Trading Diary

November 13, 2003

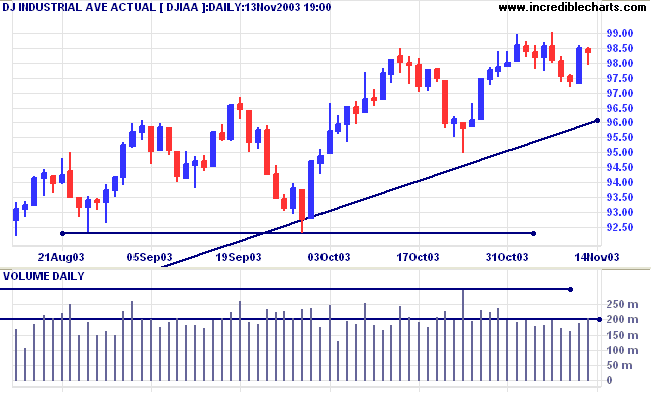

The intermediate trend is down.

The primary trend is up. A fall below 9000 would signal reversal.

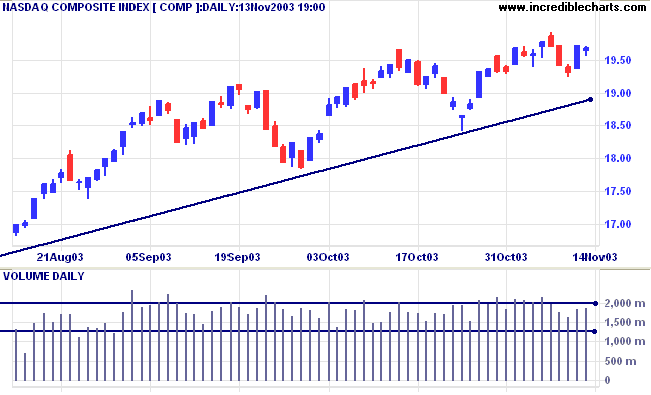

The intermediate trend is up. Expect resistance at 2000 to 2060.

The primary trend is up. A fall below 1640 will signal reversal.

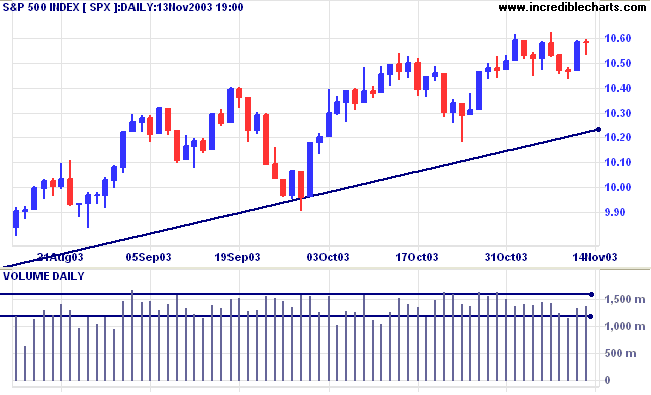

The intermediate trend is up. Expect some resistance at 1100 (a significant support level from 2001/02).

Short-term: Bullish if the S&P500 is above 1060 (Today's High).

Intermediate: Bullish above 1062 (Friday's High). Long-term: Bullish above 960.

A 3-box reversal is required to signal a bear alert.

Consumers are still cautious according to Wal-Mart CEO Lee Scott. (more)

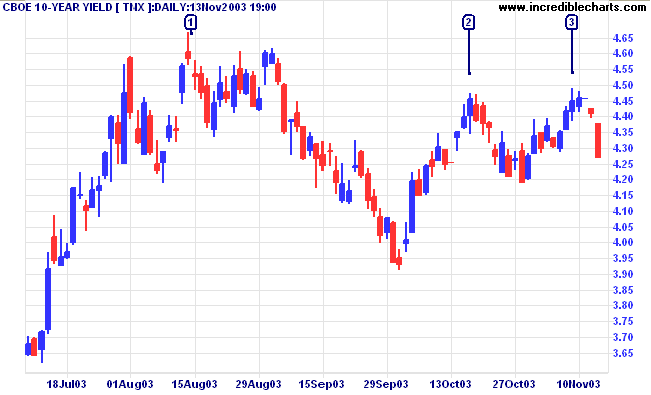

The yield on 10-year treasury notes closed down sharply at 4.27%.

The intermediate trend is up. Equal highs, [2] and [3], below the previous high [1] are a bear signal.

The primary trend is up.

New York (20:39): Spot gold increased to $395.20.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) and Slow Stochastic (20,3,3) are both below their signal lines.

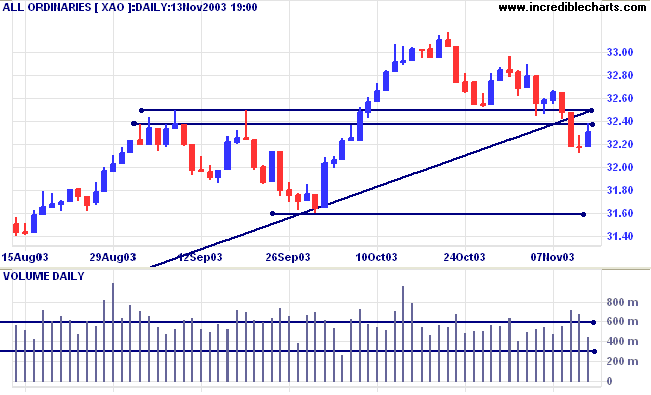

Short term: Bearish below 3238; Bullish above 3250.

The primary trend is up but the rally is extended. Probability of a reversal increases with each successive primary trend movement.

The index has broken the primary trendline and a fall below support at 3160 will signal reversal.

Twiggs Money Flow (100) has crossed below zero after a bearish triple divergence.

Intermediate: Bearish below 3160; Bullish above 3250. Long-term: Bearish below 3160.

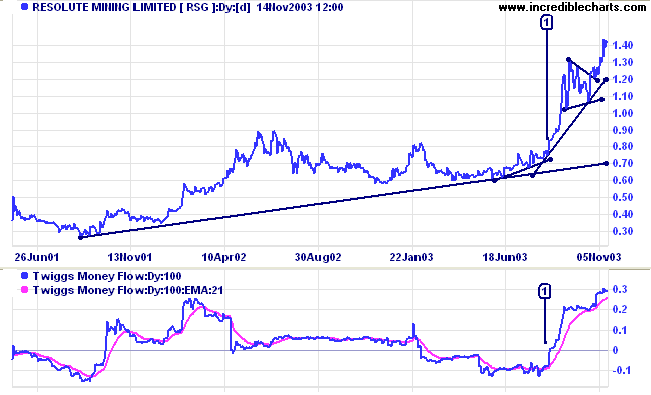

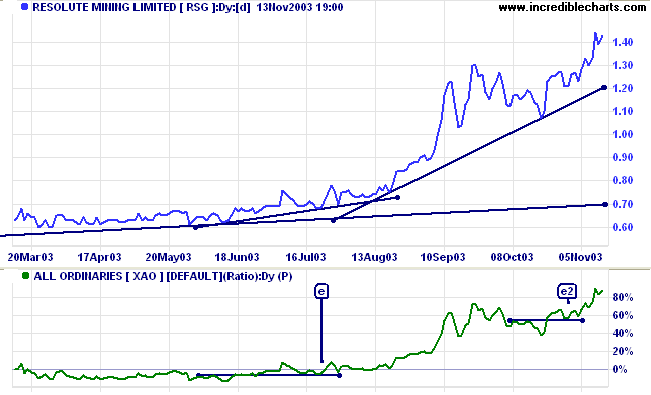

A friend has held Resolute for the past few months. The stock resumed a fast up-trend after a triangular consolidation.

Twiggs Money Flow (100) climbed sharply after crossing its signal line at [1], leveled out during the consolidation, before again starting to climb.

The earlier rise was signaled by higher lows at [e].

Consolidations often form roughly at the mid-point in an upward trend; so the target is measured from the start of the trend at, say 0.80, to the high of the triangle, at 1.35. This is then projected from the breakout at 1.25: 1.25 + (1.35 - 0.80) = 1.80.

A more conservative estimate can be calculated from the high and low of the triangle: 1.25 + (1.35 - 1.02) = 1.58.

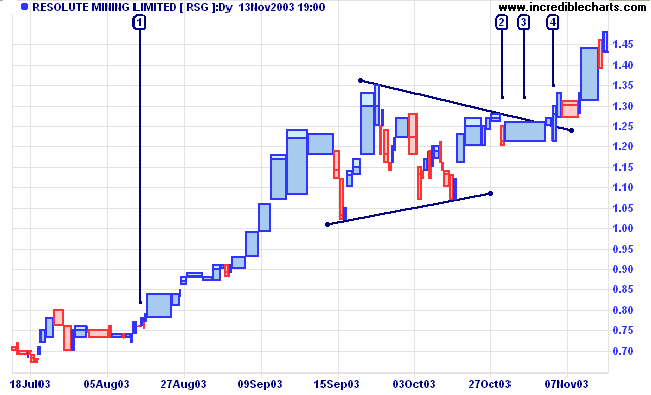

Entry points were presented at [1] and [3]. Stops at [3] should be placed below the low of [2]: the opposite edge of the triangle is too far away.

Stops should be moved up below each short-term correction or lagged further, below a moving average.

Last covered September 9, 2003.

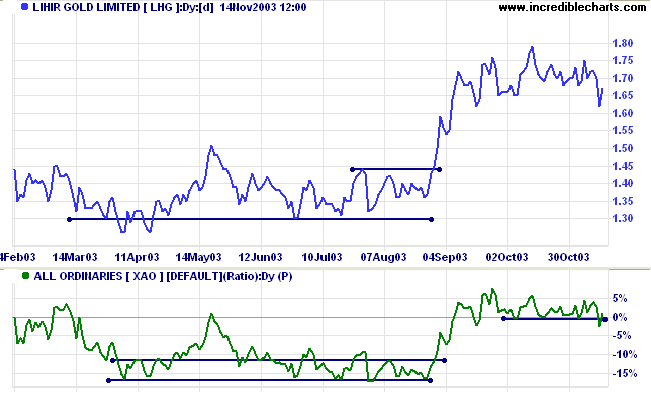

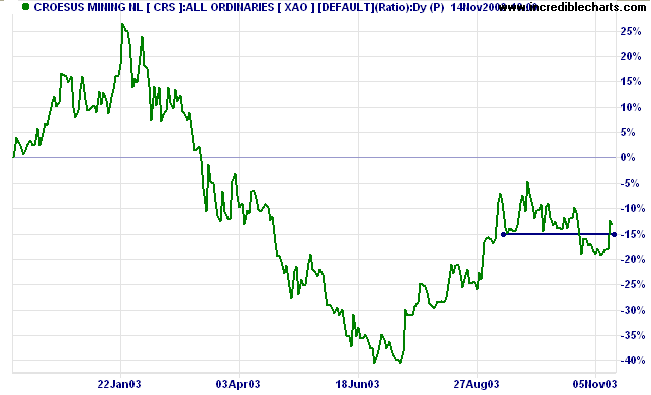

Lihir has been in a sideways consolidation before threatening a downward breakout - note the fall on RS. Price appears to be recovering but watch for further weakness.

Last covered September 9, 2003.

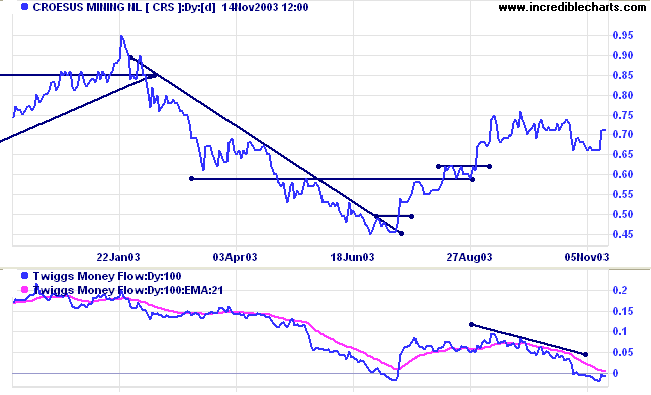

Twiggs Money Flow sometimes dips during a consolidation but in this case TMF (100) has fallen sharply, crossing below zero.

But this is not the case.

We see the world, not as it is, but as we are - or as we are conditioned to see it.

When we open our mouths to describe what we see, we in effect describe ourselves,

our perceptions, our paradigms.

When other people disagree with us, we immediately think something is wrong with them.

~ Steven Covey: The Seven Habits of Highly Effective People.

Readers have been quick to identify attempts at ramping on the forum.

Some rampers must be desperate to offload their stock

- they keep popping up under new aliases when they are suspended.

We have had to block the use of Hotmail accounts on the Chart Forum for that reason.

Please remain vigilant and beware of any "raging bull posts" that lack real substance.

I have kept one thread as an example: MPO - about to fly

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.