| Some members have reported that earlier versions of Internet Explorer interfere with the Live Update. If you experience a timeout error during the Live Update, update to Internet Explorer 6 at Microsoft Download. |

Trading Diary

January 29, 2004

USA

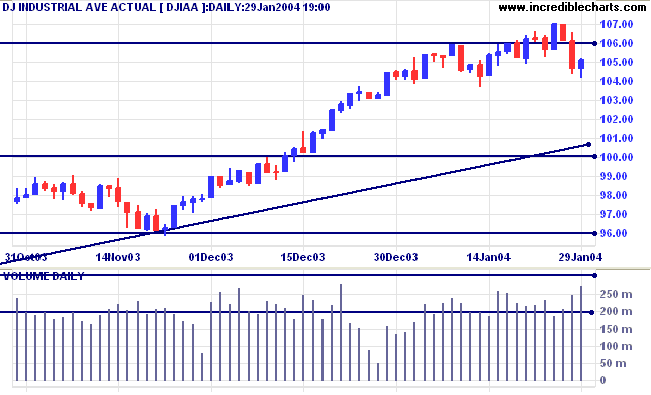

The intermediate trend is still up. The strength of the next rally will determine whether the trend reverses.

The primary trend is up. A fall below support at 9600 would signal reversal.

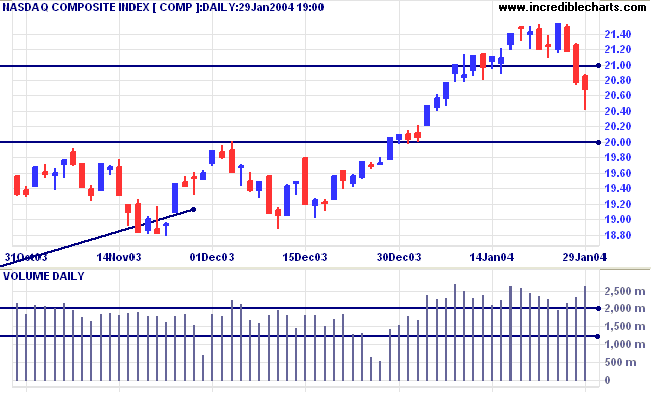

The primary trend is up. A fall below support at 1640 would signal reversal.

The intermediate trend is still up. The strength of the next rally will determine whether the trend reverses.

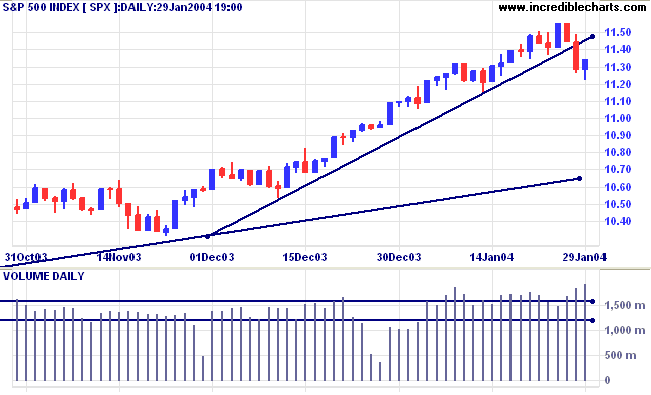

Short-term: Bullish if the S&P500 is above the high of 1155. Bearish below 1126 (Wednesday's low).

Intermediate: Bullish above 1155.

Long-term: Bullish above 1000.

New unemployment claims is almost unchanged at 342,000 for last week.(more)

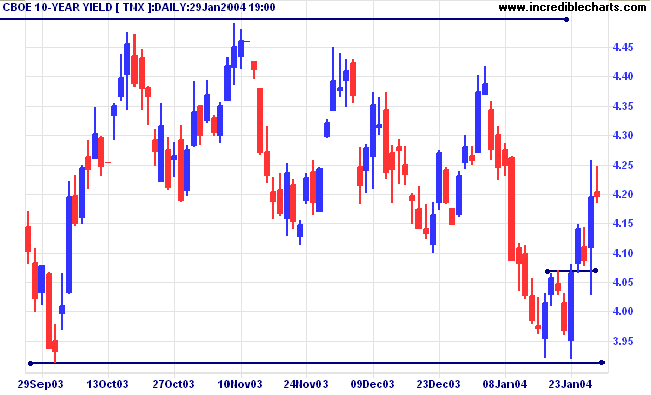

The yield on 10-year treasury notes closed almost unchanged at 4.197%.

The intermediate trend is up and appears headed for a re-test of resistance at 4.4% to 4.5%.

The primary trend is up. A close below 3.93% would signal reversal.

The intermediate trend is down.

The primary trend is up.

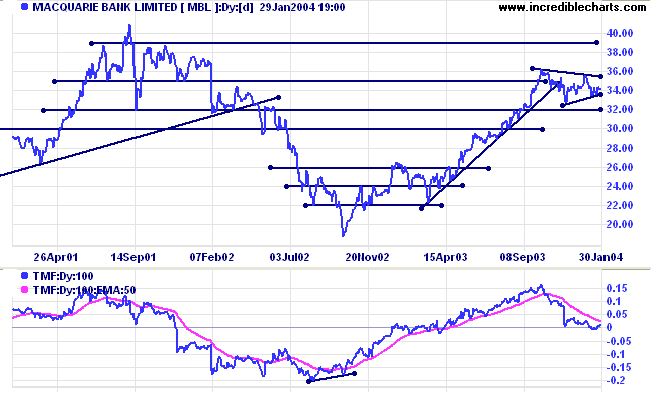

Twiggs Money Flow (100) is headed for a test of its 3-month support level.

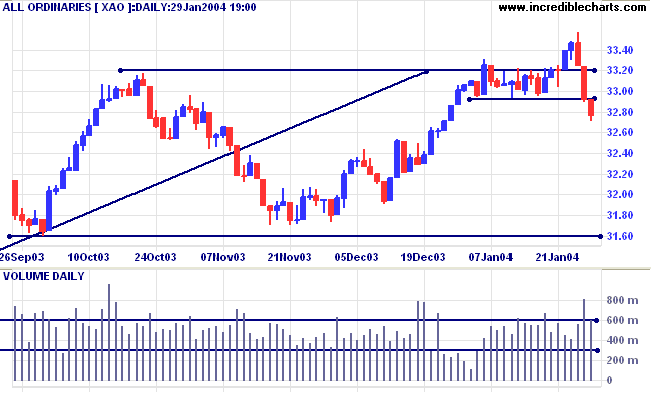

Short-term: Bullish above 3350. Bearish below 3292.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

Last covered on November 11, 2003.

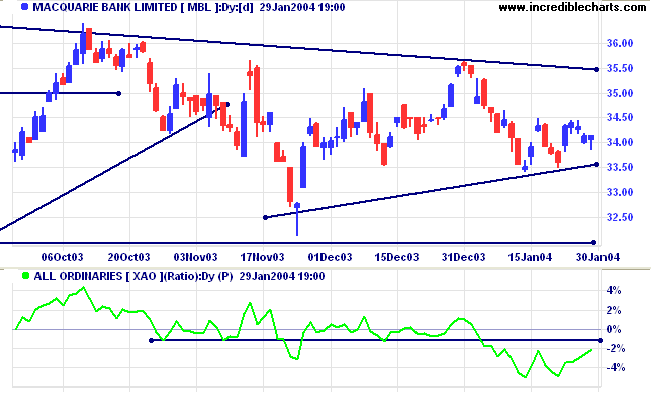

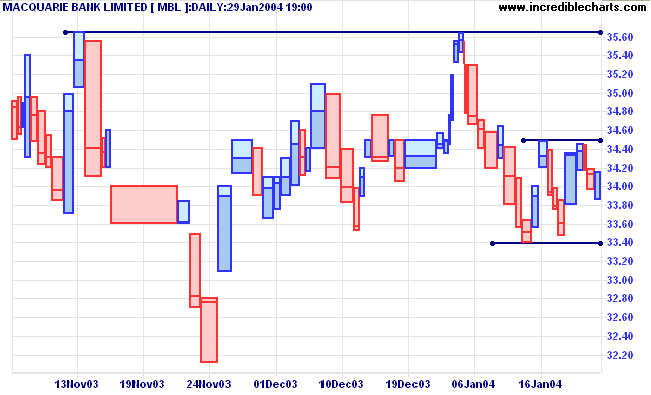

Macquarie has formed a symmetrical triangle after a healthy stage 2 up-trend. Twiggs Money Flow (100) has reversed sharply to near the zero line, but this does not necessarily mean a reversal to a stage 4 down-trend. Symmetrical triangles often appear as mid-point consolidations, resolving into a further rally, roughly equal in magnitude to the first.

What we should not ignore, however, is the state of the overall market. The direction of the market index has a large influence on the performance of individual stocks, even top performers.

A fall below 33.40 would be a bear signal. A rise above 34.50 would be bullish.

It would be prudent, however, to wait for a pull-back that fails to cross above 33.40, or below 34.50, respectively.

so far as speculation is concerned. Money is very seldom lost thereby.

People who have had experience covering one or two panics know very well

that the first lesson that has to be learned by the successful speculator

is the avoidance of the disaster always caused by a panic.

~ SA Nelson: The ABC of Stock Speculation.

- for screening US stocks .

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.