|

Incredible Charts version

4.0.2.600 See What's New for details. Check Help >> About to ensure that you have received the automatic update. |

Trading Diary

October 22, 2003

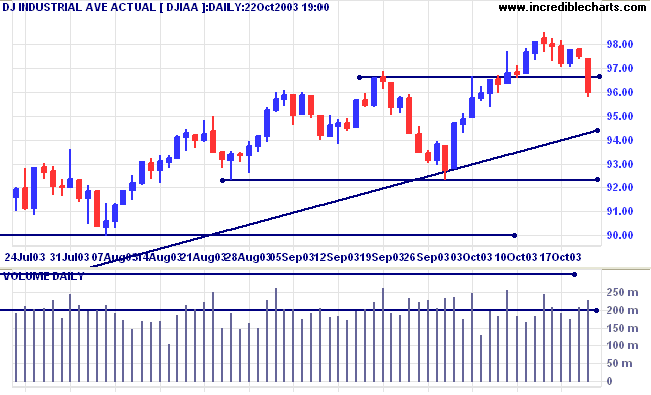

The intermediate trend has reversed. Support is at 9230.

The primary trend is up. A fall below 9000 will signal reversal.

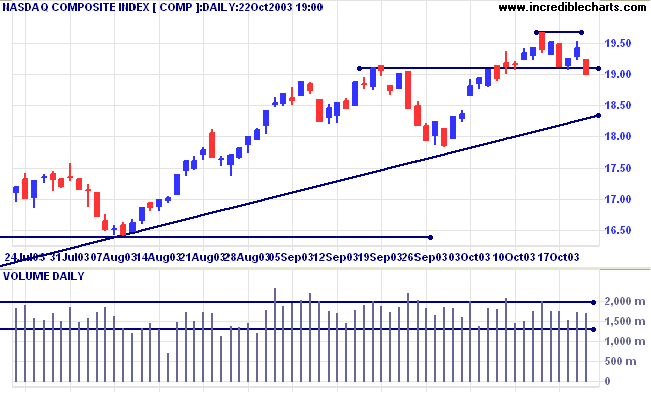

The intermediate trend has reversed. Support is at 1783.

The primary trend is up. A fall below 1640 will signal reversal.

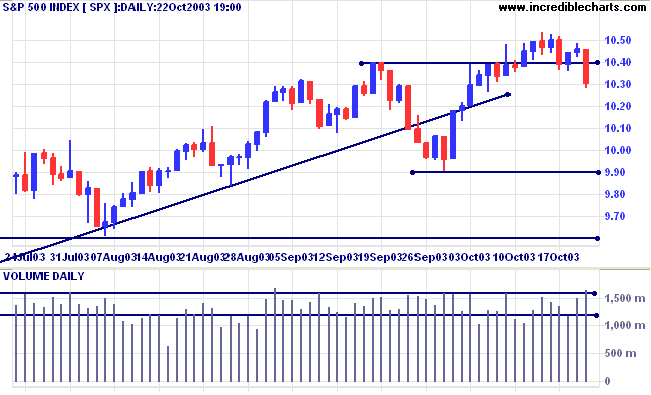

The intermediate trend has reversed. Support is at 990.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bearish if the S&P500 is below 1036.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Amazon and Lucent report favorable earnings but techs are sold down. (more)

The yield on 10-year treasury notes fell to 4.27%.

The intermediate trend is up. Expect resistance at 4.60%, support at 4.25%.

The primary trend is up.

New York (18:40): Spot gold has soared to $386.10.

The intermediate trend has turned up.

The primary trend is up.

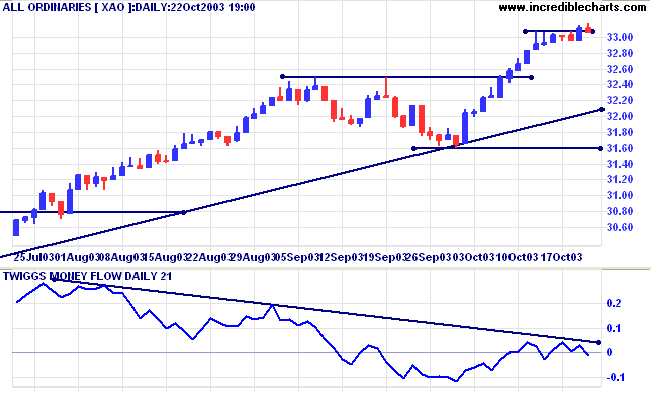

The primary trend is up. A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed below; Twiggs Money Flow (100) has whipsawed below its signal line, displaying a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3283.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

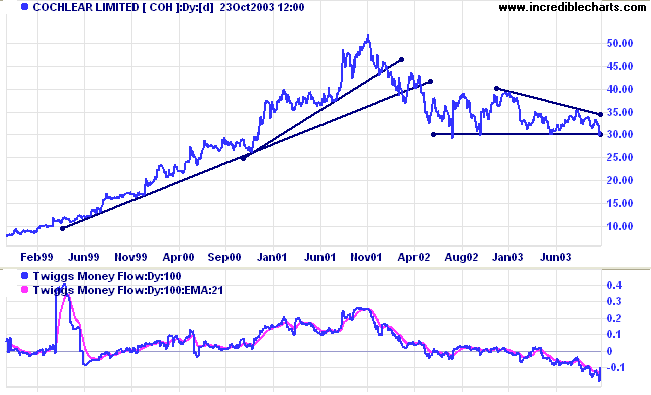

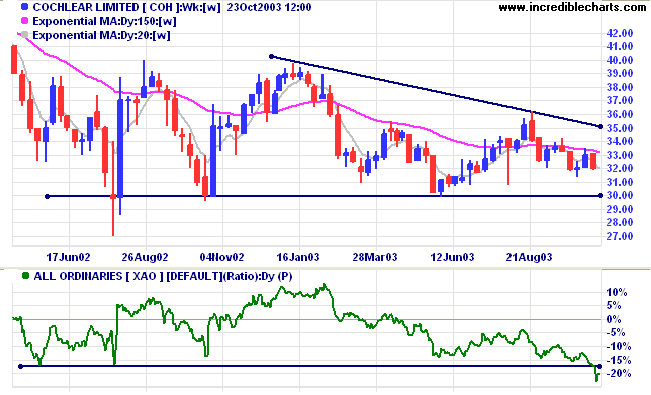

Last covered July 31, 2002. Cochlear's retreat from its high above 50.00 was interrupted by strong support at 30.00. Price has consolidated above this level for the past 12 months but is now displaying lower highs, with resistance at 35.00, a bearish sign.

Twiggs Money Flow (100) has failed to cross above zero on rallies, a strong bear signal.

A close below 30.00 will confirm this.

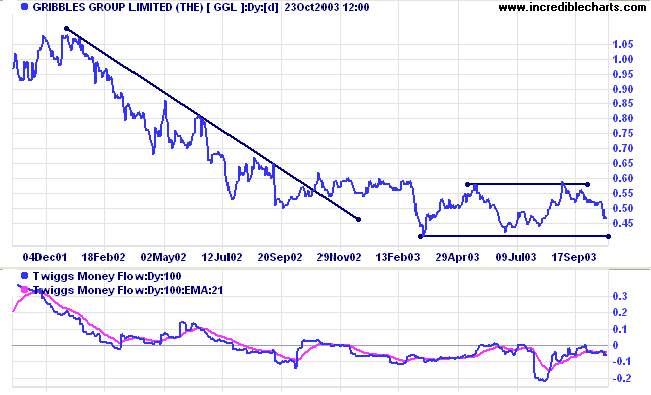

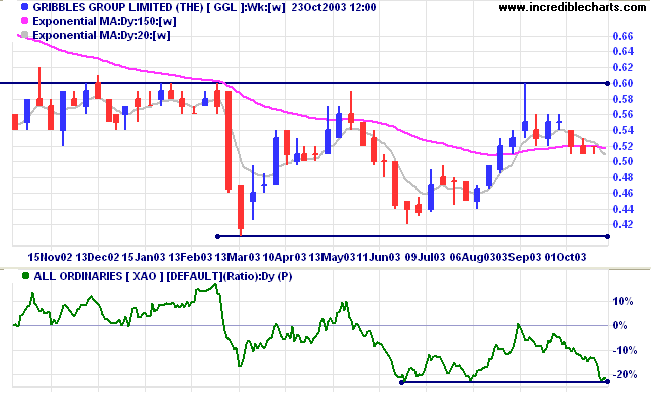

GGL displays a stage 1 base after a lengthy down-trend. Support is at 0.40 and resistance at 0.60.

while it seems to be guided by impulses too obscure to be traceable.

Consciously or unconsciously, the movement of prices reflects not the past but the future.

When coming events cast their shadows before, the shadow falls on the New York Stock Exchange.

~ William Hamilton: The Wall Street Journal (March 27, 1911)

One of our members suggested that we approach online stock/cfd brokers to negotiate a favorable deal for our members:

lower transaction fees/monthly charges and a reasonable interest rate spread.

I need to establish that there is sufficient interest before approaching any brokers.

Please post your comments at the above link.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.