Trading Diary

July 31, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow continued its consolidation after Monday's

follow-through, closing up 0.65% at 8736. The primary cycle

trends downwards.

The Chartcraft NYSE Bullish % Indicator has a

reading of 24% (July 30). See

Bullish % Index for more details.

The Nasdaq Composite closed down more than 1% at 1328 but held

above the low of Monday's

follow-through. Primary cycle is still in a down-trend.

The S&P 500 closed up 9 points at 911.

The primary cycle trends downwards.

GDP growth slows

Second-quarter GDP growth slowed to an annual rate of 1.1%,

less than half the expected rate.

(more)

IBM - PWC

Hewlett-Packard attempted to buy PW Consulting 2 years ago for

$US 18 billion. IBM is to pay $US 3.5 billion.

(more)

Survivors of the tech wreck

Microsoft, Hewlett Packard, Oracle and others have survived the

last 2 year's slide with strong balance sheets.

(more)

ASX Australia

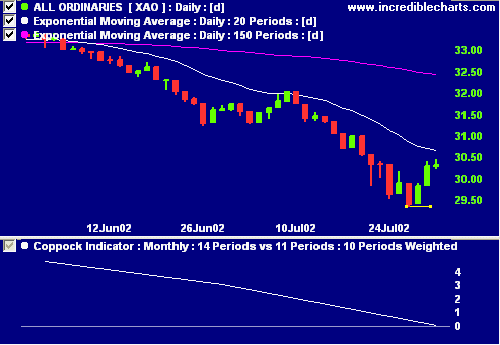

The All Ordinaries consolidated, closing up 3 points at 3033 on

average volume. It is important that the next week hold above the

2940 support level.

The primary cycle trends down.

Slow Stochastic (20,3,3) is above its signal line, MACD (26,12,9)

is below. Exponentially-smoothed money is below zero.

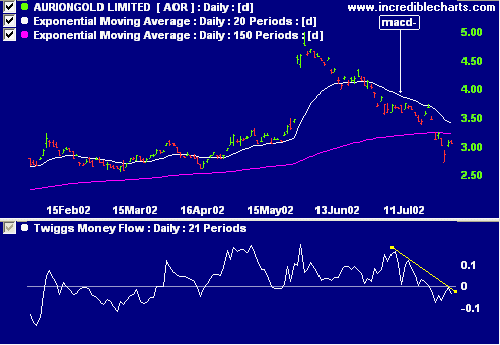

Aurion Gold [AOR]

AOR directors recommend that shareholders reject Placer Dome's

sweetened takeover offer.

(more)

The stock has crossed below it's 150-day moving average, with

falling relative strength, MACD and exponentially-smoothed

money flow.

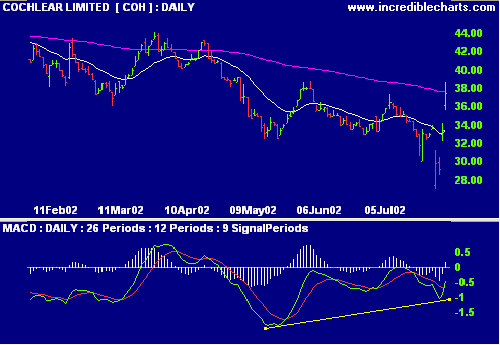

Never argue with the tape [COH]

Cochlear continues to surge on the news that their rival has

withdrawn its hearing implant product from the market.

Relative strength (price ratio: xao) and exponentially-smoothed

money flow are improving. MACD signals a bullish divergence but

is still below zero.

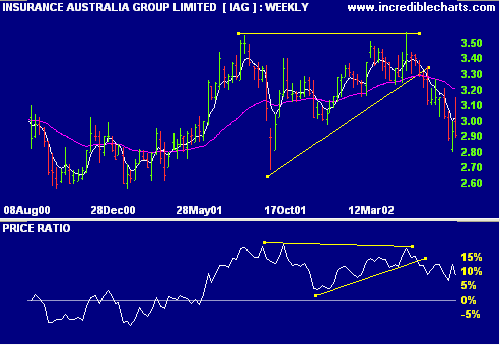

Insurance Australia Group [IAG]

IAG (formerly NRMA) announces that it will incur a net loss of

up to $ 40 million for the financial year.

(more)

The target for the breakout from the large triangle is $2.45.

Relative strength (price ratio: xao), exponentially-smoothed

money flow and MACD are all weakening.

Conclusion

Short-term: Avoid new entries. The Slow Stochastic and MACD are

on opposite sides of their respective signal lines. Keep stops

tight.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

The tape never lies.

- Edwin Lefevre.

Back Issues

Back

Issues

Access the Trading Diary Archives.