after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

February 12, 2003

The primary trend is down.

The Nasdaq Composite fell 1.3% to close at 1278.

The next major support level is at 1200.

The primary trend is up (the last low was 1108, the last high 1521).

The S&P 500 lost 11 points to close at 818.

The index has formed a base between 768 and 964 but appears headed for a re-test of the support level.

The Chartcraft NYSE Bullish % Indicator is at 44% (February 11).

News Corp reports second-quarter earnings, excluding one-off items, of 24 US cents per ADR, compared to 17 cents a year ago.

New York (16.18): Spot gold fell more than 10 dollars to $US 352.60.

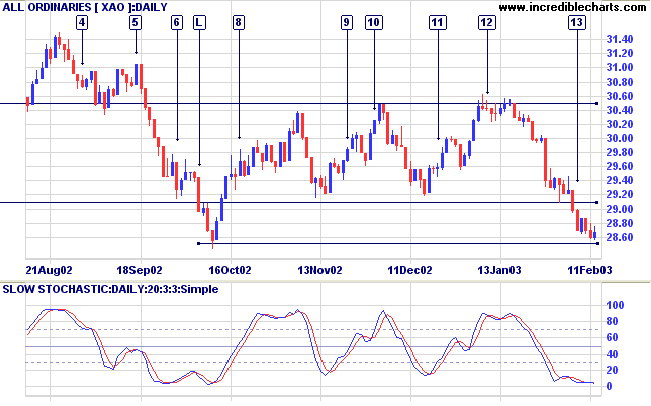

The index is approaching a major support level, with a strong band of support between 2850 and 2779, and the likelihood of a short-term rally increases.

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

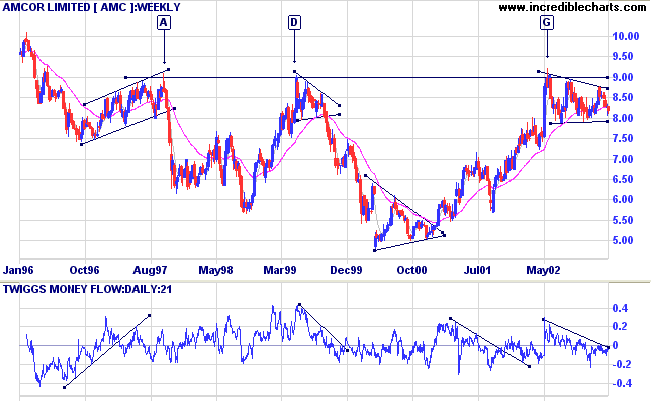

Last covered on May 8, 2002.

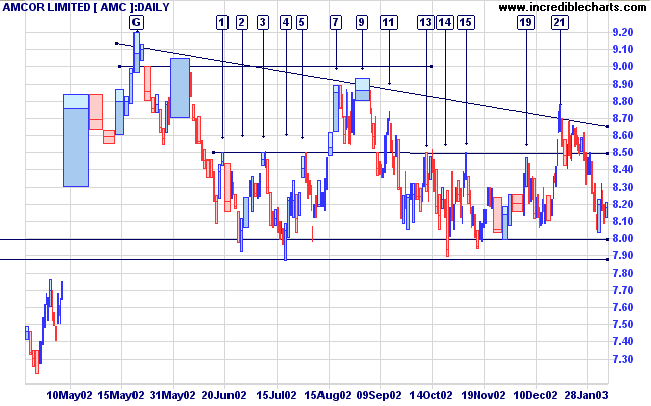

After equal highs at [A] and [D] AMC formed a triangular base at 5.00 before reversing into a stage 2 up-trend. The rally again halted at the 9.00 resistance level, with the stock forming a bearish descending triangle at [G].

Relative Strength (price ratio:xao) has levelled off, MACD is bearish and Twiggs Money Flow signals distribution.

AMC will give a strong bear signal if it breaks below 8.00 on reasonable volume and then respects the new resistance level from below. The shorter the duration of the pull-back, and the lighter the volume, the stronger the subsequent fall is likely to be.

A break above the high of [21] would be a bull signal.

For further guidance see Understanding the Trading Diary.

Weapons are the tools of violence;

all decent men detest them.

Weapons are the tools of fear;

a decent man will avoid them

except in the direst necessity

and, if compelled, will use them

only with the utmost restraint.

Peace is his highest value.

If the peace has been shattered,

how can he be content?

His enemies are not demons,

but human beings like himself.

He doesn't wish them personal harm.

Nor does he rejoice in victory.

How could he rejoice in victory

and delight in the slaughter of men?

He enters a battle gravely,

with sorrow and with great compassion,

as if he were attending a funeral.

- Lao Tse

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.