|

ETOs and

Warrants ETOs and warrants are ready and will be introduced this week. US stocks will follow. |

Trading Diary

October 6, 2003

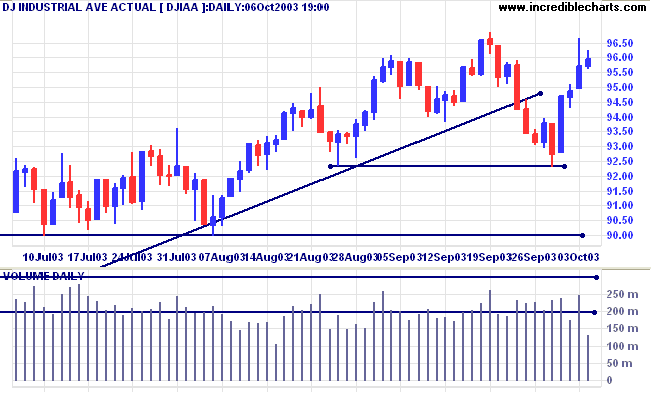

The intermediate trend is down. A rise above 9686 will signal reversal.

The primary trend is up. A fall below 9000 will signal reversal.

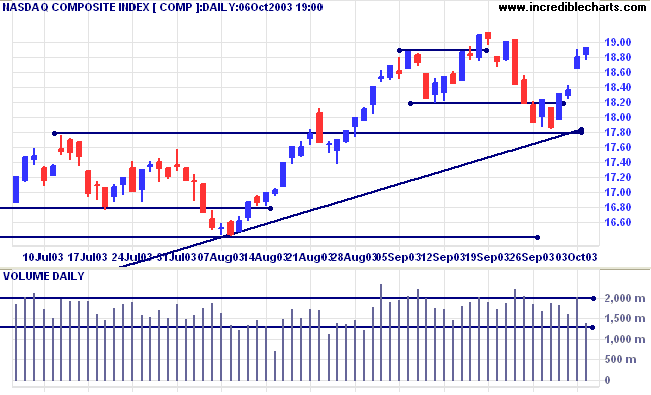

The intermediate trend is down. A rise above 1914 will signal reversal.

The primary trend is up. A fall below 1640 will signal reversal.

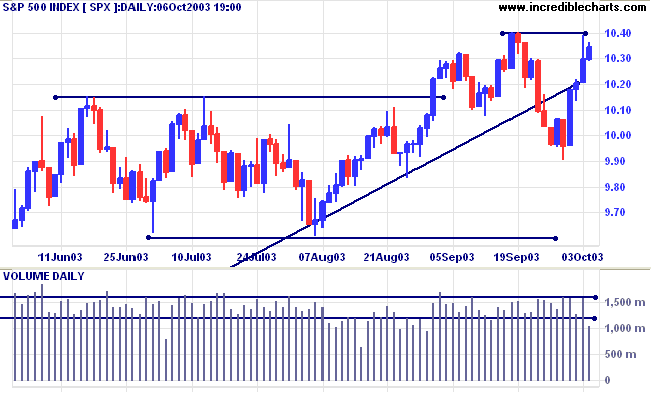

The intermediate trend is weak. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1029.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

Most Fed-watchers say that it is too soon, and that the Fed will wait for further evidence of recovery before acting. (more)

The yield on 10-year treasury notes consolidated at 4.15%, after a sharp jump to 4.20%.

The intermediate down-trend appears weak.

The primary trend is up.

New York (17:32): Spot gold has leveled out at $372.50.

The intermediate trend has turned down.

The primary trend is up. A fall below 350 will signal reversal.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

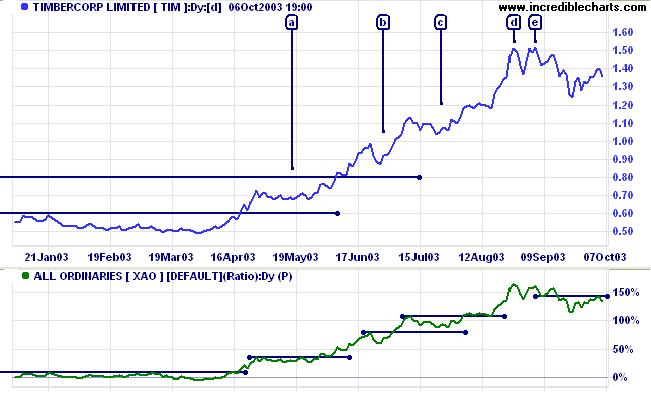

The primary trend is up. A fall below 3000 will signal reversal.

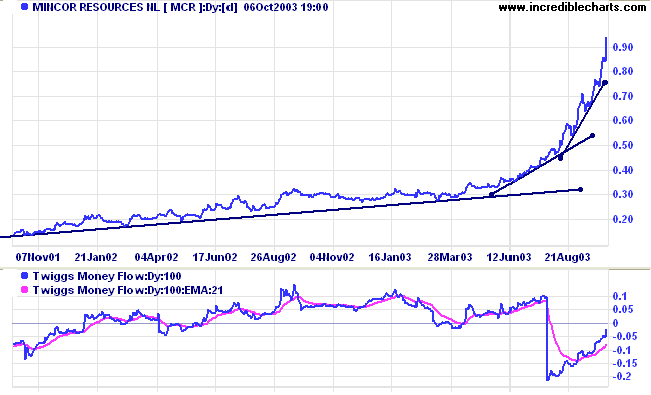

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow signals distribution.

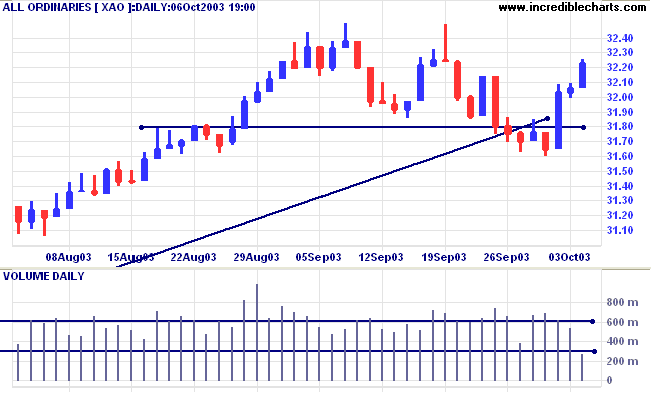

Short-term: Bullish if the All Ords is above 3209. Bearish below 3200.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

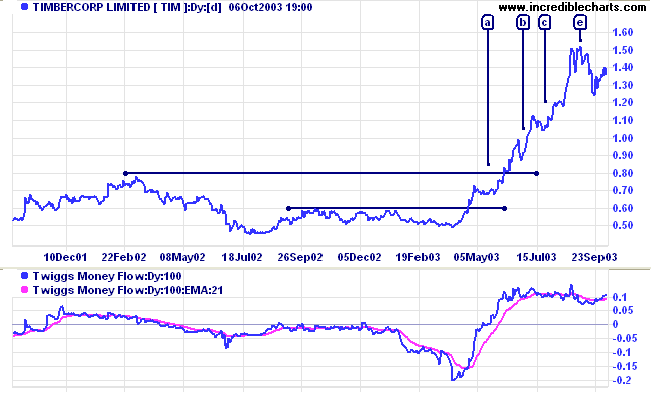

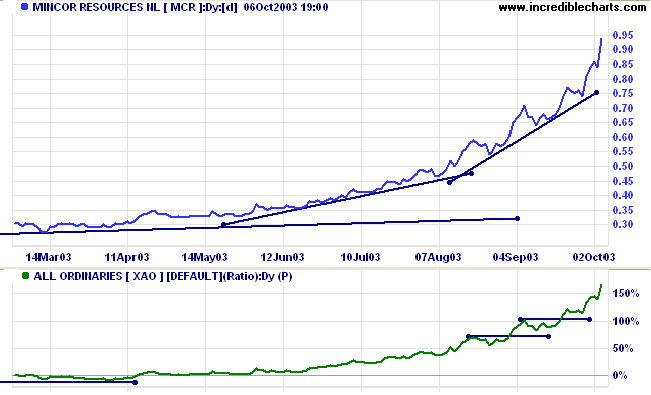

Last covered July 14, 2003.

TIM enjoyed a strong rally, with 3 fairly weak corrections at [a], [b] and [c], before a top formed at [e].

Twiggs Money Flow has crossed back above its signal line.

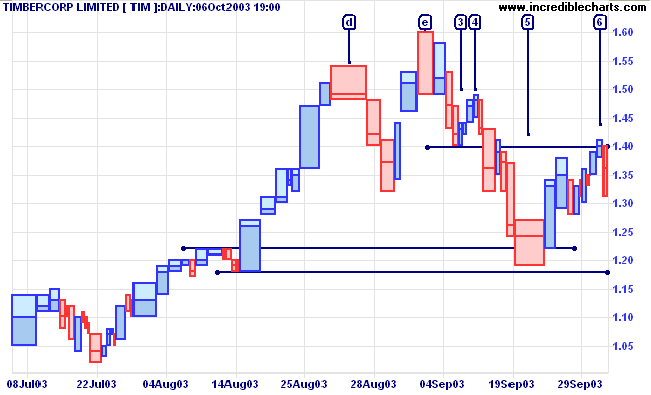

The double top at [d] and [e] is an intermediate bear signal.

A fall below 1.18 will be a strong bear signal.

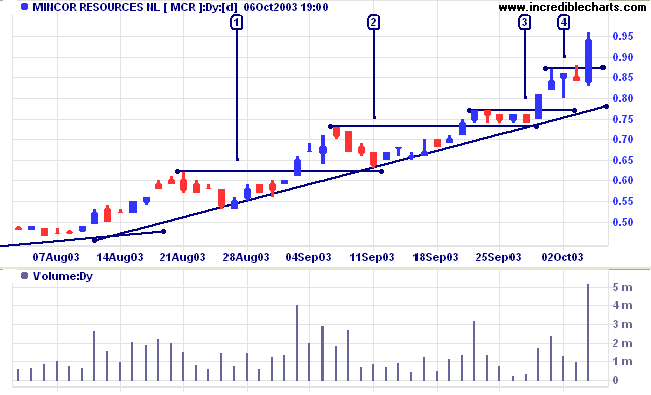

Mincor appears to be headed for a sharp blow-off reversal.

Twiggs Money Flow (100) is rising rapidly after an earlier fall.

- Counter-trends are shorter, with a one day reversal at [4], after 4-day counter-trends at [1], [2] and [3];

- The gap between the low of each reversal and the previous high is increasing - one of Bill McLaren's strongest signals;

- Volume and volatility are increasing on each breakout above the previous high.

But what is dangerous is not the belonging to a group, or groups,

but not understanding the social laws that govern groups and govern us.

When we're in a group, we tend to think as that group does:

we may even have joined the group to find 'like-minded' people.

But we also find our thinking changing because we belong to a group.

It is the hardest thing in the world to maintain an individual dissident opinion,

as a member of a group.

~ Doris Lessing: Prisons We Choose To Live Inside (1994).

to display a list of the 20 most recently charted stocks.

Only stocks from the current session are displayed.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.