|

The latest version of Incredible Charts is now available.

Your version should automatically update when you login to

the server. Check under Help >> About to

confirm that you have received the update. If you experience a timeout error, download the latest version and install over your present version. This will not affect your watchlists and indicator settings. |

Trading Diary

January 20, 2004

USA

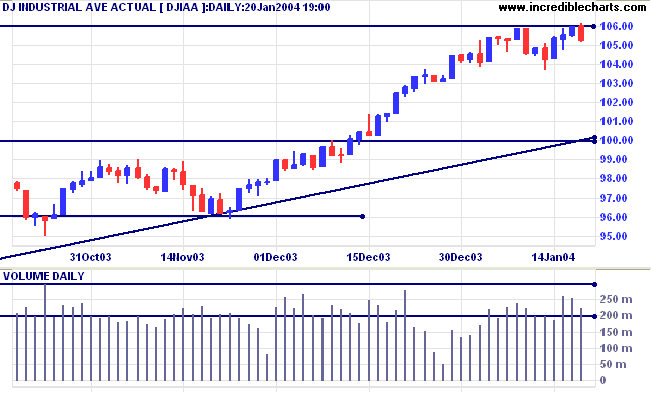

The intermediate trend is up. Equal highs in an up-trend are not bearish, most resolving in a continuation of the trend. However, a fall below last Tuesday's low of 10367 would complete a double top reversal pattern, with a target of 10134: 10367-(10600-10367).

The primary trend is up. A fall below support at 9600 will signal reversal.

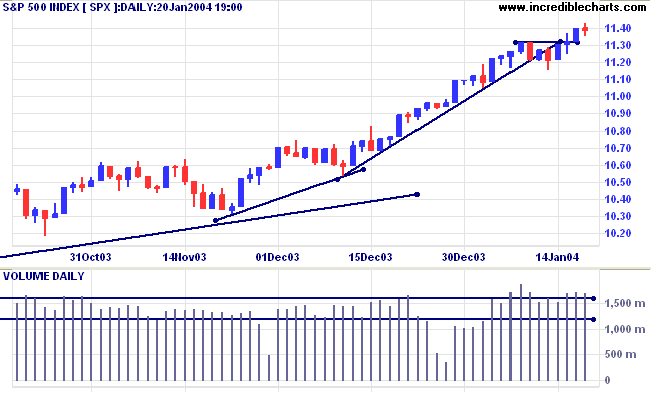

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is up. The next resistance level is at 1175. A fall below 1115 ( last Tuesday's low) would be bearish.

Short-term: Bullish if the S&P500 is above 1132. Bearish below 1115.

Intermediate: Bullish above 1115.

Long-term: Bullish above 1000.

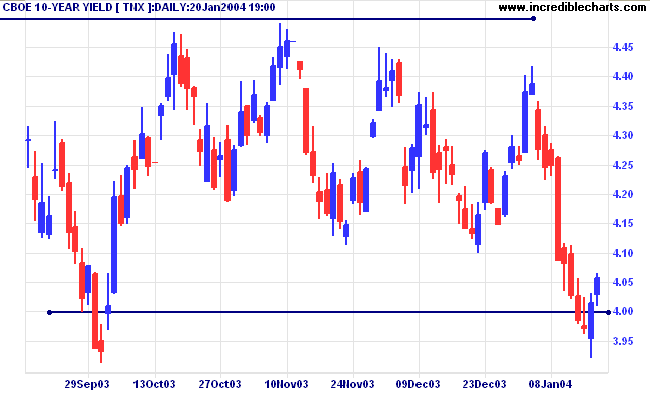

The yield on 10-year treasury notes rallied to 4.057%.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

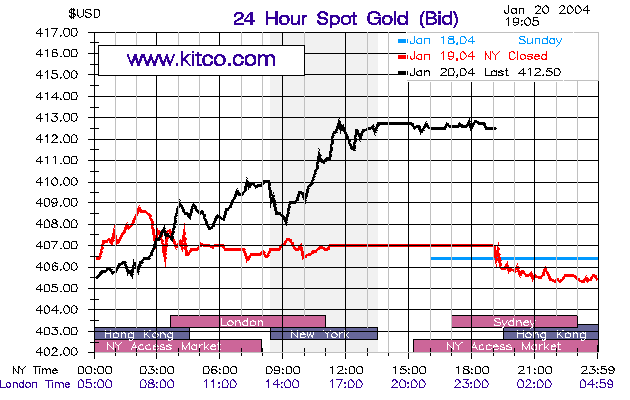

New York (19.05): Spot gold rallied to $412.50 after a low near 405.

The intermediate trend is up.

The primary trend is up.

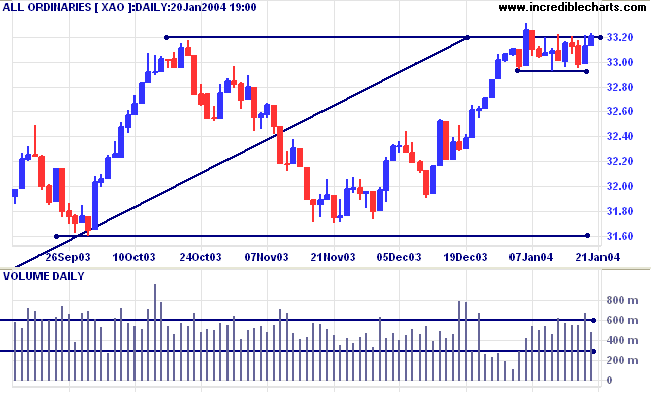

Short-term: Bullish above 3320. Bearish below 3293.

The primary trend is up but will reverse if there is a fall below 3160.

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

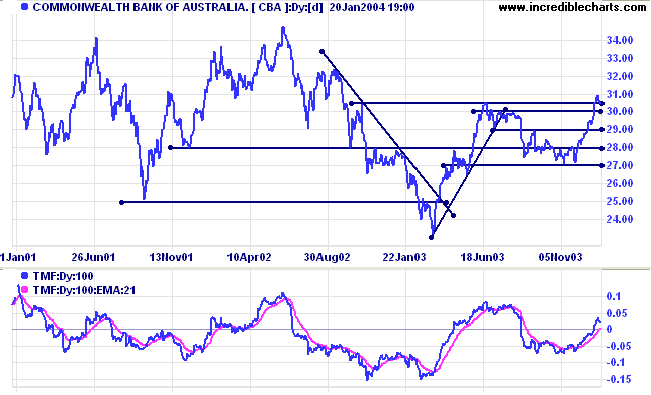

Last covered January 12, 2004.

Commonwealth has pulled back to test support after breaking through resistance at 30.50. Rising Twiggs Money flow (100) signals accumulation.

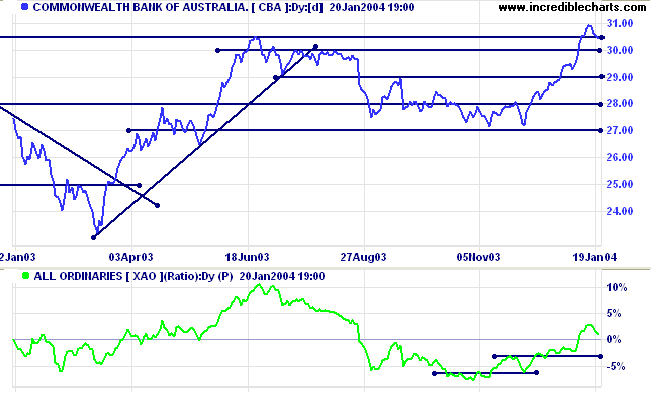

Relative Strength (price ratio: xao) is rising, signaling continuation of the up-trend.

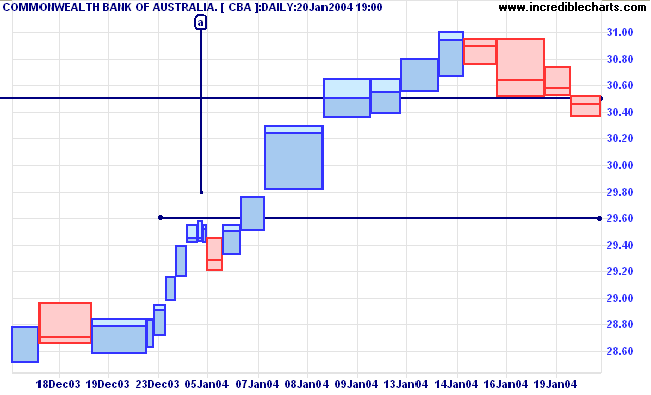

An early up-turn, while above the previous peak at [a], will signal continuation of the fast up-trend.

A correction lasting into next week will signal a loss of upward momentum.

We needed to stop asking about the meaning of life, and instead to think of ourselves

as those who were being questioned by life - daily and hourly.

Our answer must consist, not in talk and meditation, but in right action and in right conduct.

Life ultimately means taking the responsibility to find the right answer to its problems

and to fulfill the tasks which it constantly sets for each individual.

~ Viktor Frankl: Man's Search For Meaning (1963)

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the

links at

the

Suggestion box.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.