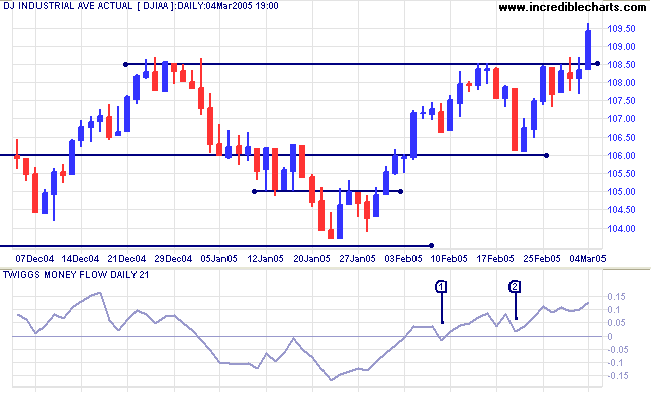

The Dow Industrial Average broke strongly above 10850/10860 after four days of consolidation below the resistance level.

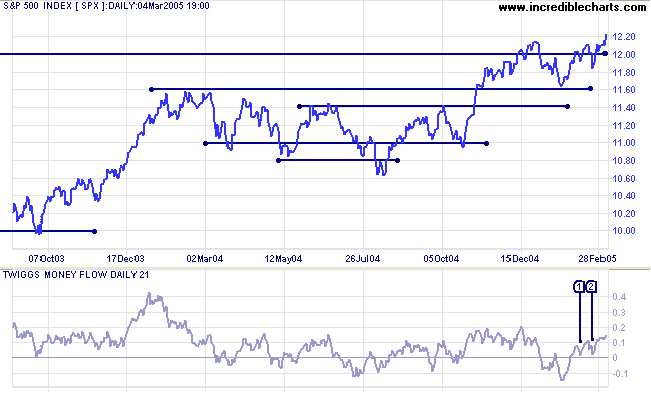

This follows two bullish troughs on Twiggs Money Flow (21-day).

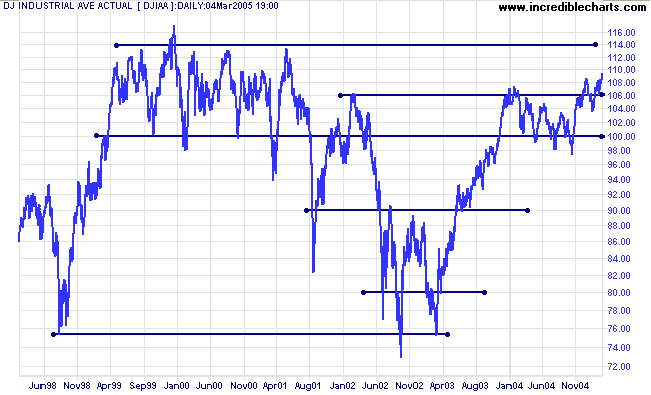

The first line of support is at 1150/1160. The market has a positive outlook as long as the index stays north of this line.

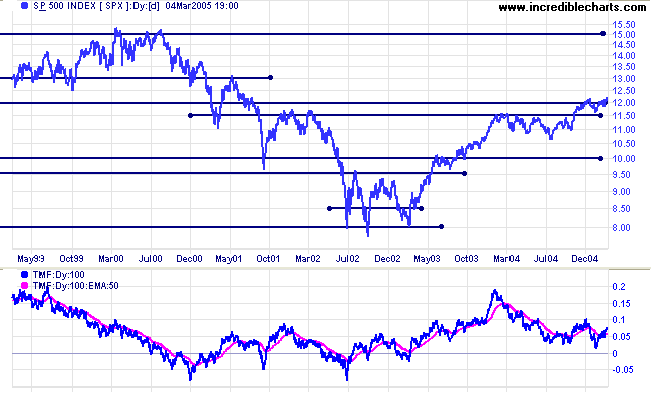

Twiggs Money Flow (100-day) has risen above the signal line, signaling accumulation. A pull-back that fails to cross below the signal line would be a further bull signal.

|

|

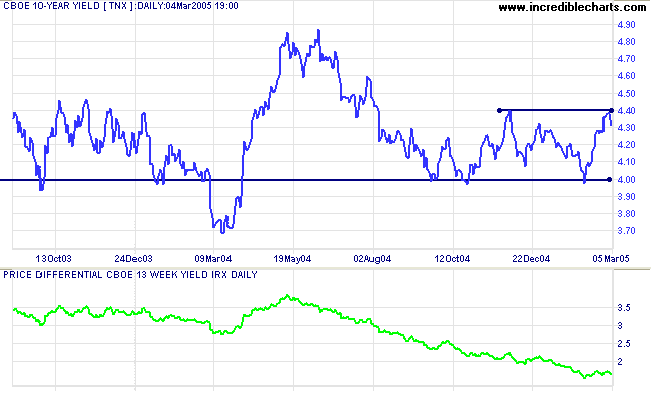

The yield on 10-year treasury notes rallied to 4.40% before encountering resistance.

The yield differential (10-year T-notes minus 13-week T-bills) is consolidating at 1.6%.

Below 1.0% would be a (long-term) bear signal for equity markets.

New York: Spot gold dipped briefly below support at $430 on Friday before rallying strongly to close at $433.60.

Expect a test of resistance at $450.

|

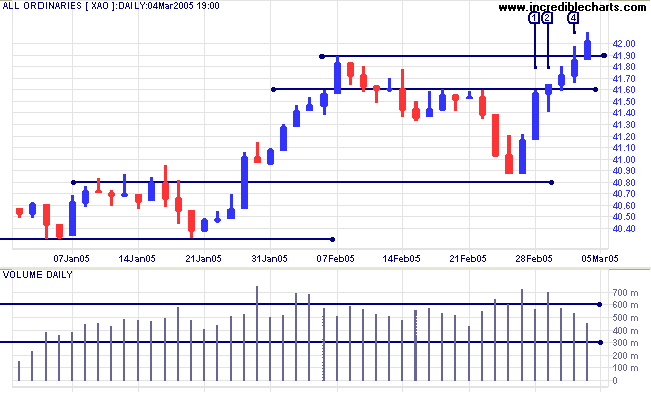

The All Ordinaries broke through initial resistance at 4130 on Monday [1], warning that the down-trend was weakening.

The breakout above the next resistance level at 4160 on Tuesday signaled that the intermediate trend had reversed upwards. Note the long tail and strong volume at [2], telling us that buyers had to overcome significant selling pressure before the breakout.

Thursday [4] tested the previous high of 4190 before Friday's strong rise confirmed that the primary trend had resumed.

Declining volume in the last three days warns that buyers may run out of steam. Watch for the first pull-back: if it respects support at 4183/4190, that would be a bullish sign. A retreat to 4160 would warn that the up-trend has slowed.

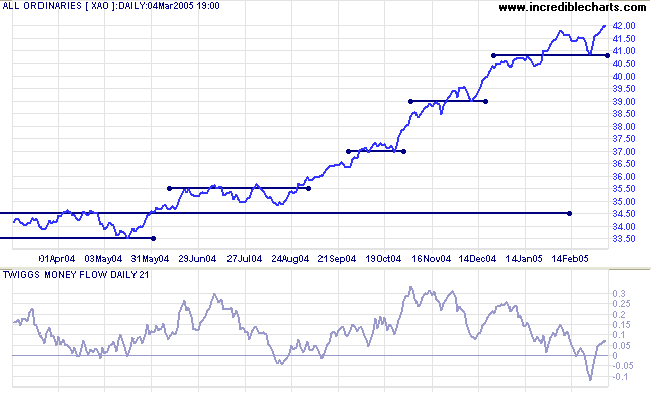

At some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly tested support at previous long-term highs during an up-trend. This as a reminder not to get carried away with the bull market and to stay alert for signs of a reversal.

~ Bernard Baruch

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.