In future an early edition of the Trading Diary (sans US charts)

will be available on the website and emailed before 7:00 a.m. (Sydney time).

A later US market update will be emailed around midday.

Trading Diary

November 26, 2003

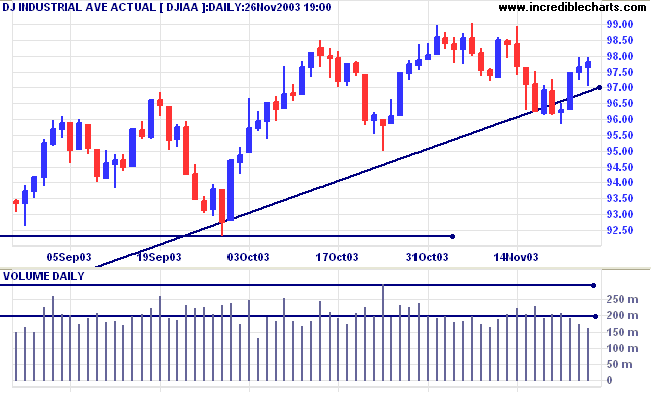

The Dow Industrial Average closed slightly up at 9780. Low volume may be due to tomorrow's holiday.

The intermediate trend is down. Expect support at 9500 and 9230.

The primary trend is up. A fall below support at 9000 will signal reversal.

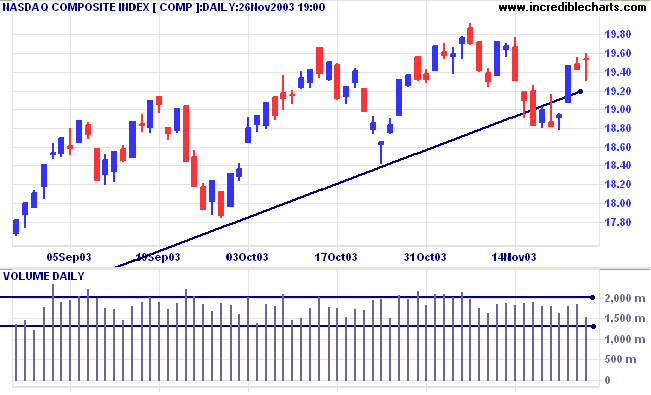

The intermediate trend is down. Expect support at 1840 and 1780.

The primary trend is up. A fall below support at 1640 will signal reversal.

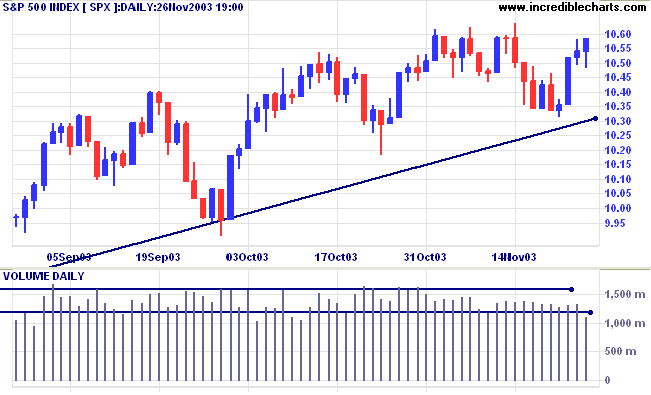

The intermediate trend is down.

Short-term: Bullish if the S&P500 is above the high of 1064. Bearish below 1048 (Today's low).

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

The University of Michigan index of consumer confidence strengthened to 93.7 from 89.6 in October. (more)

New unemployment claims fell to a 33-month low of 351,000 last week. (more)

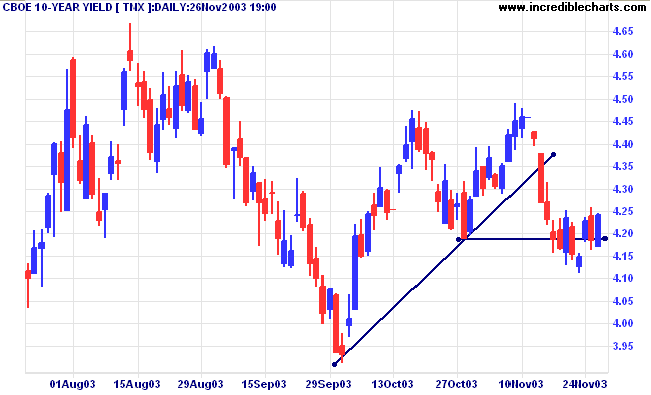

The yield on 10-year treasury notes closed up slightly at 4.24%.

The intermediate trend is down after bearish equal highs below a higher peak.

The primary trend is up.

New York (13.30): Spot gold rallied to $396.50.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has whipsawed above its signal line.

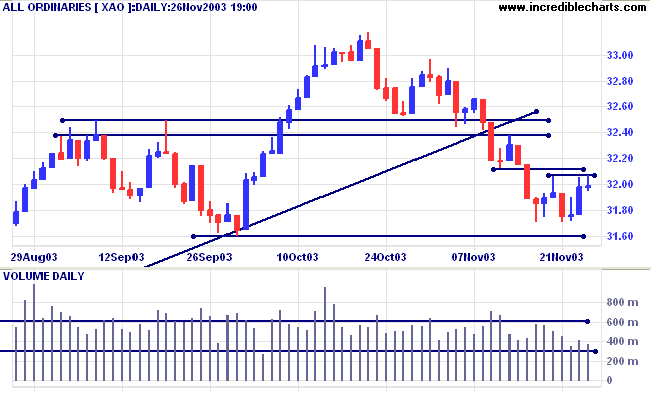

Short-term: Bullish if the All Ords rises above 3212 (the November 12 low). Bearish below today's low of 3194.

The primary trend is up but will reverse if there is a fall below 3160 (the October 1 low).

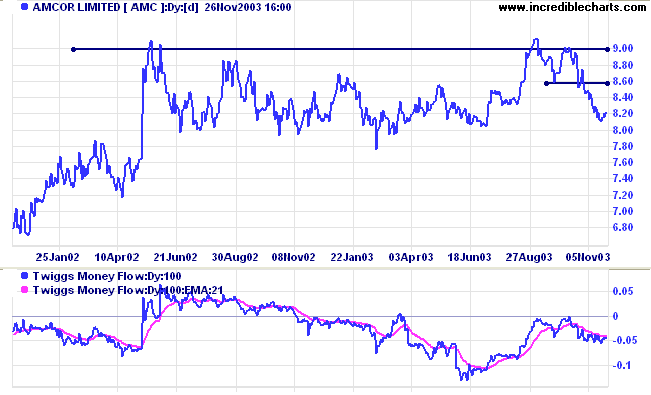

Twiggs Money Flow (100) signals distribution after a bearish triple divergence.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Neutral. Bearish below 3160.

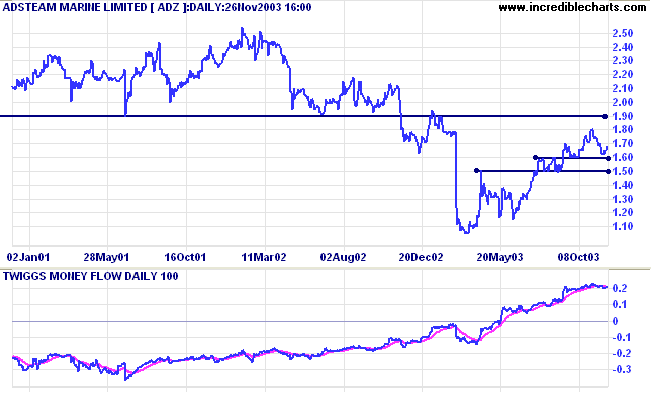

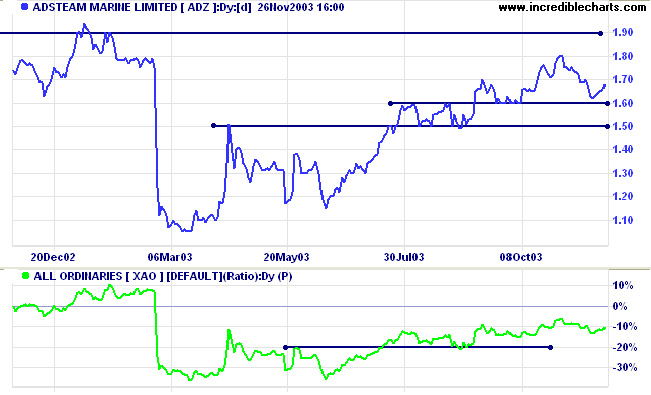

Twiggs Money Flow (100) has climbed strongly over the last 6 months, signaling accumulation, after a cathartic sell-off in February.

At this stage of the market I would rather aim for a neutral position, balancing existing long positions with new short entries.

Last covered on February 12, 2003.

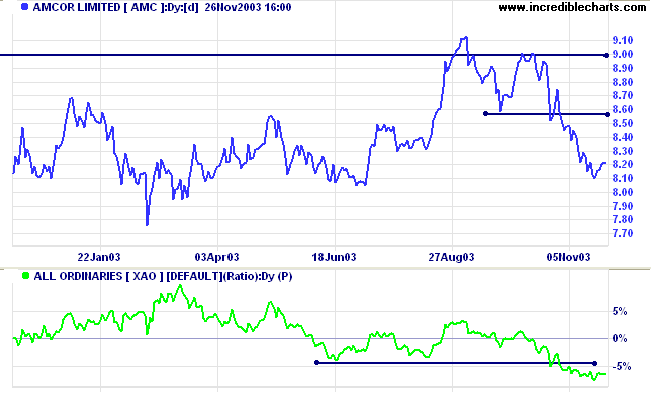

AMC has completed a double top at resistance at 9.00 and now appears to be starting a pull-back to test the new resistance band at 8.50 to 8.57. A strong bear signal will result if price and Relative Strength (xao) both respect the new resistance level.

A rise above 9.00 would be bullish.

Happy is he who has been able to learn the cause of things.

~ Virgil.

Our server switch-over has taken longer than expected.

We are now in the final stages of the setup.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.