|

ETOs and

Warrants ETOs and warrants will be available shortly. US stocks will follow. I repeat this, as much to keep us focused on the task as for any other reason. |

Trading Diary

September 25, 2003

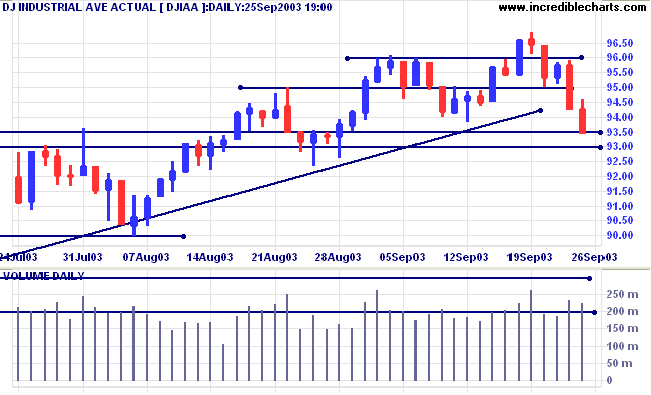

The intermediate trend is weak. Low volume in the past month and the fall below 9381 are both bear signals.

The primary trend is up.

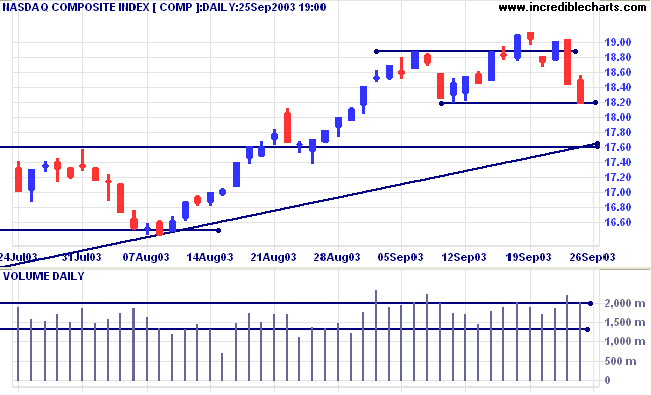

The intermediate trend is down and appears headed for a re-test of the long-term supporting trendline.

The primary trend is up.

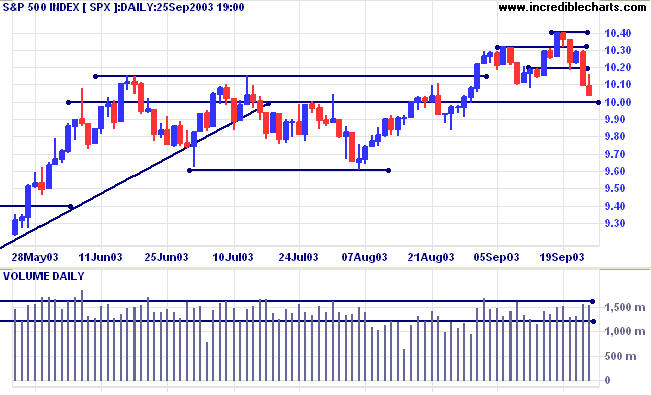

The intermediate trend is weak. A fall below 1000 will signal reversal.

The primary trend is up.

Short-term: Long if the S&P500 is above 1020. Short if below 1000.

Intermediate: Long if S&P 500 is above 1020.

Long-term: Long if the index is above 1008.

Jobless claims were sharply lower last week but the cause was power outages at a number of Labor Department offices, caused by Hurricane Isabel. (more)

The intermediate down-trend continues, with the yield on 10-year treasury notes at 4.10%, testing support at 4.10% to 4.00%.

The primary trend is up.

New York (17:55). Spot Gold tested 393 before retreating to $385.20.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

The primary trend is up.

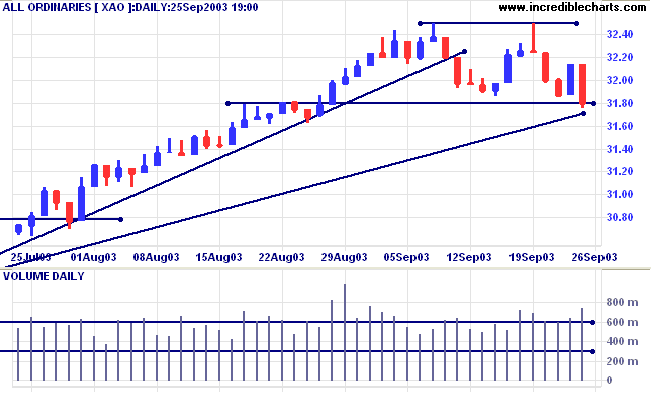

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow has turned up, below zero, after a bearish divergence.

Short-term: Long above 3214. Short if below 3180.

Intermediate: Long if the index is above 3214.

Long-term: Long if the index is above 3180.

Last covered August 21, 2003.

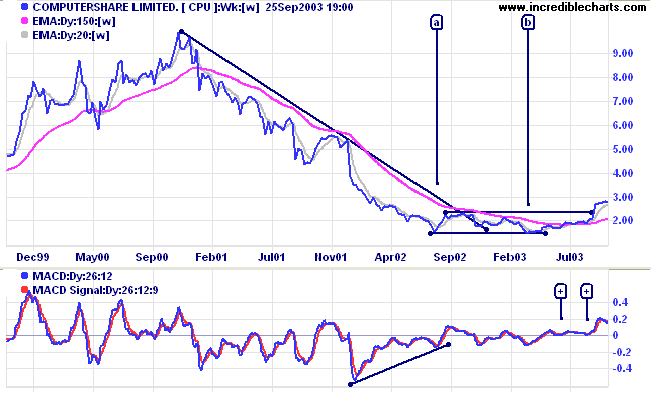

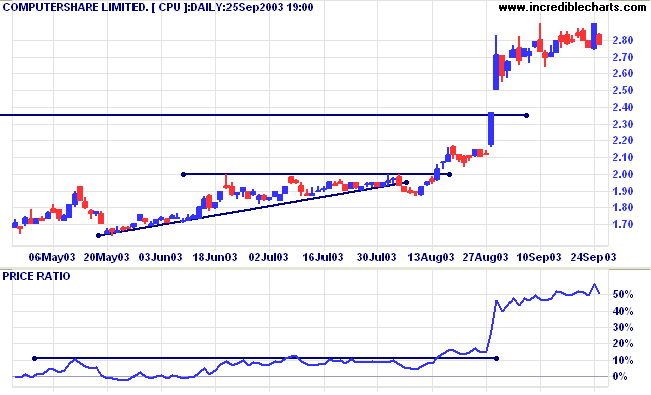

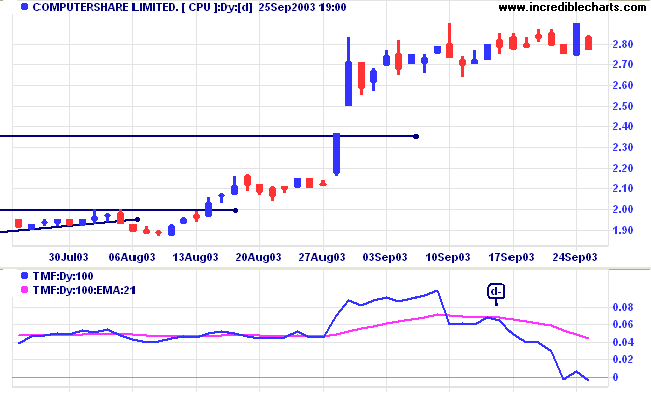

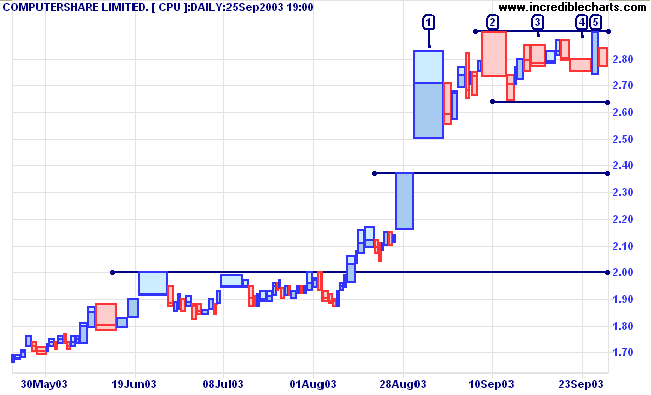

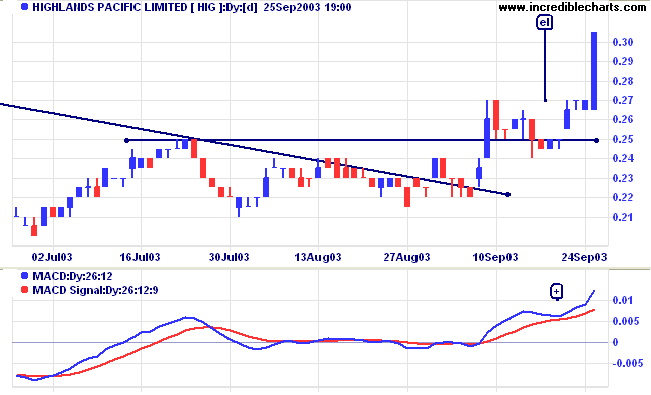

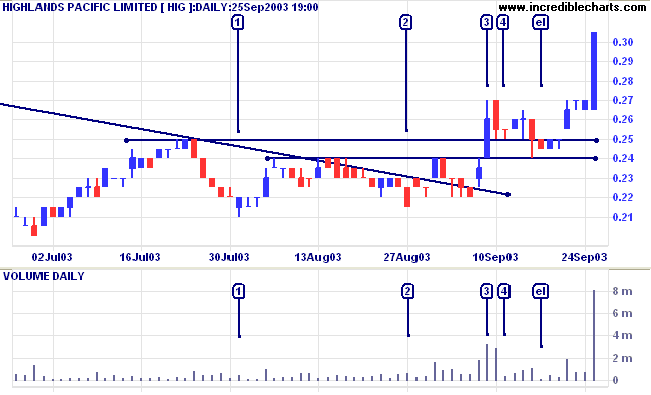

CPU broke out of its base after rallying off a marginal break at [b], below the previous low at [a]. MACD showed a strong bullish divergence at [a] followed by bullish troughs above the zero line [+].

A close above 2.90 will signal continuation of the up-trend, with a target of 3.80 (2.90 + 2.90 - 2.00).

I missed this one but it is such a good example of an entry on a reversal that it is worth featuring. Lately I have been taking more of an interest in the ASX 300 because of the high number of strong performers compared to the ASX 200.

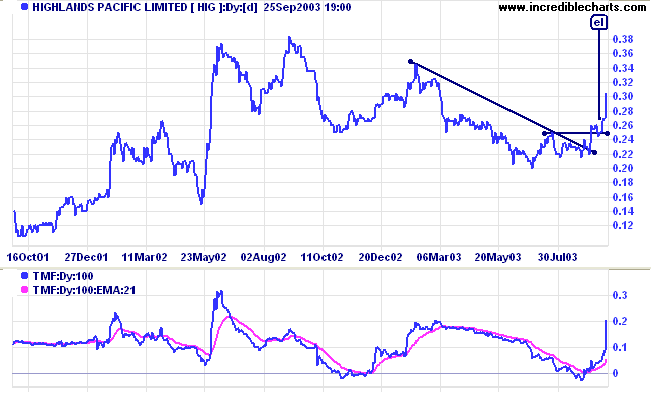

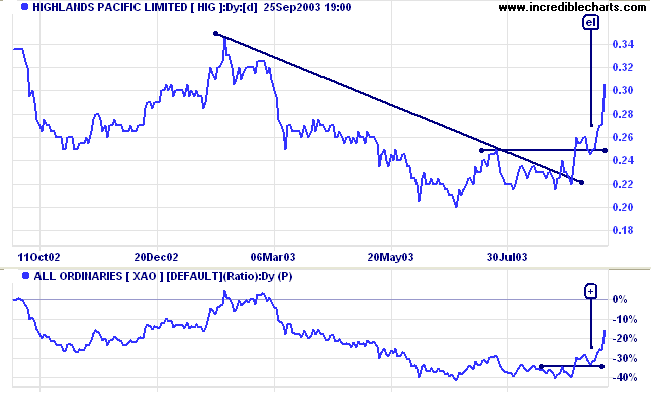

HIG is in the Materials sector: Diversified Metals & Mining. It broke the downward trendline after two higher lows, a bullish sign.

Twiggs Money Flow (100) turned up strongly above its signal line.

We may rue the lost opportunity, but there is still hope for an intermediate pull-back in the next few months, to re-test support levels.

We weave a strand of it every day

and soon it cannot be broken.

~ Horace Mann.

|

Stock Screening: Price

Filter To screen for stocks in a specific price range, for example, stocks between 5 cents and 1 dollar: (1) select Price Filter; (2) enter 5 as the Minimum and 100 as the Maximum; and (3) Submit. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.