The new Premium data will include market statistics:

New Highs/Lows, Advances/Declines and Advance/Decline Volume.

Trading Diary

March 12, 2003

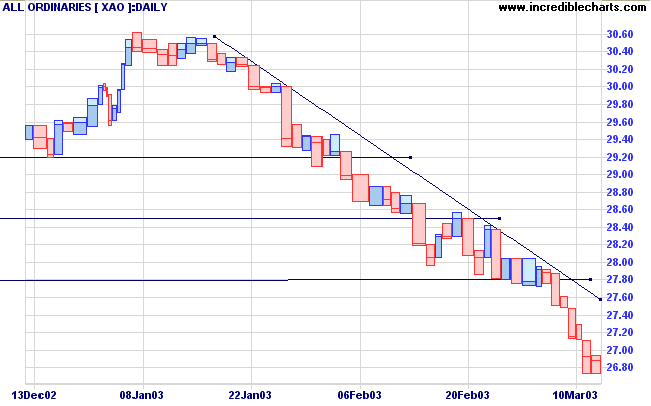

The intermediate cycle is down; the next support level is at 7500.

The primary trend is down.

The Nasdaq Composite made a similar reversal to close up 8 points at 1279.

The intermediate trend is down, with the next support level at 1200.

The primary trend is up; a fall below 1108 will signal a reversal.

The S&P 500 mimicked the Dow, closing up 4 points at 804.

The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 38% (March 11).

Crude oil prices approach $US 40 barrel as government data shows falling supplies. (more)

The chip-maker unveils a new wireless technology chip for laptops, called the Centrino. (more)

New York (16.50): Spot gold is down 440 cents at $US 345.50.

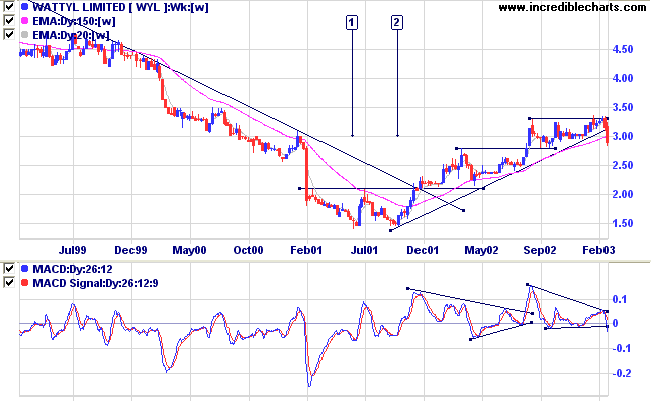

After a double bottom at [1] and [2] WYL commenced a slow stage 2 up-trend. Price has now broken below the trendline on strong volume.

Relative Strength (price ratio: xao) is falling; Twiggs Money Flow and MACD show bearish divergences.

Chemical stocks (ORI, SYM and NUF) are generally bearish.

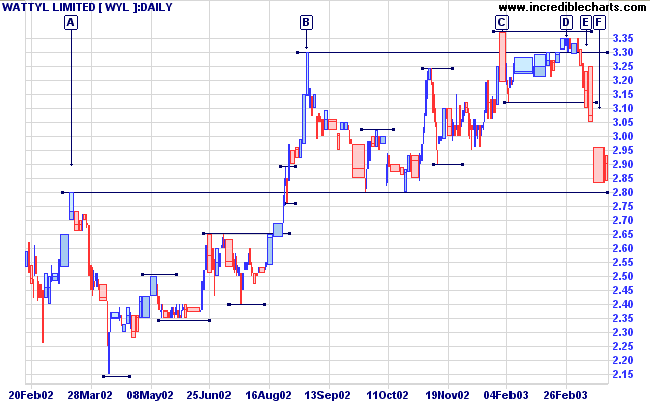

WYL then gapped down to [F] but left a long shadow, closing at the day's high, signaling short-term exhaustion. The inside day following indicates that some consolidation above the 2.80 support level can be expected.

A break below 2.80 will be a strong bear signal.

For further guidance see Understanding the Trading Diary.

If you can trust yourself when all men doubt you

But make allowance for their doubting too

- Rudyard Kipling: IF

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.