Trading Diary

January 22, 2005

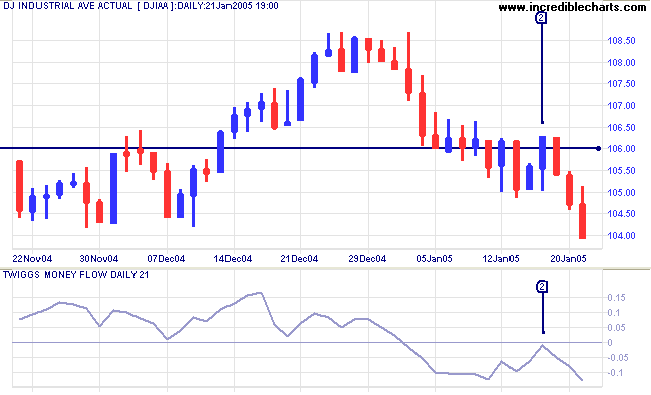

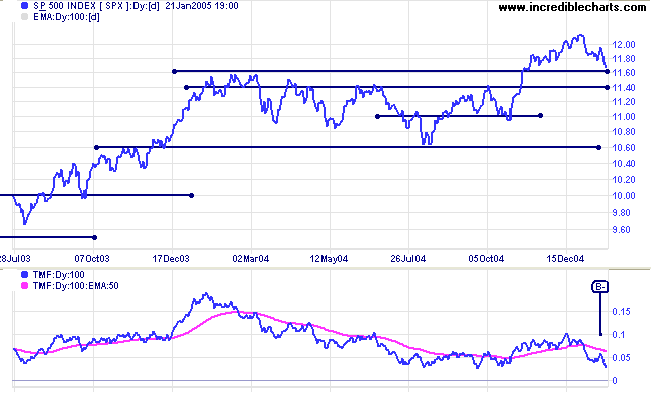

The Dow Industrial Average recovered above resistance at 10600 (Tuesday) but failed to hold on to these gains, slipping back below the previous low on increasing volume. The marginal break [2] is a bearish sign, signaling continuation of the intermediate down-trend. This is supported by the 21-day Twiggs Money Flow which completed a peak below the zero line at [2]: a strong bear signal.

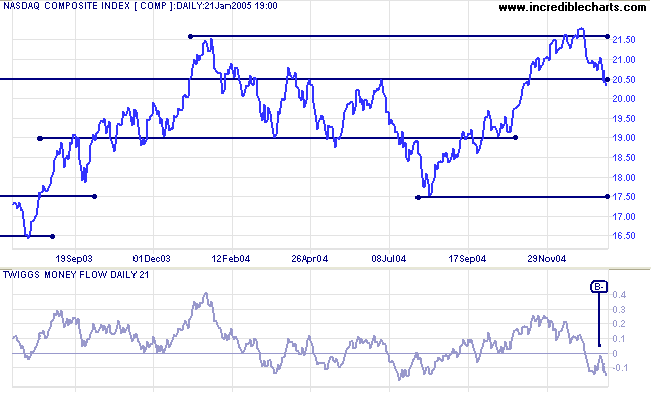

Twiggs Money Flow (21-day) has completed a peak below the zero line at [B-], signaling that bears are in control.

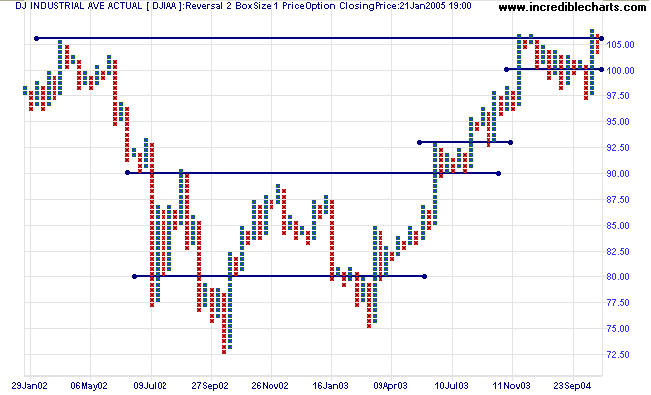

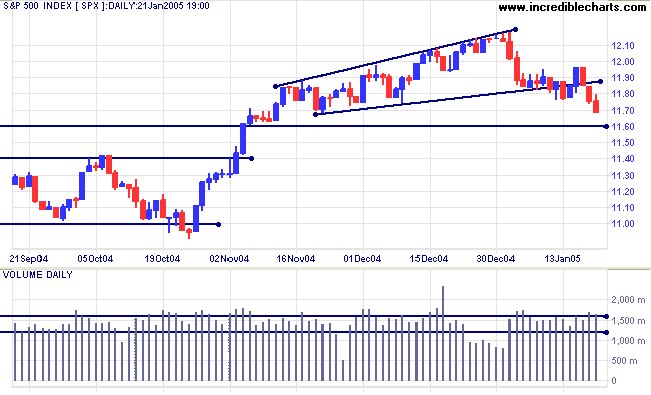

The primary trend direction is up but we appear to be headed for a correction/consolidation.

A fall below support at 1100 would have (long-term) bearish implications.

|

|

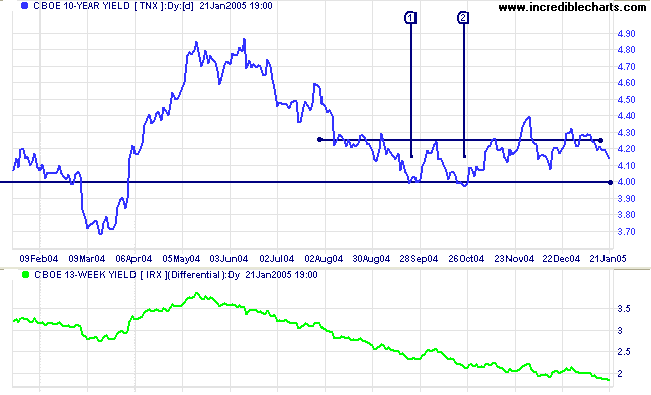

The yield on 10-year treasury notes continues to consolidate in a narrow band above 4.00%, indicating that long-term yields may weaken further. A bearish sign for equity markets.

The yield differential (10-year T-notes minus 13-week T-bills) continues to fall: below 1.0% would be a long-term bear signal for equity markets.

New York: Spot gold has consolidated above support at $420, with Friday's close at $426.50 signaling another test of resistance at $430. A close below $420 would signal continuation of the intermediate down-trend, with a likely test of support at $400 and possibly the 1-year low of $375.

|

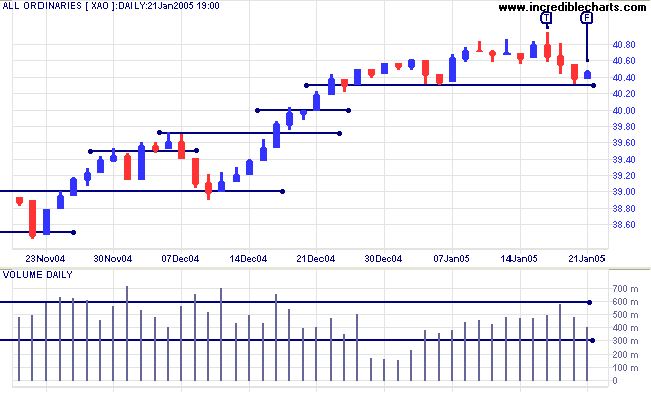

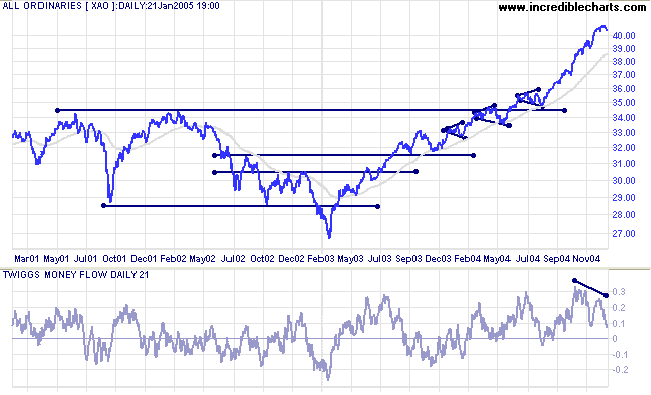

The All Ordinaries continued to encounter resistance around 4080 after bearish activity in US equity markets. This is evidenced by a tall shadow on Tuesday at [T] followed by a retreat to test support at 4030. Friday [F] displays an inside day, signaling indecision. A close below 4030 would signal that a test of 3900 is likely (with possibly some support at 4000 or 3970).

A rally above the high of [F] would signal further consolidation.

but if we begin with doubts, and are patient in them,

we shall end in certainties.

~ Francis Bacon

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.