In future an early edition of the Trading Diary (sans US charts)

will be available on the website and emailed at 7:00 a.m. (Sydney time).

A later US market update will be emailed around midday.

Trading Diary

November 24, 2003

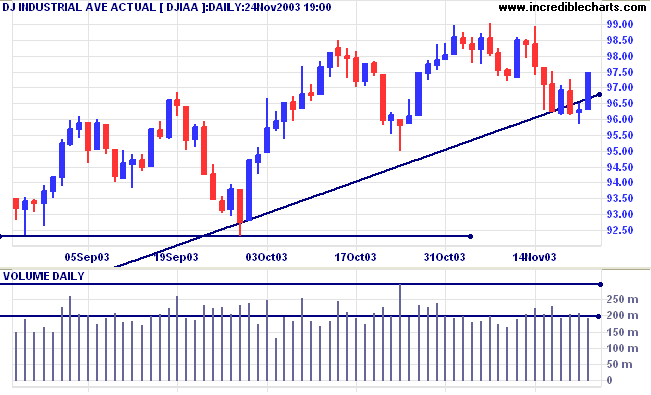

The intermediate trend is down. Expect support at 9500 and 9230.

The primary trend is up. A fall below support at 9000 will signal reversal.

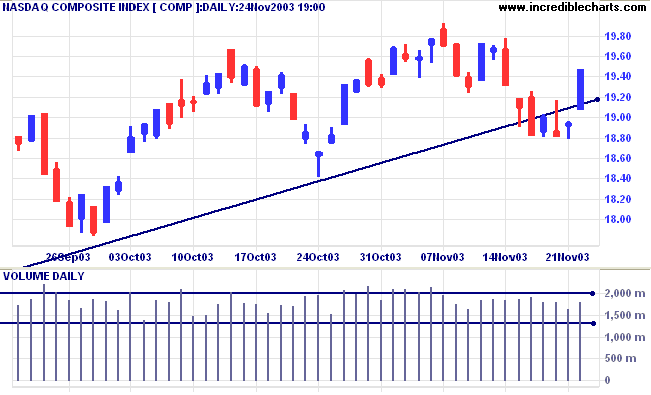

The intermediate trend is down. Expect support at 1840 and 1780.

The primary trend is up. A fall below support at 1640 will signal reversal.

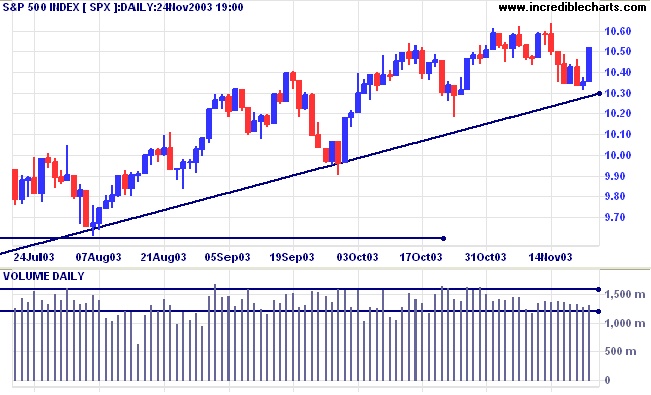

The intermediate trend is down.

Short-term: Bullish if the S&P500 is above the high of 1064. Bearish below 1034 (Tuesday's low).

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

The dollar recovered against the yen and euro on thin pre-holiday trade. (more)

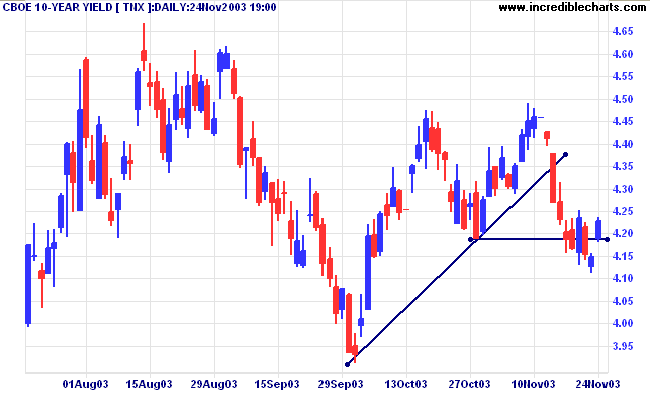

The yield on 10-year treasury notes gapped up to 4.23%, a bullish sign.

The intermediate trend is down after bearish equal highs below a higher peak.

The primary trend is up.

New York (20.13): Spot gold retreated to $391.40.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has whipsawed back below its signal line.

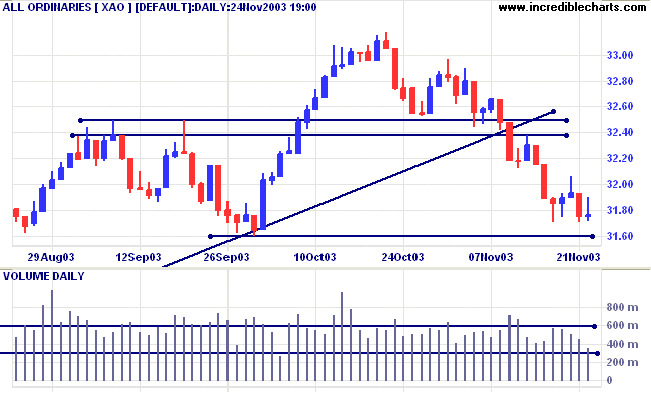

Short-term: Bullish if the All Ords rises above Thursday's high of 3206. Bearish below Thursday's low of 3189.

Twiggs Money Flow (100) signals distribution after a bearish triple divergence.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Bearish below 3160.

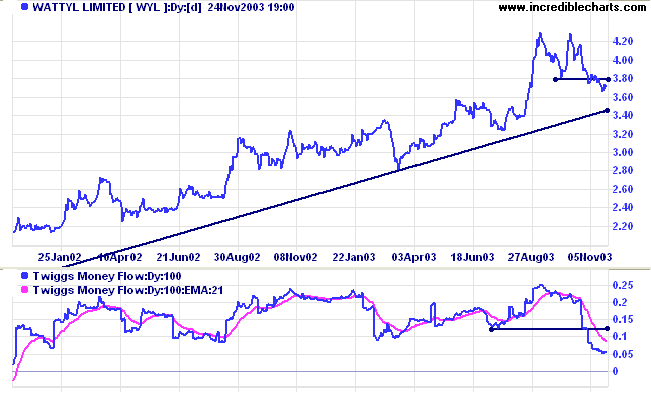

Last covered on March 12, 2003.

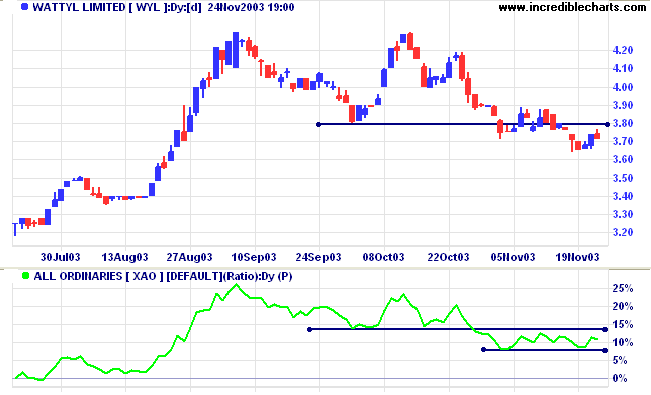

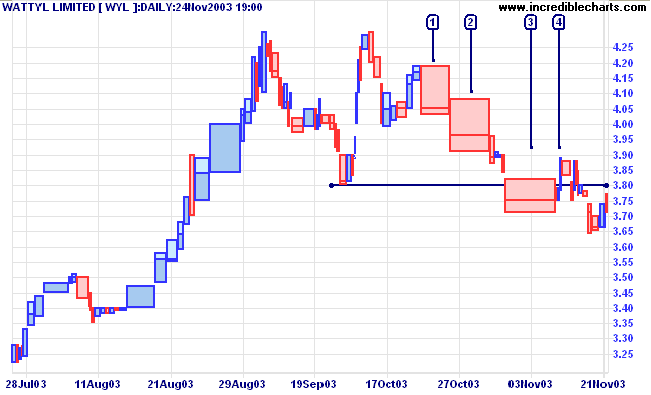

WYL has broken downwards after a September-October double top and appears headed for a test of the primary supporting trendline. Twiggs Money Flow (100) is bearish after a sharp fall below the previous low.

and the deeper it sinks into the mind.

~ Samuel Coleridge.

Our server switch-over has taken longer than expected

but we are now in the final stages of the setup.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.