|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

October 2, 2003

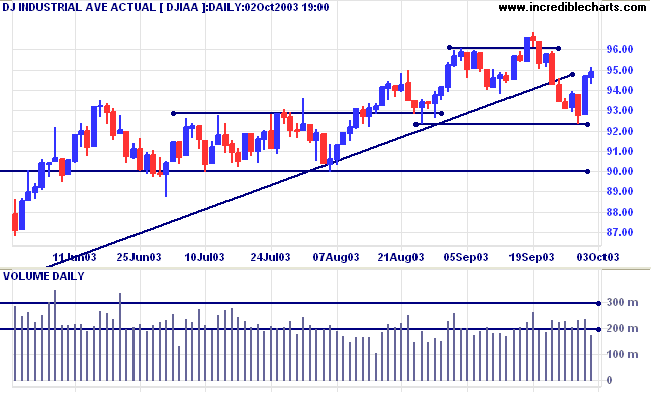

The intermediate trend is still down.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

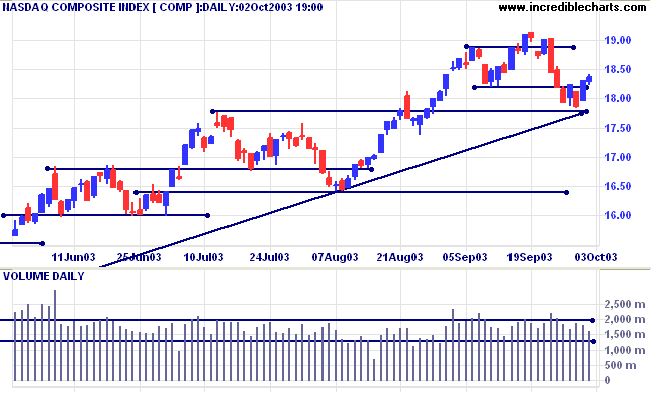

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

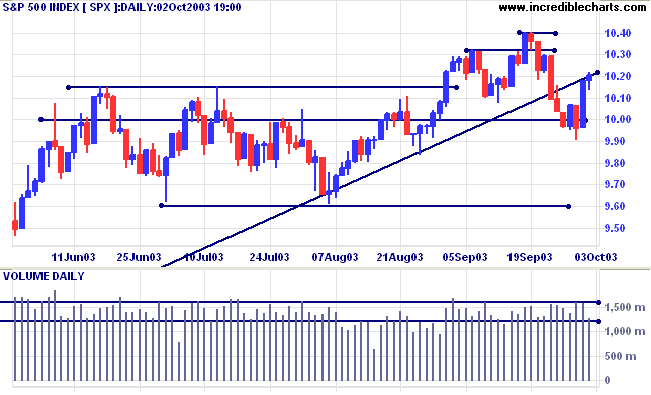

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

Short-term: Bearish below 1013. Bullish above 1040.

Intermediate: Bearish below 960. Bullish above 1040.

Long-term: Bullish above 960.

New unemployment claims increased to 399,000 from a revised 386,000 in the previous week. (more)

The yield on 10-year treasury notes rose slightly to 4.01%, after 2 days below support at 4.00%.

The intermediate trend is down.

The primary trend is up.

New York (17:30): Spot gold eased to $382.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

The primary trend is up. A fall below 3000 will signal reversal.

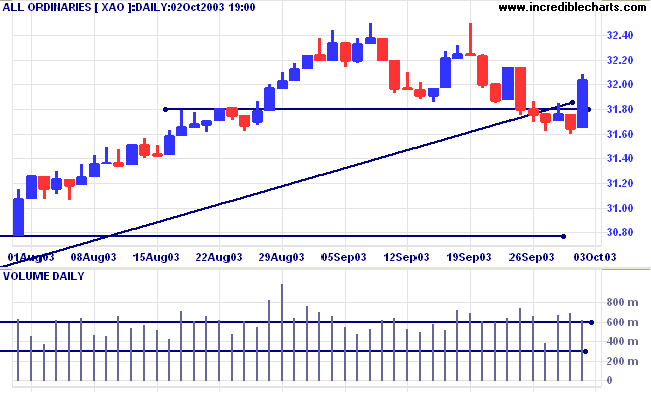

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3160.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

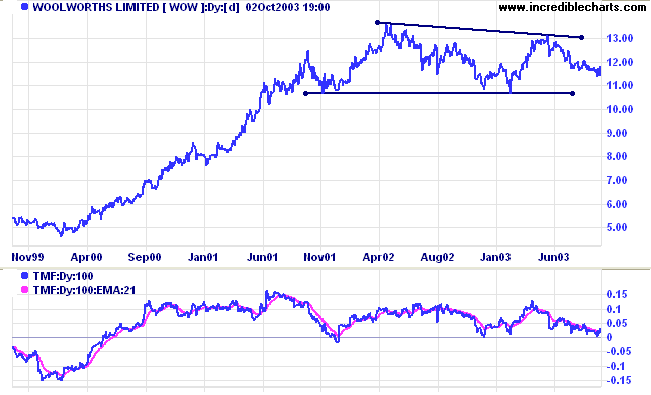

Last covered on July 24, 2003.

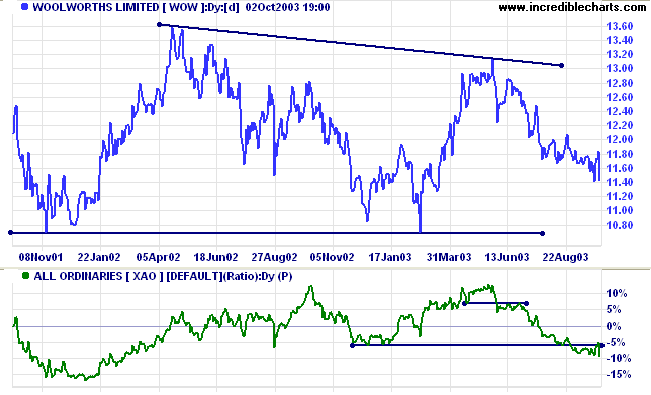

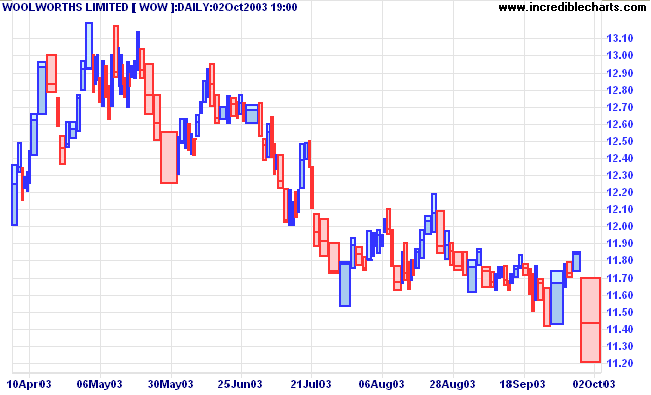

Woolworths has formed a broad stage 3 top. Twiggs Money Flow (100) threatens to cross below zero. MACD is bearish.

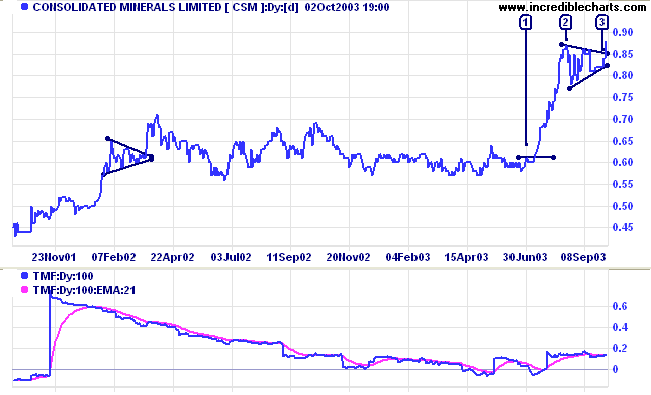

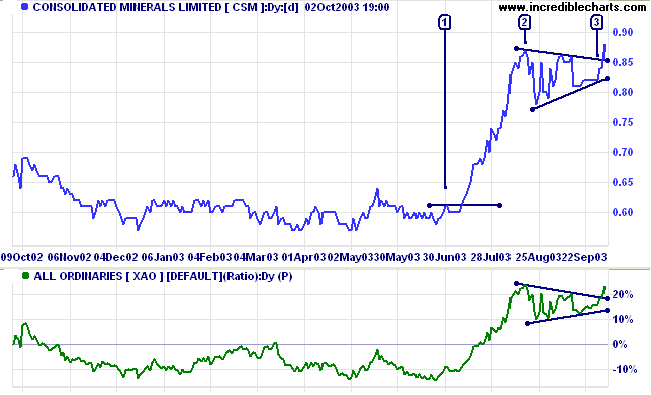

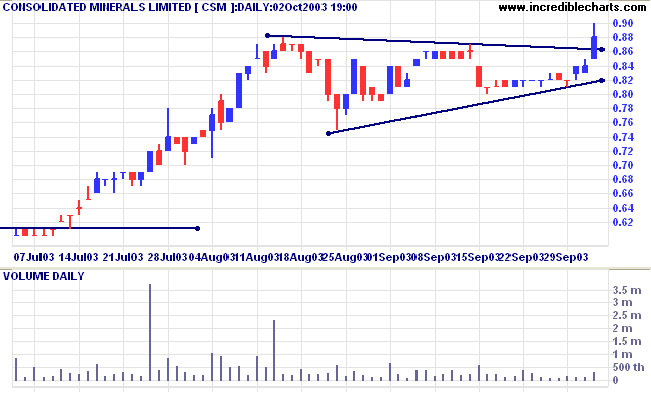

An ASX 300 stock, CSM broke out of a broad consolidation, rallying strongly before forming a triangle pattern. Twiggs Money Flow (100) signals accumulation. MACD has formed a bullish trough above zero.

Relative Strength has formed a similar pattern.

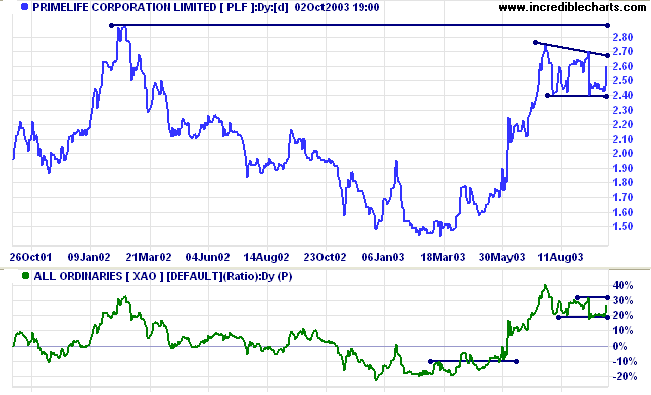

Another ASX 300 stock shows a similar mid-point consolidation after a strong rally. But there is one major difference: overhead resistance at 2.90. The target should be adjusted accordingly.

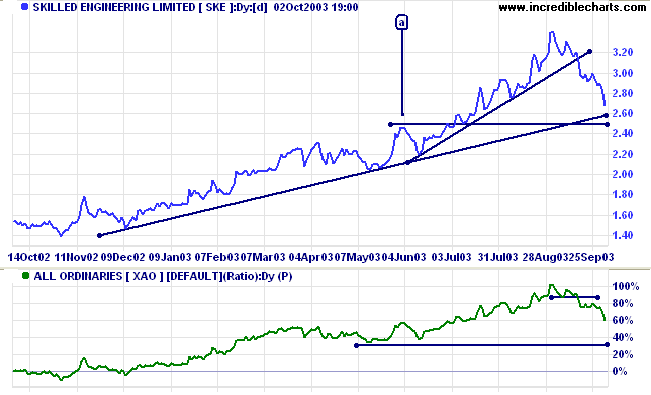

SKE has corrected sharply after a healthy rally off the long-term trendline. We are likely to see a re-test of the supporting trendline. Short-term and intermediate traders may find long opportunities if volume and volatility dry up, or there is a strong reversal signal, at the trendline.

A close below 2.50 will be bearish, while a close below 2.00 would signal reversal of the primary trend.

Showy words are not sincere.

Those who know are not "widely learned";

Those "widely learned" do not know.

The good do not have a lot;

Those with a lot are not good.

~ Lao Tse.

|

To alter the width of the price bars,

separately from other indicators: (1) select Format Charts >> Indicator Width >> Set Candle/OHLC/Parabolic SAR Width; (2) enter a value between 1 and 5 in the pop-up box; (3) click OK. I have set the All Ordinaries chart above as an example: Indicator Width is 2, but Candle Width is set at 3. Note the difference between the price and volume bars on the chart. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.