Trading Diary

February 19, 2005

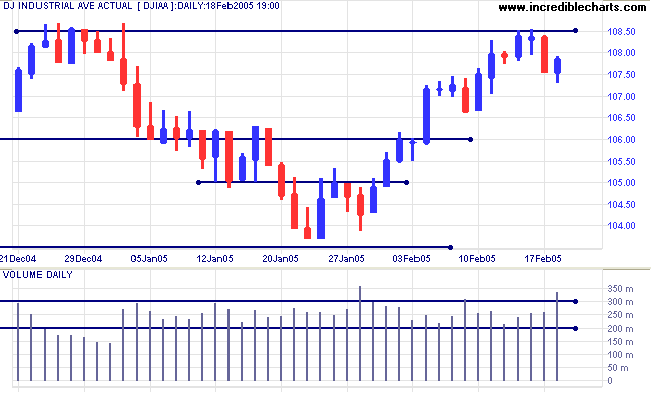

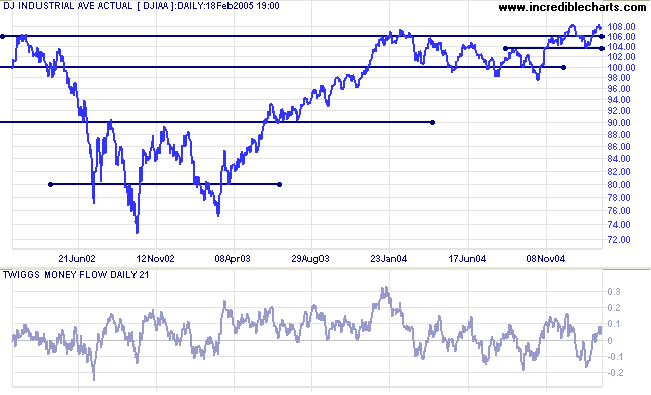

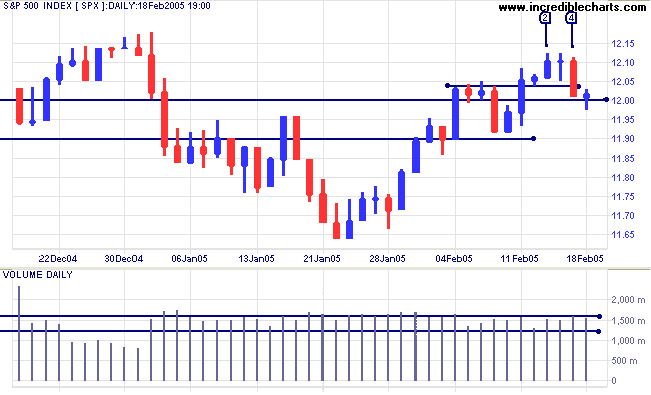

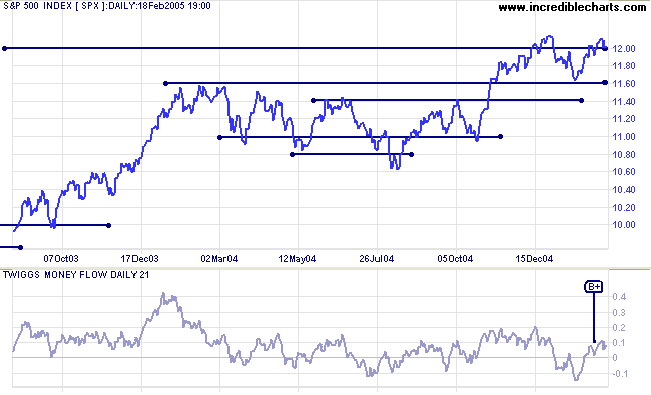

The Dow Industrial Average respected resistance at 10850 to 10860, with a strong red candle on Thursday. However, Friday shows buying support at 10750 with strong volume and a close near the high. A rise above Friday's high would signal another attempt at resistance at 10850 to 10860. A break through resistance would be a strong bull signal. A fall below the low of February 9 would signal that a re-test of support at 10350 is likely.

Twiggs Money Flow (21-day) is above the zero line, but the longer term trend is lower and it is too early to call this a recovery.

|

|

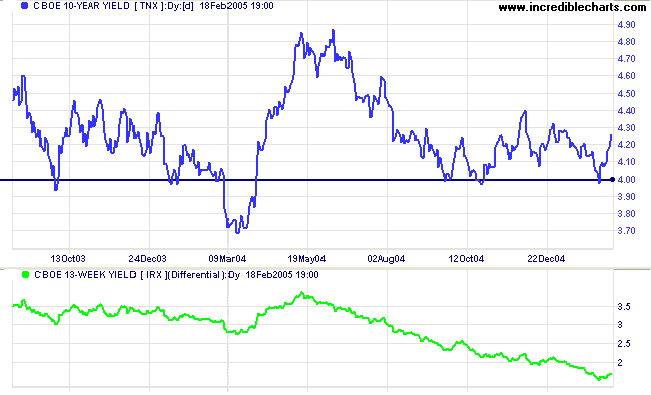

The yield on 10-year treasury notes jumped after a sharp increase in the January core producer price index re-ignited fears of inflation and consequent steeper rates increases from the Fed.

The yield differential (10-year T-notes minus 13-week T-bills) increased to 1.70% this week. Below 1.0% would be a (long-term) bear signal for equity markets.

New York: Spot gold has broken through resistance at $420, the base of the recent consolidation, with Friday closing at $427.30.

The (intermediate) down-trend has slowed and further consolidation below $430 is likely. A rise above $430 would signal a test of resistance at $450.

|

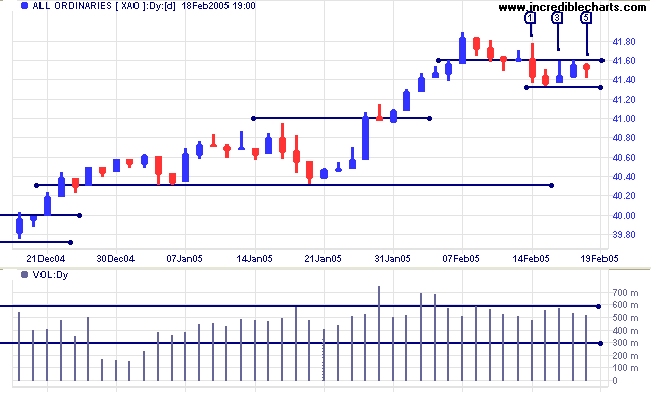

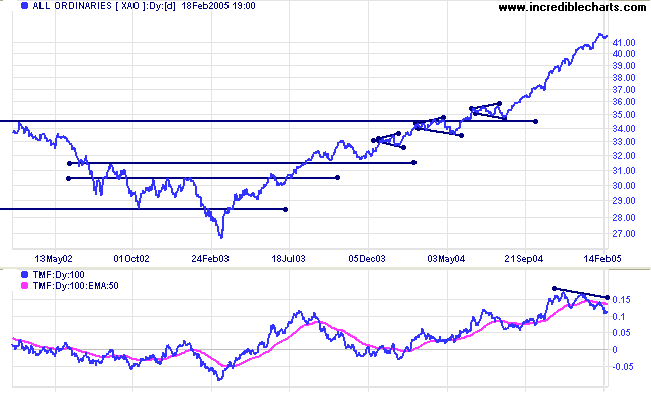

The All Ordinaries has retreated from its February 7 high. An attempted rally at [1] quickly reversed due to a lack of buying support, with support later evident at 4130. A weak close at [3] indicated selling pressure, before a brief consolidation with inside days at [4] and [5]. A rise above the high of [3] would signal another test of the February 7 high, while a fall below support at 4130 would signal that a test of support at 4030 is likely.

We need to bear in mind that at some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly tested support at previous highs during an up-trend.

of what you ought to be doing.

~ John F. Hindelong

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.