Trading Diary

November 12, 2003

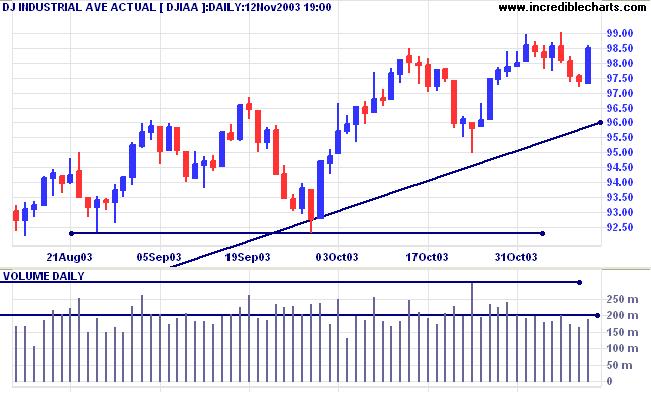

The intermediate trend is down.

The primary trend is up. A fall below 9000 would signal reversal.

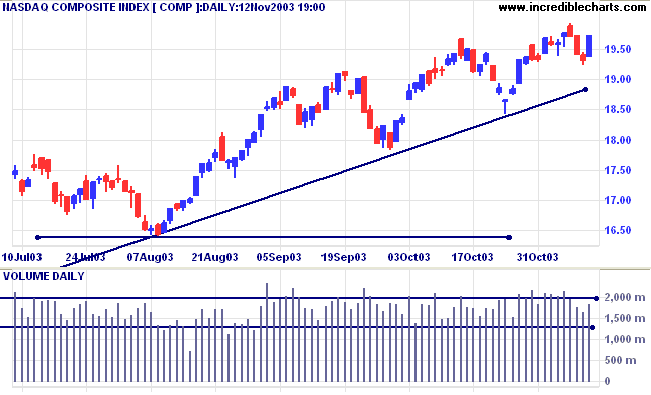

The intermediate trend is up. Expect resistance at 2000 to 2060.

The primary trend is up. A fall below 1640 will signal reversal.

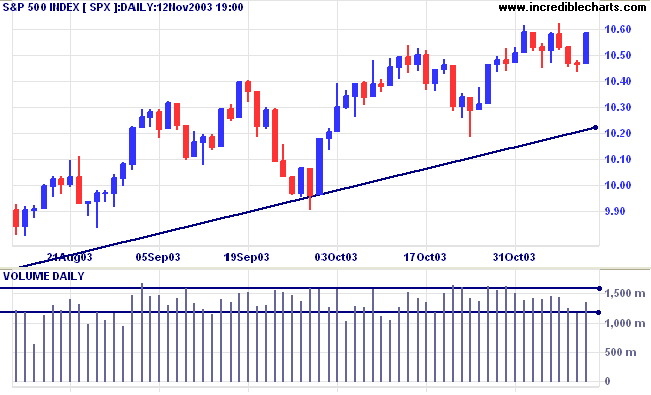

The intermediate trend is up. Expect some resistance at 1100, a significant support level from 2001/02.

Short-term: Bullish if the S&P500 is above 1048 (Tuesday's High).

Intermediate: Bullish above 1062 (Friday's High). Long-term: Bullish above 960.

A 3-box reversal would signal a bear alert.

The weakening US dollar, and the cheaper bullion price in euros and yen, have fuelled a rise in spot gold. (more)

The yield on 10-year treasury notes closed down slightly at 4.41%.

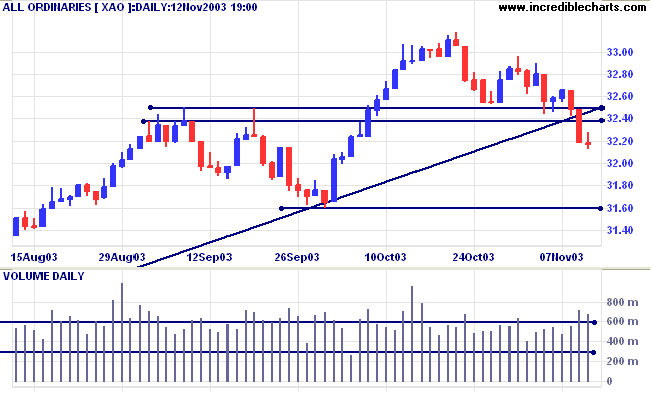

The intermediate trend is up. The recent high is only marginally above the previous high on October 16th, signaling possible weakness.

The primary trend is up.

New York (19:39): Spot gold jumped to $394.00.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) and Slow Stochastic (20,3,3) are both below their signal lines.

Short term: Bearish below 3238; Bullish above 3250.

The index has penetrated the primary trendline and a fall below support at 3160 will signal reversal. The primary trend is up but the rally is extended. Probability of a reversal increases with each successive primary trend movement.

Intermediate: Bearish below 3160; Bullish above 3250. Long-term: Bearish below 3160.

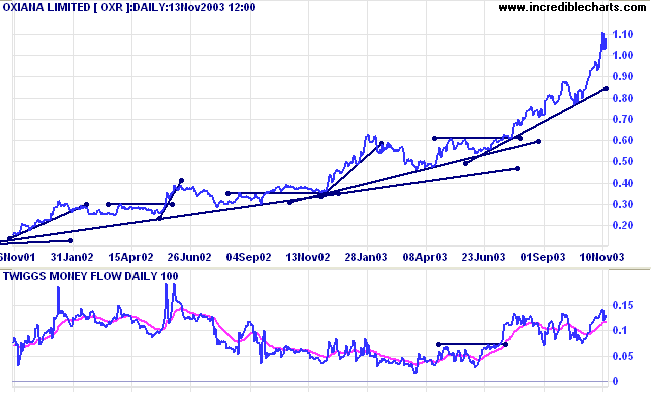

Last covered September 9, 2003.

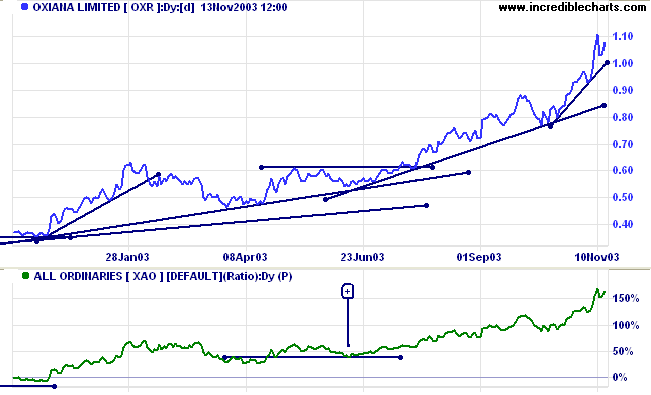

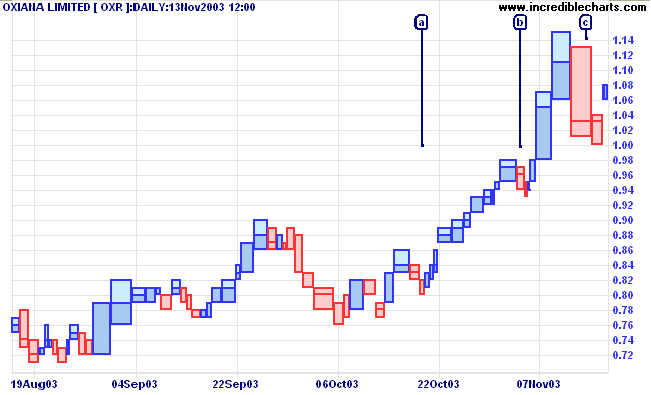

Oxiana has been in a stage 2 up-trend for the past 3 years and now threatens to accelerate into a spike (or blow-off), normally followed by a sharp reversal. Warning signs are: 4 or more trendlines of increasing slope; increased volume on the up-swing; frequent gaps; and short corrections, not longer than 2 days.

Twiggs Money Flow (100) signals strong accumulation, remaining above zero for over 2 years.

The earlier entry signal [+] came from price respecting the second trendline, rising RS, and a dry-up of volume and volatility at the reversal.

A close (or a fall on heavy volume) below 1.00 will be a bear signal.

I just watch the government and report the facts.

~ Will Rogers, American cowboy humorist (1879 - 1935).

Please give me feedback/suggestions on the presentation of Market Strategy.

Is it an improvement or do you prefer the old way?

There is a thread at Trading Diary on the Chart Forum.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.