|

Incredible Charts version

4.0.2.500 The new version is now available. Check Help>>About to ensure that your software has been automatically updated. The update offers further improvements to the watchlist menu, powerful new scrolling features and supports the use of Large Font settings on laptop (and desktop) computers. See What's New? for further details. |

Trading Diary

September 9, 2003

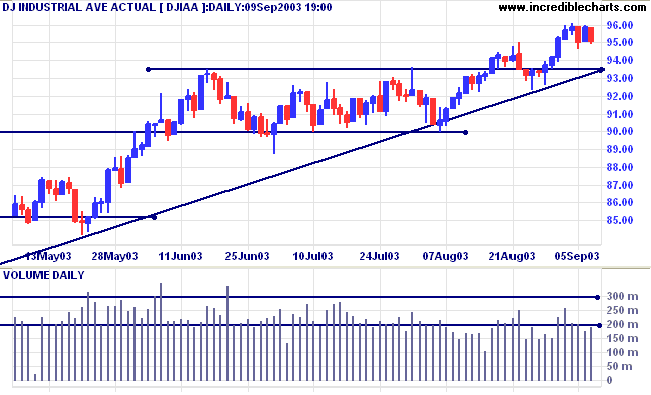

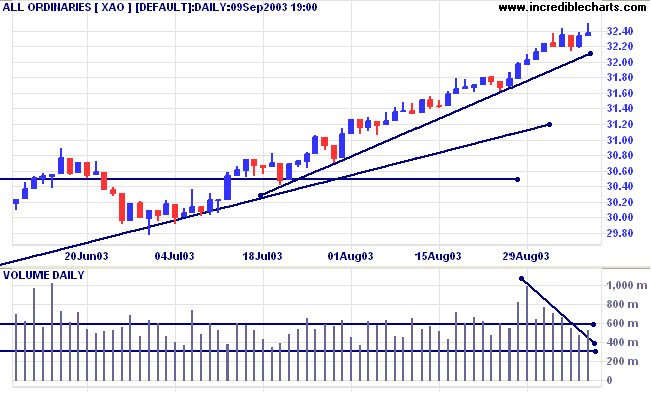

The intermediate trend is up.

The primary trend is up.

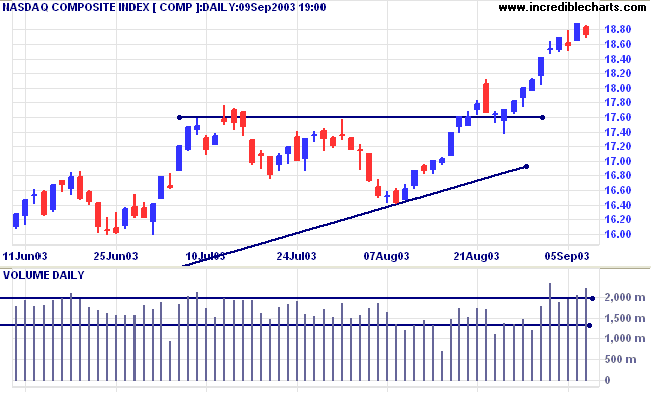

The intermediate trend is up.

The primary trend is up.

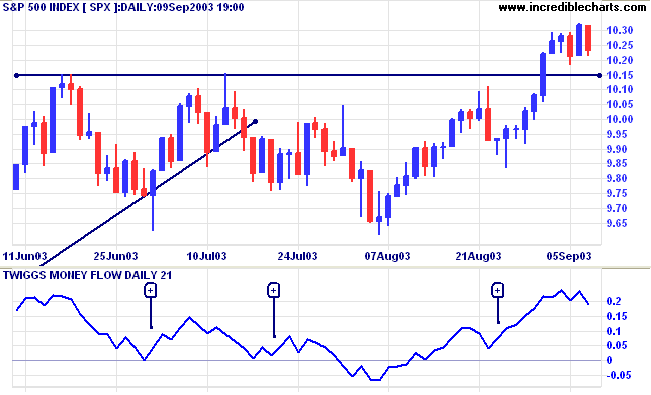

The intermediate trend is up.

The primary trend is up.

Short-term: Long if the S&P500 is above 1032.

Intermediate: Long if S&P 500 is above 1015.

Long-term: Long is the index is above 960.

The yield on 10-year treasury notes closed almost unchanged at 4.37%.

The yield is ranging just above the support level, a bullish sign.

The primary trend is up.

New York (20.22): Spot gold climbed to test overhead resistance at 382, before retreating to $381.00.

The primary trend is up.

Price has broken above a symmetrical triangle formed since the start of the year. If gold penetrates overhead resistance at 382, the target is the 10-year high of 420.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed above; Twiggs Money Flow shows a bearish divergence.

Short-term: Long above 3250.

Intermediate: Long if the index is above 3160.

Long-term: Long if the index is above 2978 .

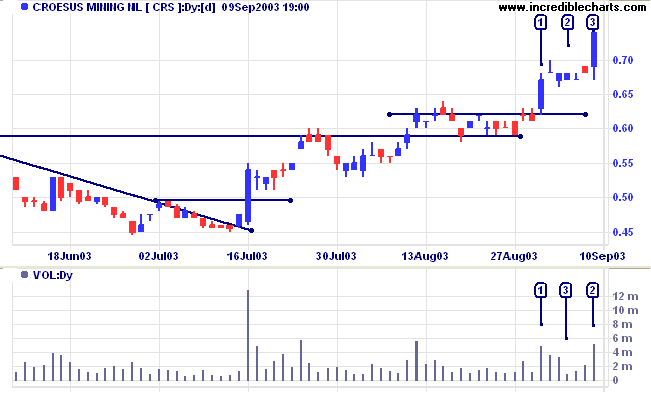

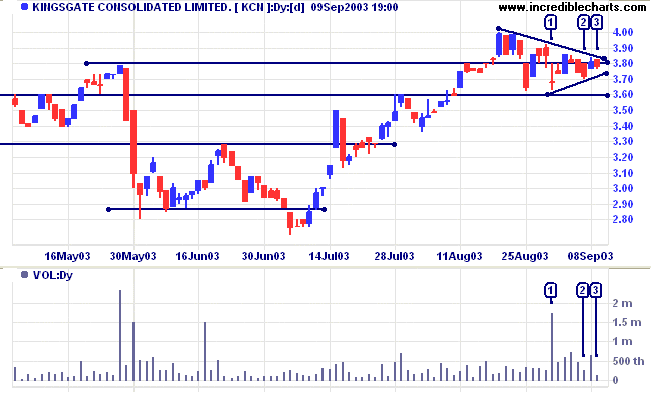

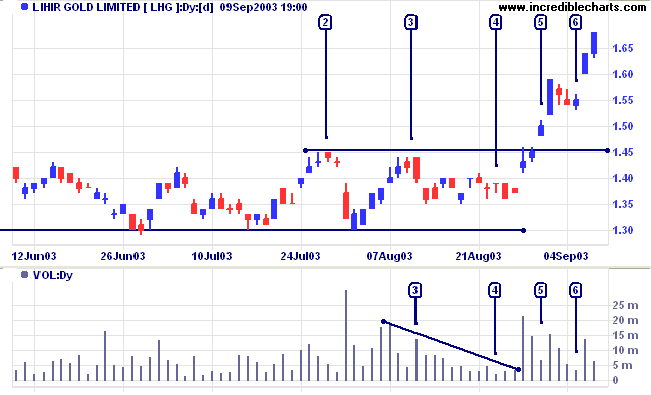

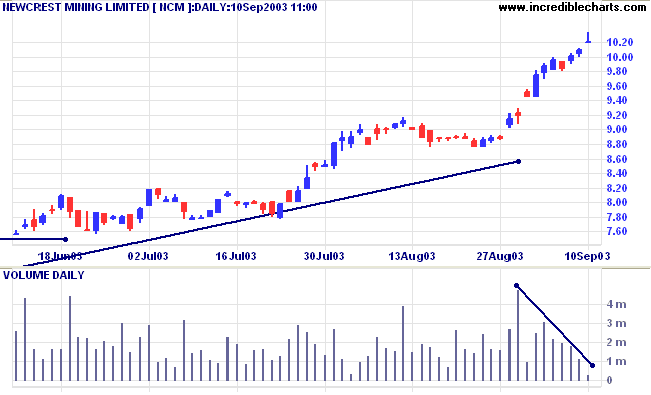

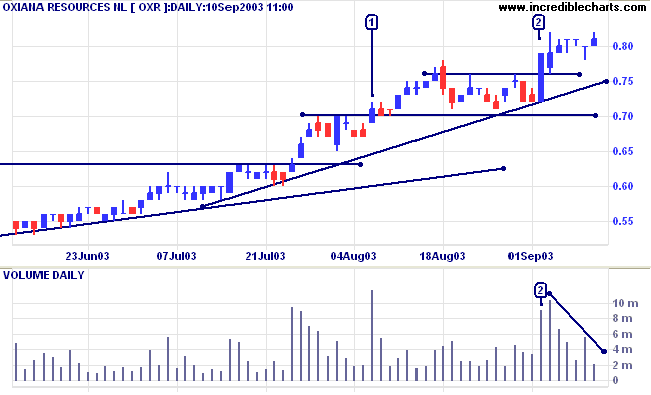

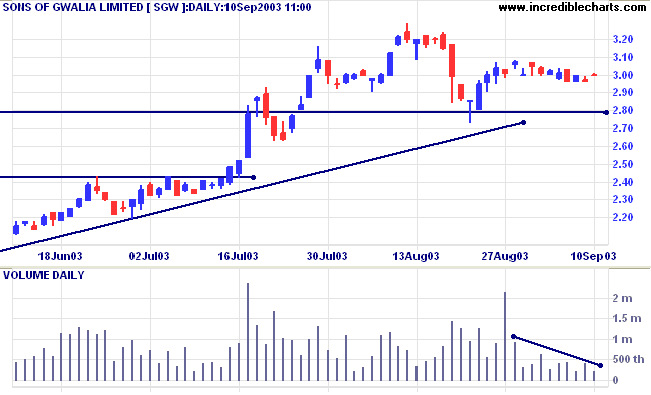

An update on how gold stocks are performing:

~ Warren Buffet.

|

On the right of the toolbar there are four

(horizontal) scrolling arrows. To scroll directly to the start of the data, click the first arrow |<. To scroll forward, day-by-day or week-by-week, click the third arrow >. To scroll back, use the second <. To return to the latest data, click >|. To change the scrolling interval, select View >> Scroll Period. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.