Trading Diary

February 26, 2005

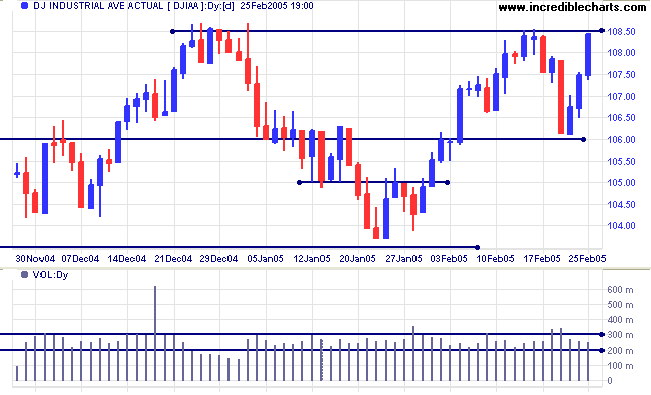

The Dow Industrial Average has had a turbulent week. Stocks fell sharply on Tuesday, with a large red candle and strong volume. Support then held at 10600, with a 3-day rally testing resistance at 10850 to 10860. Lighter volume on the rally indicates that resistance may hold and we could see further consolidation between 10860 and 10600.

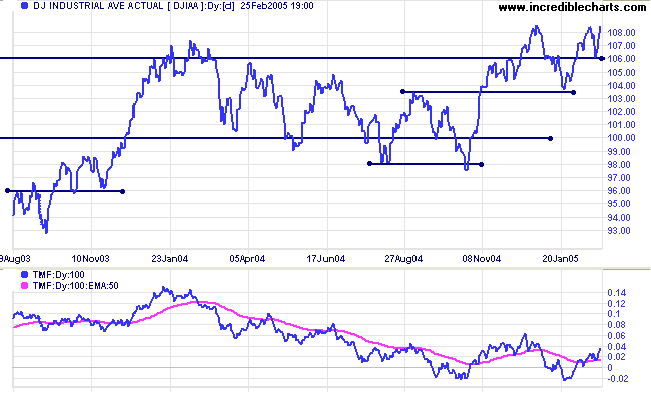

Twiggs Money Flow has strengthened: the last pull-back respected the signal line and the indicator appears about to complete a broad double bottom.

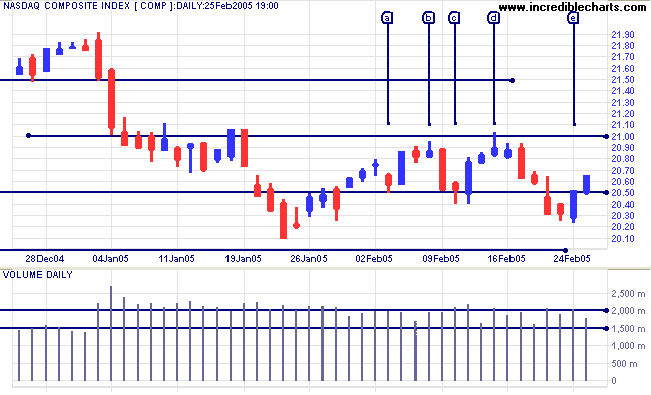

Twiggs Money Flow (21-day) is weaker than the Dow or S&P 500, lingering below the zero line.

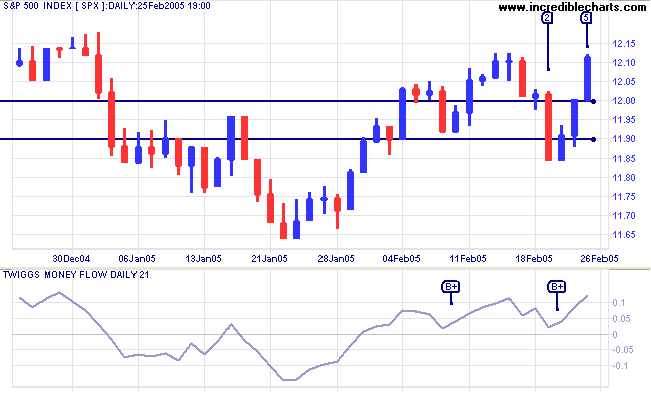

A pull-back that respects support at 1200 would be a bull signal, while another fall below 1200 would signal weakness.

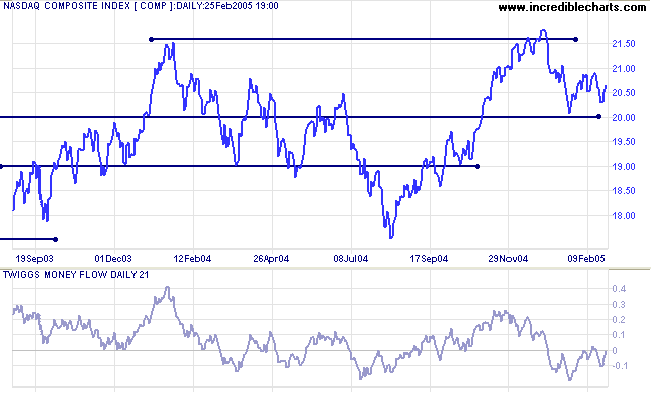

Twiggs Money Flow has completed a second bullish trough above the zero line, favoring an upside breakout.

|

|

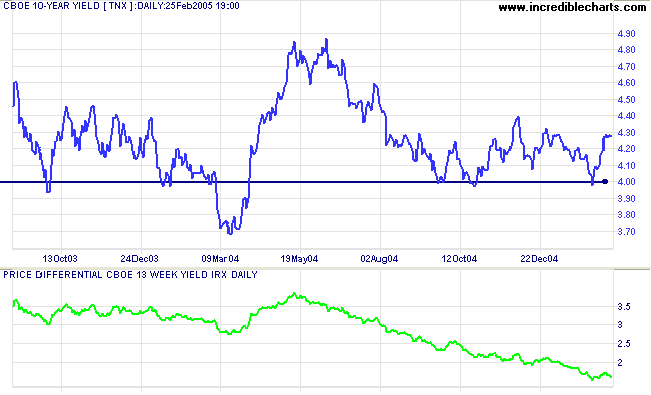

Last week's jump in the core PPI gave long-term yields a boost, with the yield on 10-year treasury notes back above 4.25%.

The yield differential (10-year T-notes minus 13-week T-bills) continues to weaken: back at 1.6% this week.

Below 1.0% would be a (long-term) bear signal for equity markets.

New York: Spot gold has broken above resistance at $430 (upper border of the recent consolidation) with Friday closing at $434.70.

If this holds, we are likely to see a test of resistance at $450. Look for a pull-back that respects the new support level at $430.

|

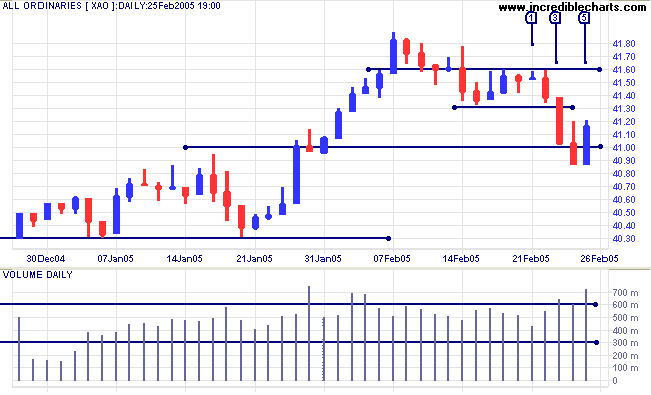

After a brief consolidation the All Ordinaries fell sharply on strong volume at [3]. The attempted rally [4] at the first line of support quickly faded, ending in further losses; but buyers were able to gain control on Friday [5], with a tall blue candle on strong volume.

Expect a test of the initial resistance level at 4130. If this holds, there is likely to be another strong down-swing.

A fall below the low of [5] would signal that a test of support at 4030 is imminent.

A rise above 4160 would signal that the intermediate trend has reversed upwards.

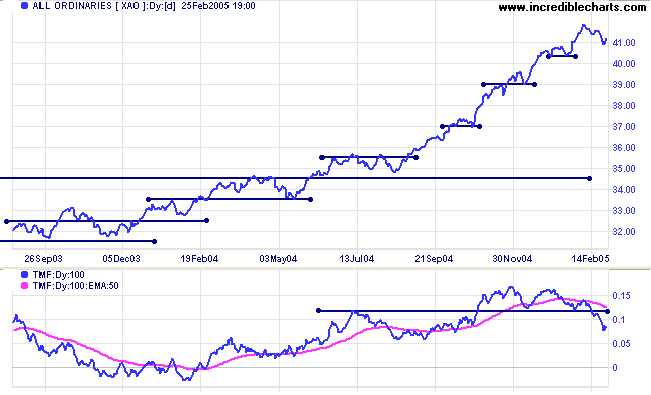

Bear in mind that at some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly tested support at previous long-term highs during an up-trend.

Gain control over your thoughts and you maintain control over your life.

Retrain your mind and you regain your freedom.

~ Andrew Pacholyk: Peaceful Mind

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.