| Searching the Trading Diary Archives |

Use the normal Search function at the top

of the website page:

EXAMPLE |

Trading Diary

July 17, 2003

The Dow retreated a further 0.5% to close at 9050. Lower volume improves the chance of the index respecting support at 9000, despite the recent bear signal of two equal highs below the previous high.

The intermediate trend is up. A decline below 8978 will signal a down-turn.

The primary trend is up.

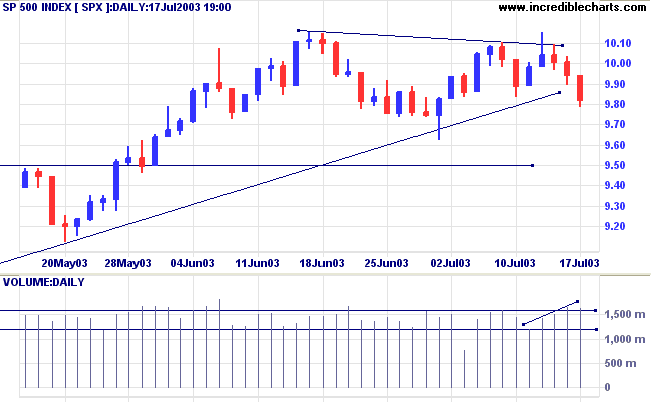

The fall below the recent low of July 10 signals that the intermediate up-trend is weakening. A decline below 962 will signal a down-turn.

The primary trend is up.

The fall below the previous low of 1707 signals that the intermediate up-trend is weakening.

The primary trend is up.

Intermediate: Long if the S&P is above 1015. Short if the index falls below 962.

Long-term: Long.

The software giant reported earnings for the quarter of 18 cents a share, after a charge of 5 cents for legal settlements, compared to 24cents a year ago. Sales were up strongly at 11%. (more)

New York (17.29): Spot gold is slightly higher at $US 344.40.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

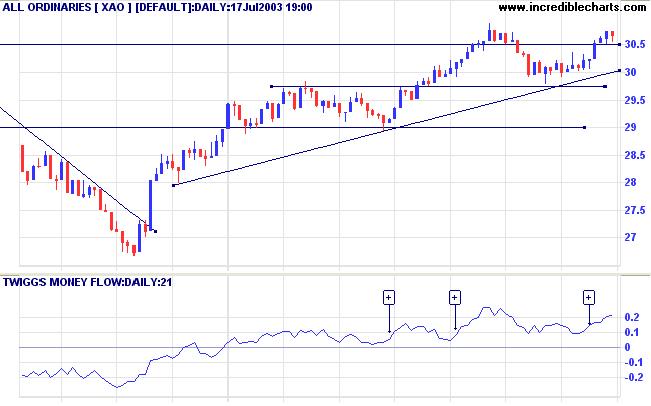

MACD (26,12,9) is above its signal line, having completed two bullish troughs above zero; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (21) signals accumulation, also displaying bullish troughs above the zero line.

Intermediate: The primary trend is up; Long if the All Ords is above 3075.

Long-term: Long.

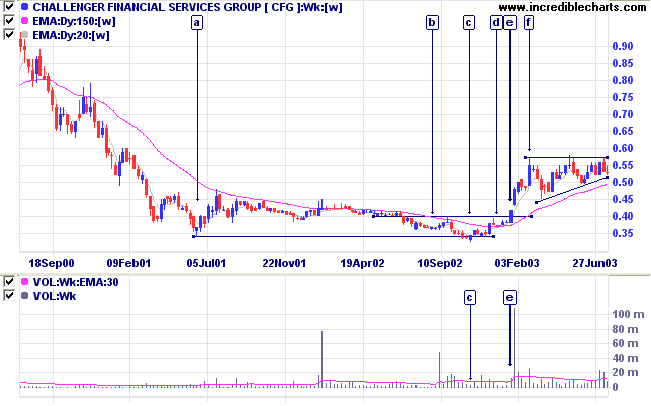

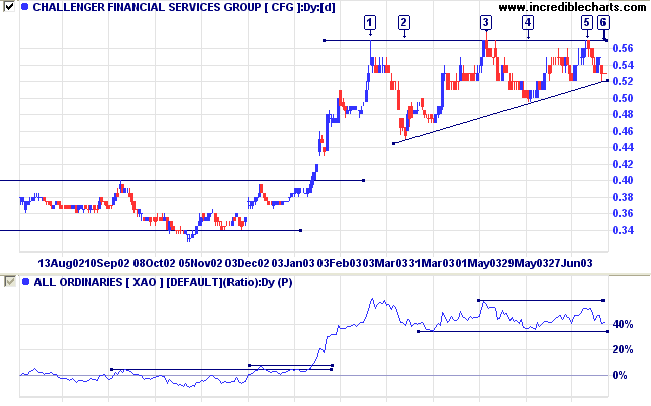

CLI last covered on March 10, 2003.

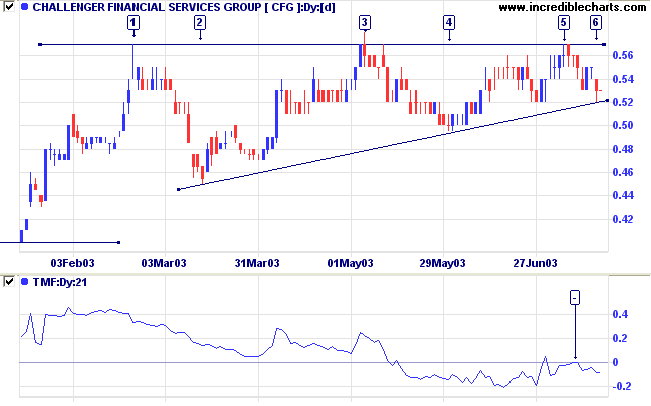

CLI and CPH are in the process of being merged to trade as CFG. Further information is available on the ASX site.

Looking at the new entity, CFG formed a broad stage 1 base before a breakout at [e]. The stock then rallied strongly before forming an ascending triangle, from [f]. Note the earlier dry up of volume when price made a marginal break below support at [c].

Ascending triangles are normally bullish, but Twiggs Money Flow (100-day) has declined below zero and MACD is also bearish.

When they die, they are rigid........

If a soldier is rigid, he will not win;

If a tree is rigid, it will not survive.

Rigidity and power occupy the inferior position;

Suppleness and softness occupy the superior position.

~ Lao Tse.

| Stock Screens: Ranging Stocks |

|

Directional Movement provides a

useful filter for identifying ranging stocks: |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.