| Some members have reported that earlier versions of Internet Explorer interfere with the Live Update. If you experience a timeout error during the Live Update, update to Internet Explorer 6 at Microsoft Download. |

Trading Diary

January 28, 2004

USA

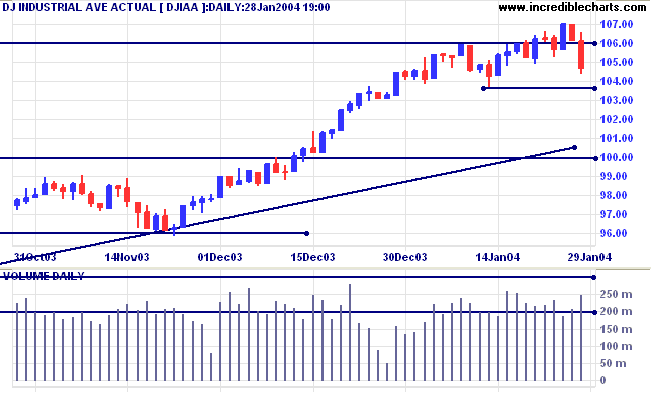

The intermediate trend is up. A trend reversal is likely to result in a re-test of support at 10000.

The primary trend is up. A fall below support at 9600 will signal a trend reversal.

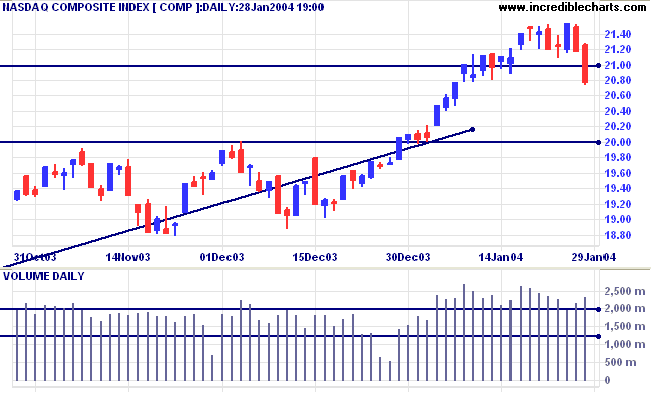

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

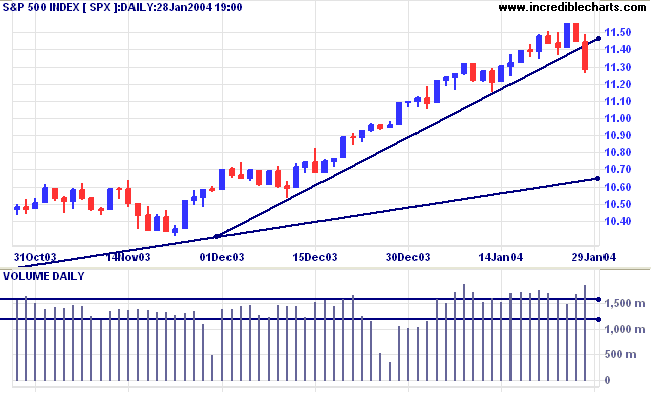

The intermediate trend is up but the trendline has been broken; a bearish sign.

Short-term: Bullish if the S&P500 is above the high of 1155. Bearish below 1136.

Intermediate: Bullish above 1155.

Long-term: Bullish above 1000.

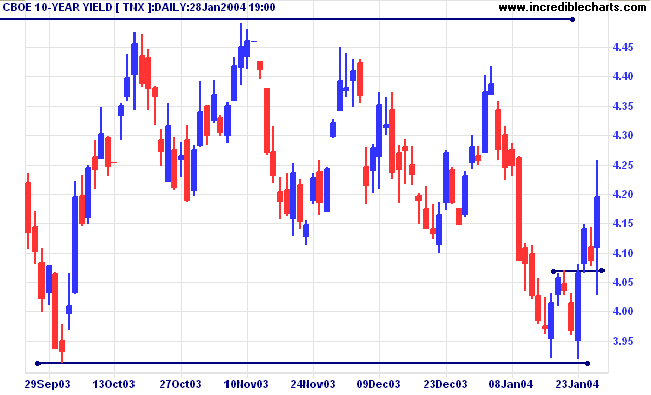

The Federal Reserve Board drops its commitment to hold rates steady "for a considerable period". (more)

The yield on 10-year treasury notes tested support before rallying strongly to close at 4.195%.

The intermediate trend is up and appears headed for a re-test of resistance at 4.4% to 4.5%.

The primary trend is up. A close below 3.93% would signal reversal.

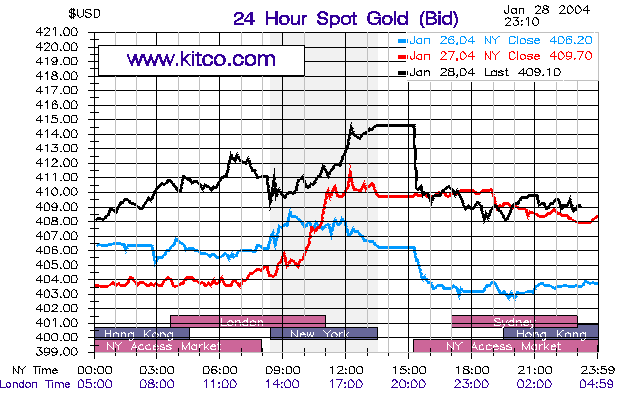

New York (23.10): Spot gold tested 415 before falling back to $409.10.

The intermediate trend is down.

The primary trend is up.

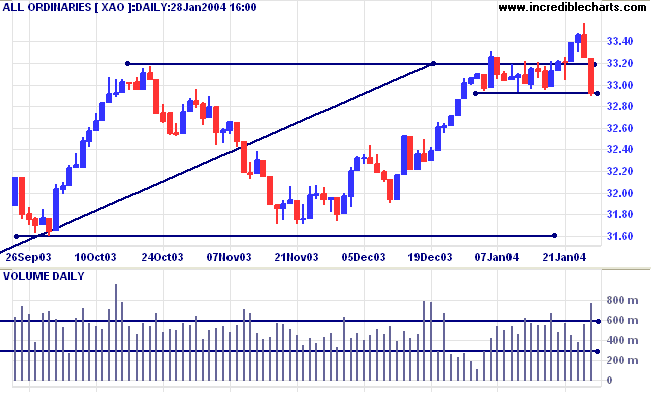

The All Ordinaries fell sharply to close at 3292, roughly at the intermediate support level. Large volume and a strong close indicate sustained selling pressure. A follow-through (below 3292) tomorrow will signal a re-test of support at 3160.

Twiggs Money Flow (100) is headed for a test of the 3-month support level.

The primary trend is up. A fall below support at 3160 would signal reversal.

Short-term: Bullish above 3350. Bearish below 3292.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

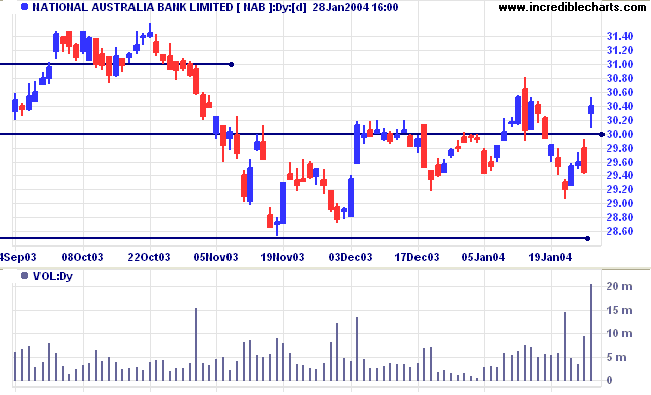

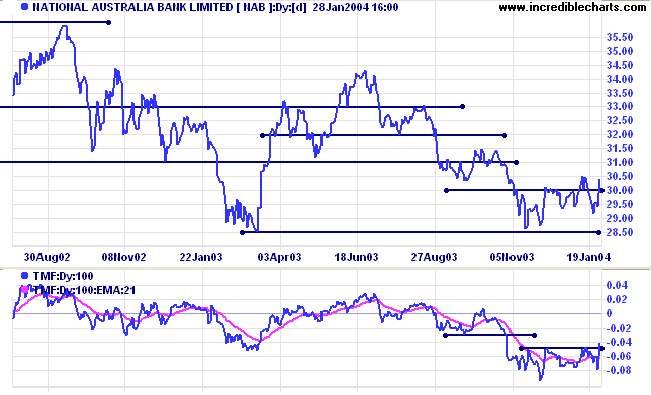

Last covered on January 27, 2004.

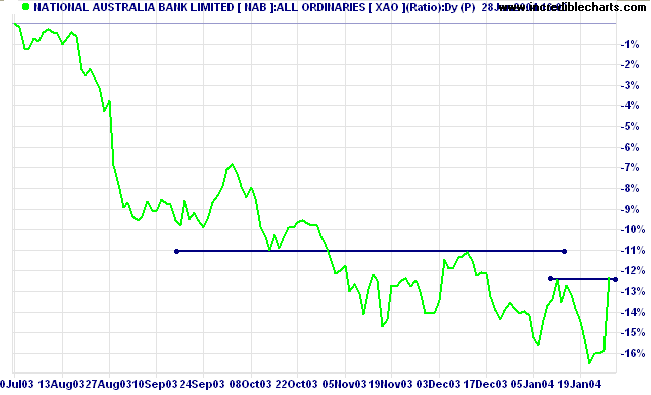

The market can be a fickle mistress. Yesterday I commented that NAB was weakening, with falling Relative Strength and Twiggs Money Flow. Today price gapped above resistance at 30.00. This emphasizes the importance of waiting for the trigger (a fall below 28.50), and not trying to anticipate signals.

Gaps often exhaust short term momentum and we could well tomorrow see another retreat. It is unwise to base trading decisions on a single day's price movement. In this situation it would be prudent to wait for Relative Strength to follow price above resistance and for a pull-back to successfully test the new support level.

The quote below has particular relevance.

starts out as the tiniest shoot;

A nine-story terrace rises up from a basket of dirt.

A high place one hundred, one thousand feet high

begins from under your feet.

~ Lao Tse: Te-Tao Ching.

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the links

at

the

Suggestion box.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.