|

ETOs and

Warrants ETOs and warrants will be available shortly. US stocks will follow. |

Trading Diary

September 23, 2003

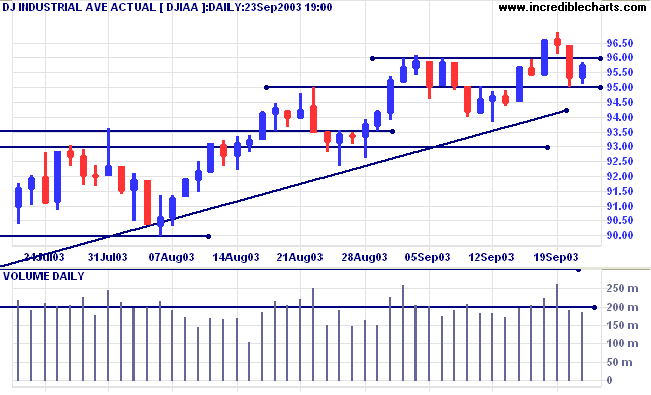

The intermediate trend is up. Continued low volume signals weakness. A fall below 9381 will be a bear signal.

The primary trend is up.

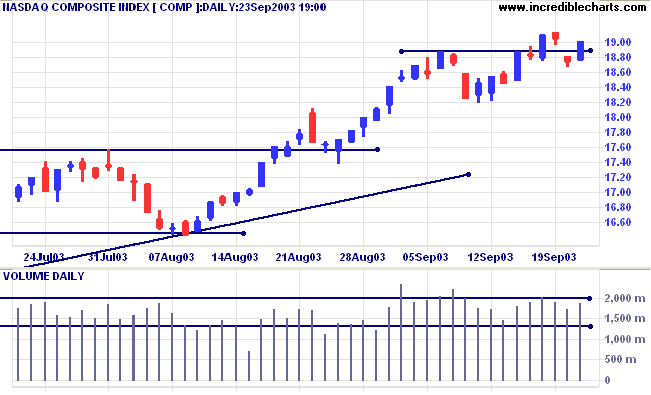

The intermediate trend is up.

The primary trend is up.

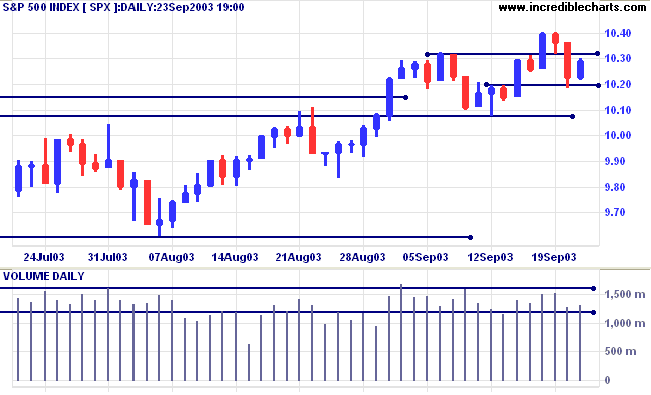

The intermediate trend is up.

The primary trend is up.

Short-term: Long if the S&P500 is above 1030. Short if below 1008.

Intermediate: Long if S&P 500 is above 1030.

Long-term: Long is the index is above 1008.

A survey of small-business owners reflects a large jump in optimism. (more)

The yield on 10-year treasury notes eased to 4.21%, above the band of support at 4.10% to 4.00%.

The intermediate and primary trends are both up.

The first chart I check every morning is gold. The New York (19.17) spot gold price has eased to $384.60.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321). But expect heavy resistance at 400 to 415 (the 10-year high).

The primary trend is up.

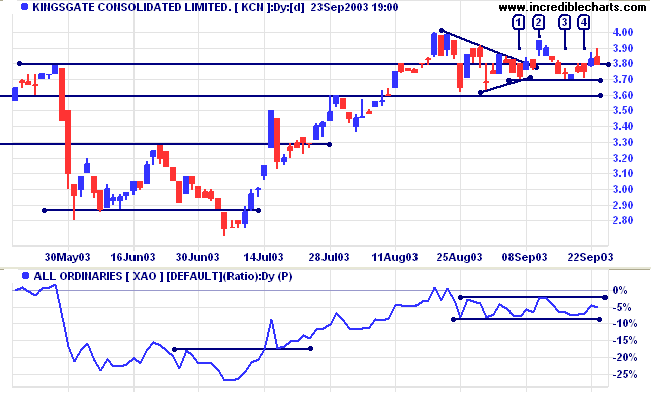

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to below;

Twiggs Money Flow signals distribution, after a bearish divergence.

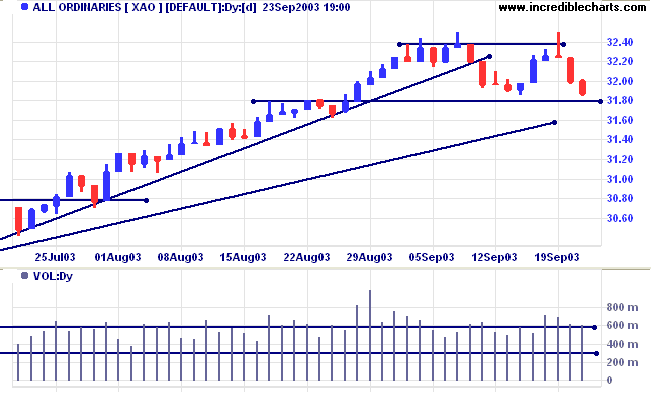

Short-term: Long above 3201. Short if below 3180.

Intermediate: Long if the index is above 3201.

Long-term: Long if the index is above 3180.

Last covered September 9, 2003.

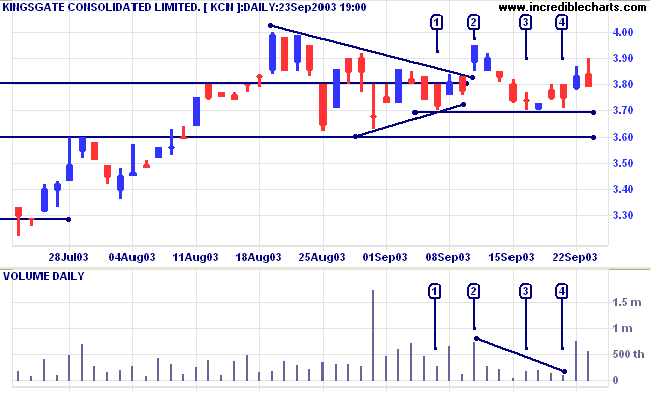

Several gold stocks are, understandably, in fast up-trends. There are one or two laggards, however, that warrant closer inspection.

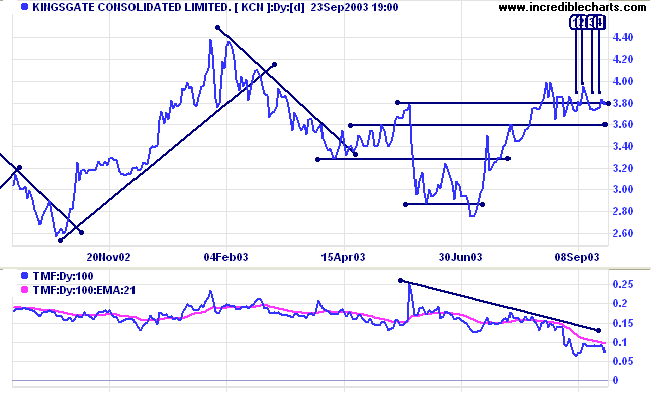

KCN has consolidated below resistance at 4.00 with Twiggs Money Flow (100) showing a bearish divergence.

In the intermediate term, a fall below 3.60 would be a bear signal, while a rise above 4.00 will be bullish.

Last covered September 9, 2003.

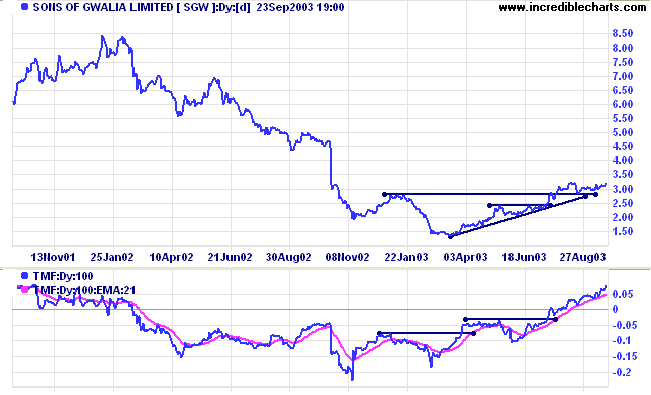

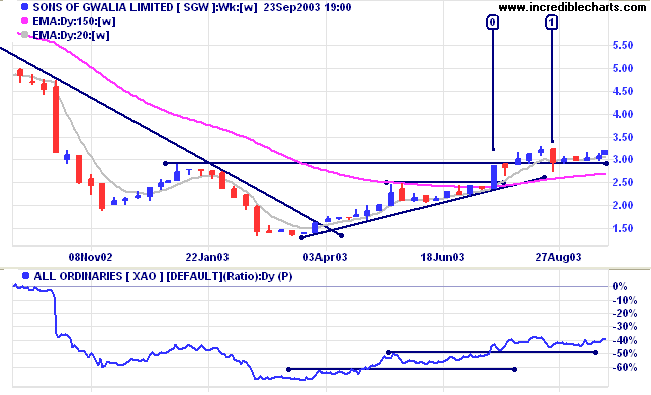

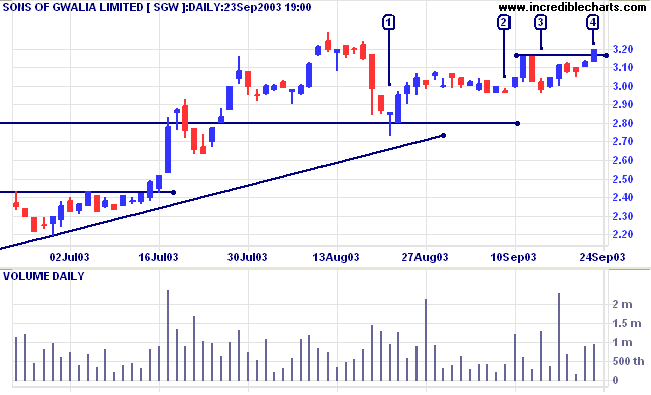

SGW has also been a bit slow out of the blocks, consolidating around 3.00 after a bullish ascending triangle at 2.50.

Twiggs Money Flow (100) signals accumulation after a bullish divergence, while MACD has formed two bullish troughs above zero.

These two are the most expensive eighths in the world.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

|

Relative Strength/ Price

Ratio Thank you for the posts regarding Price Ratio and Price Comparison. There appear to be some members who prefer the existing method of calculation and it may be necessary to offer both options, at least for Relative Strength/Price Ratio. If you would like to express your opinion, please post at Chart Forum: Indicators. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.