| Some members have reported that earlier versions of Internet Explorer interfere with the Live Update. If you experience a timeout error during the Live Update, update to Internet Explorer 6 at Microsoft Download. |

Trading Diary

January 27, 2004

USA

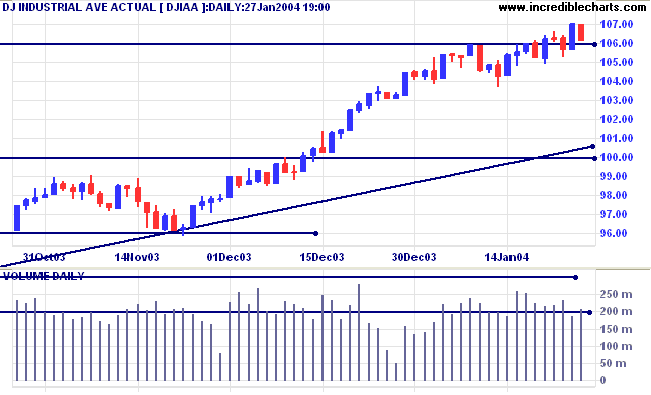

The intermediate trend is up. A fall below 10367 would be bearish.

The primary trend is up. A fall below support at 9600 would signal reversal.

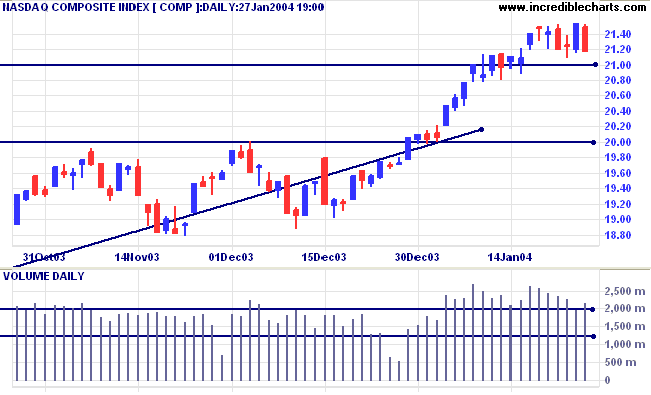

The intermediate trend has lost momentum, forming a consolidation.

The primary trend is up. A fall below support at 1640 will signal reversal.

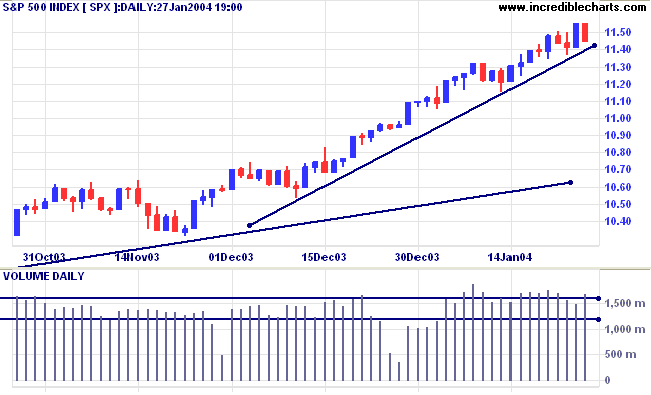

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above 1155 (Monday's high). Bearish below 1136 (Friday's low).

Intermediate: Bullish above 1136.

Long-term: Bullish above 1000.

The internet retailer reported strong fourth-quarter sales and earnings of 29 cents a share, compared to 19 cents a year earlier. (more)

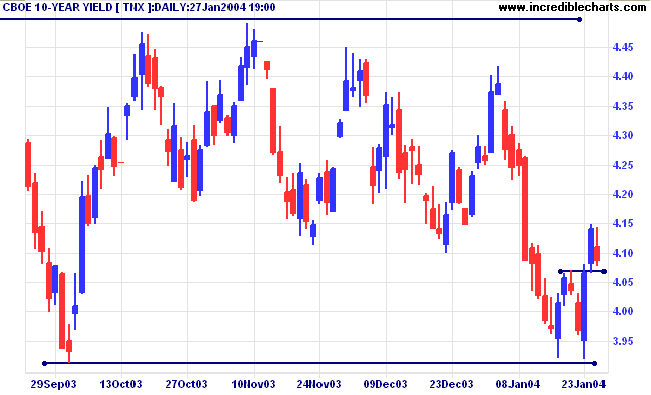

The yield on 10-year treasury notes pulled back to close at 4.087%, testing support at the double bottom neckline.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

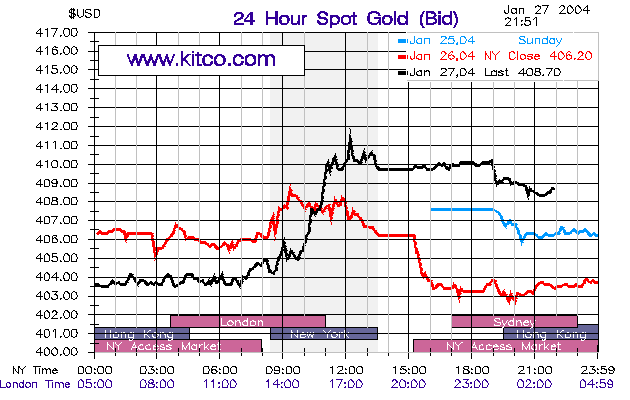

New York (21.51): Spot gold rebounded to $408.70.

The intermediate trend is down and we are likely to see a test of support at 400.

The primary trend is up.

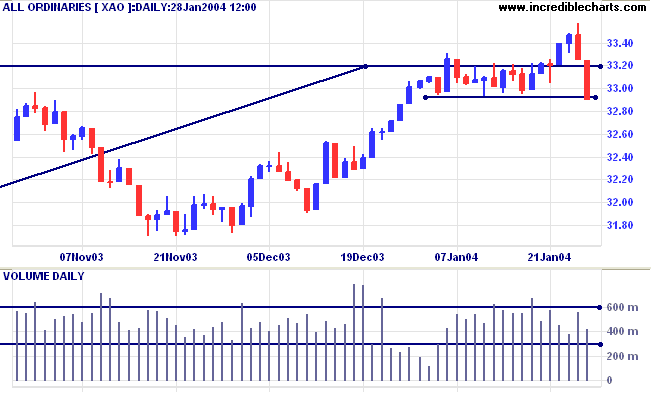

The All Ordinaries has pulled back to test the new 3320 support level. Higher volume indicates selling pressure.

Twiggs Money Flow (100) has made a marginal new high, signaling buyer caution.

The primary trend is up. A fall below support at 3160 would signal reversal.

Short-term: Bullish above 3350. Bearish below 3293.

Intermediate term: Bullish above 3293. Bearish below 3160.

Long-term: Bearish below 3160.

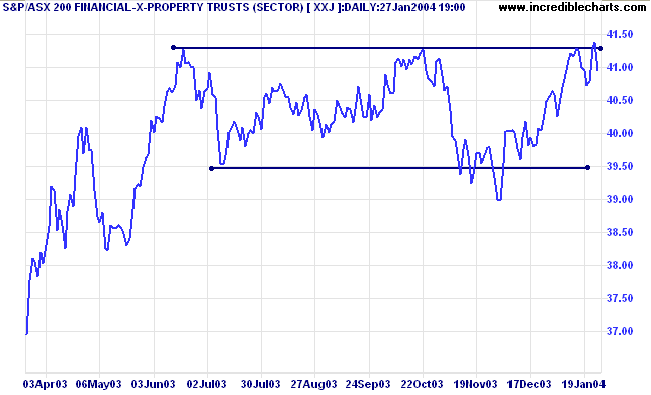

The Financials-X-Property Trusts index [XXJ] has retreated back below resistance at 4127. A marginal break above resistance is often followed by a re-test of support levels at the opposite border of the consolidation pattern.

The breakout falsely signaled the start of a Stage 2 up-trend.

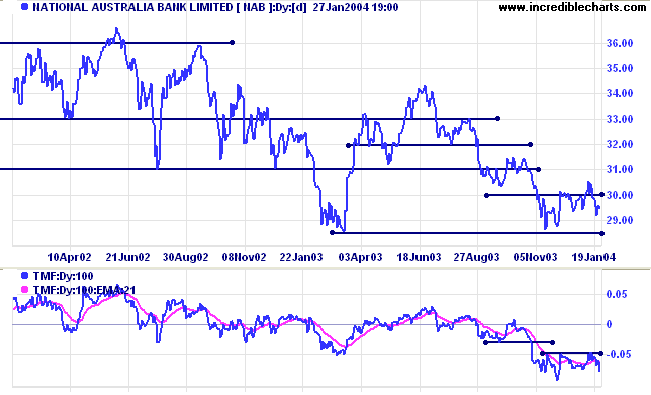

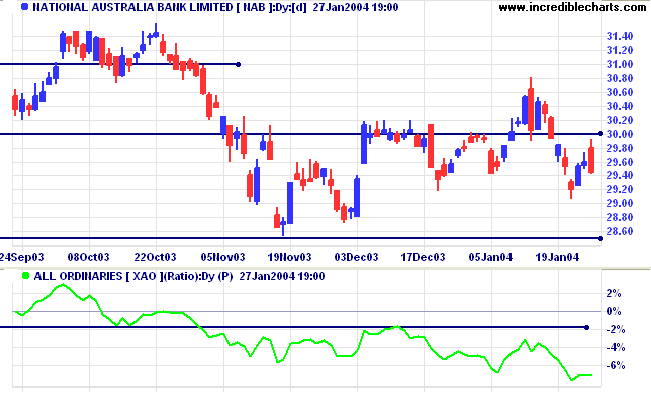

NAB has experienced a reversal of fortunes since last covered on January 12, 2004.

Price retreated back below support at 30.00, completing a marginal break. This may precede a re-test of support at 28.50

Twiggs Money Flow (100) has turned downwards, signaling further distribution.

A close below 28.50 would signal a re-test of support at 24.50. Given the earlier false breaks, it would be prudent to wait for a pull-back (that respects the new resistance level).

knowing that the profit takes care of itself if the other things are attended to.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the links

at

the

Suggestion box.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.