Trading Diary

January 29, 2005

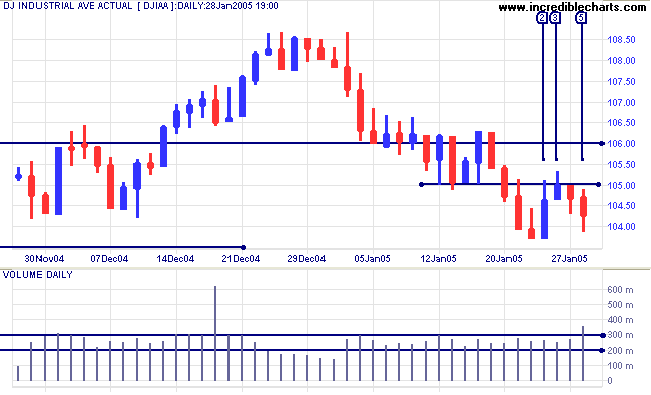

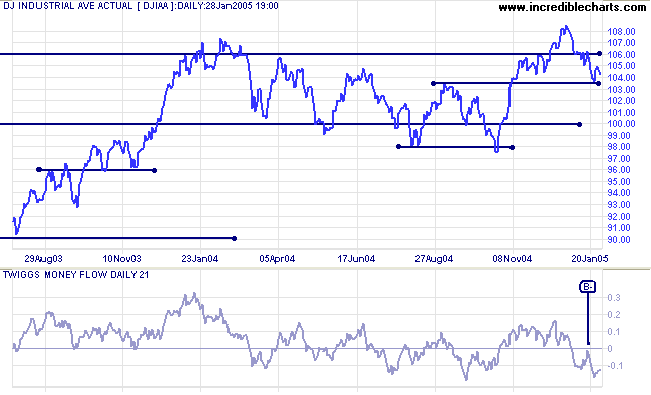

The Dow Industrial Average encountered resistance at 10500 after a short upswing, candles [2] and [3] displaying long shadows. This led me to believe that a strong down-trend would follow, but Thursday and Friday [5] both have long tails, reflecting buying support. Strong volume on Friday indicates a volatile market and we may witness a sharp move in either direction.

If the index holds above 10000, that would still be moderately bullish and further attempts to break above resistance at 10600 are likely. If the correction reaches the previous low of 9750, on the other hand, that would signal bear strength: expect a change in the primary trend.

Twiggs Money Flow (21-day) continues to signal distribution after the peak below zero at [B-] (a strong bear signal).

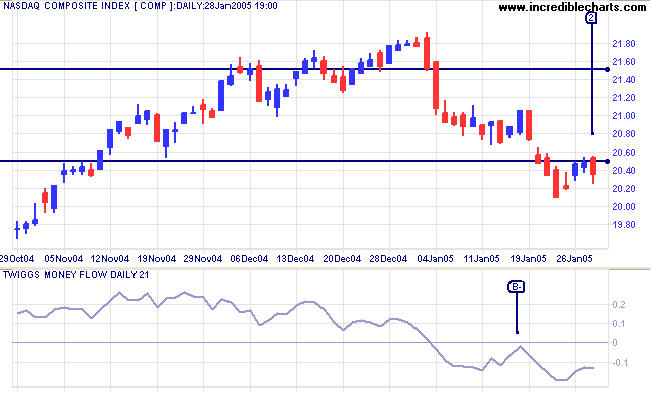

On the other hand, a further downward move would indicate that a test of 1900 is likely.

Twiggs Money Flow (21-day) continues to signal distribution after the bearish peak below the zero line at [B-].

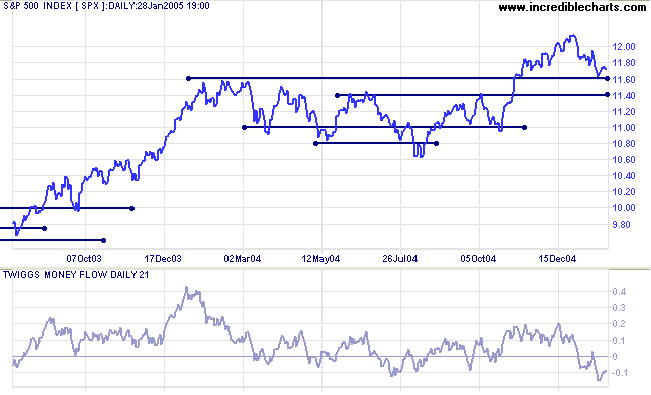

A fall below support at 1100 would have (long-term) bearish implications.

|

|

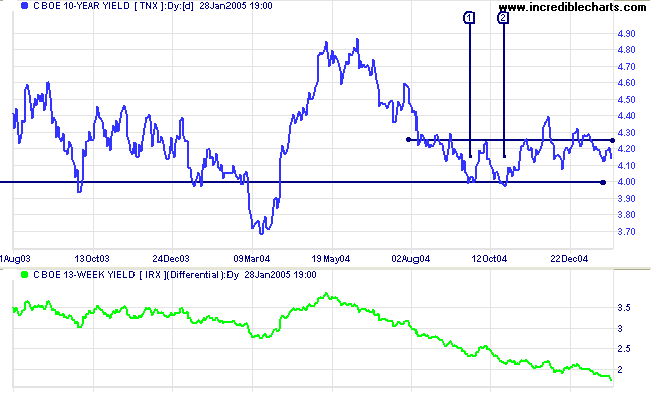

The yield on 10-year treasury notes remains soft, consolidating in a narrow band above 4.00%, despite the Fed being almost certain to raise interest rates by another quarter per-cent at next week's meeting.

The yield differential (10-year T-notes minus 13-week T-bills) continues to fall, reaching 1.75% this week. Below 1.0% would be a long-term bear signal for equity markets.

New York: Spot gold has consolidated in a narrow range between $420 and $430. A close below $420 would signal continuation of the intermediate down-trend, with a likely test of support at $400 and possibly the 1-year low of $375.

Though less likely, a break above $430 would signal another test of $450 (the one-year high).

Friday's close was $425.20.

|

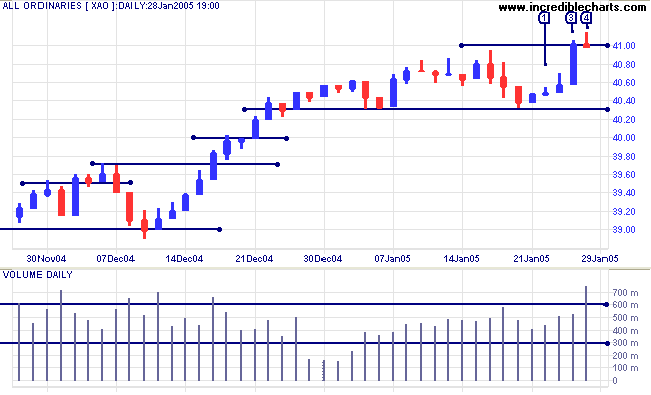

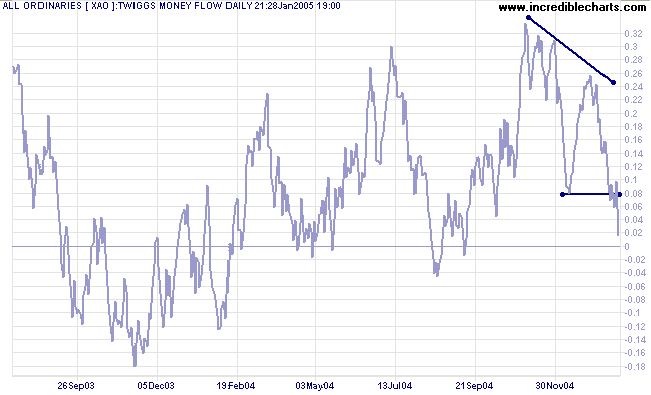

After a hesitant start, with tall shadows signaling resistance on Monday [1] and Tuesday, the All Ordinaries rallied to a new high on Thursday [3]. The index has now encountered committed selling, with a weak close and strong volume at [4]. I expect resistance at 4100 to hold and a downswing to test support at 4030.

A close above 4100 (or a rise above the high of [4]) would signal continuation of the rally.

The primary trend still appears strong but we need to bear in mind that at some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly tested support at previous highs in an up-trend.

no matter how small,

is ever wasted.

~ Aesop

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.