Trading Diary

July 8, 2003

The Dow formed an inside day, signaling indecision. The index closed almost unchanged at 9223 on average volume.

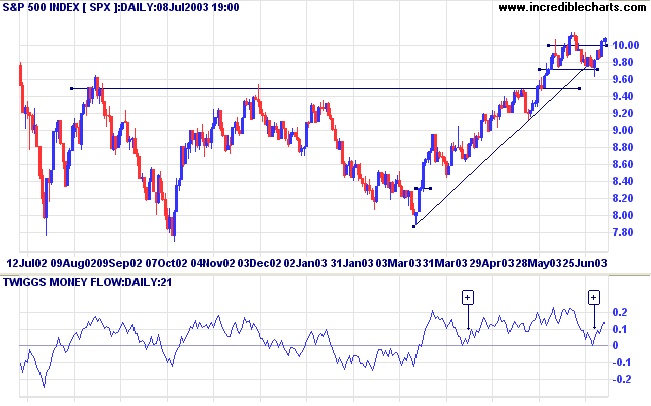

The intermediate trend has turned up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

Intermediate: Long if the S&P is above 995.

Long-term: Long.

The software giant will cease to issue stock options and in future award shares to employees. (more)

New York (17.57): Spot gold declined almost $4.00 to $US 344.40.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend has turned up.

The primary trend is up.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs Money Flow (21) signals accumulation.

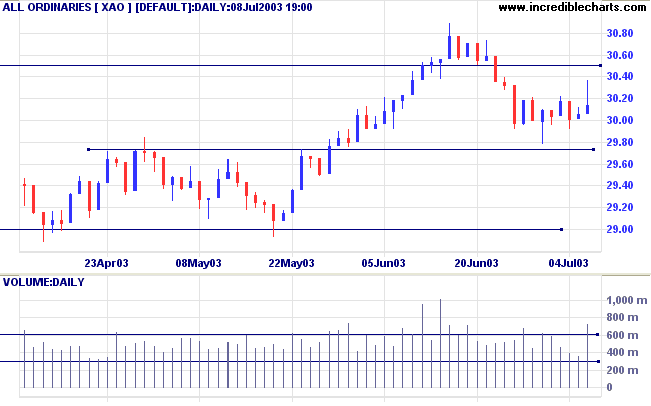

Intermediate: The primary trend is up; Long if the All Ords is above 3022.

Long-term: Long.

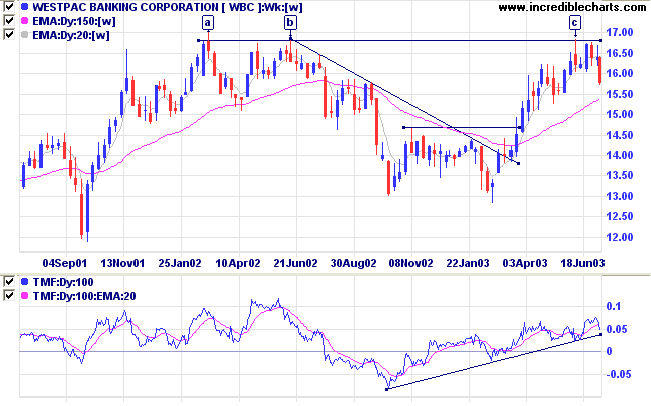

Last covered on June 26, 2003.

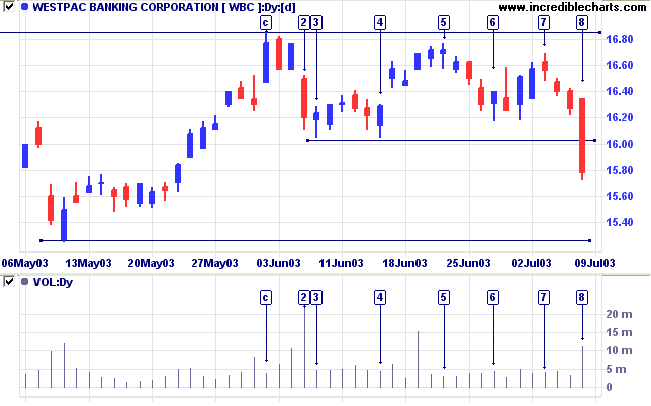

Westpac has retreated after testing resistance below 17.00.

Relative Strength (price ratio: xao) is weakening.

Twiggs Money Flow (100-day and 21-day) still signal accumulation.

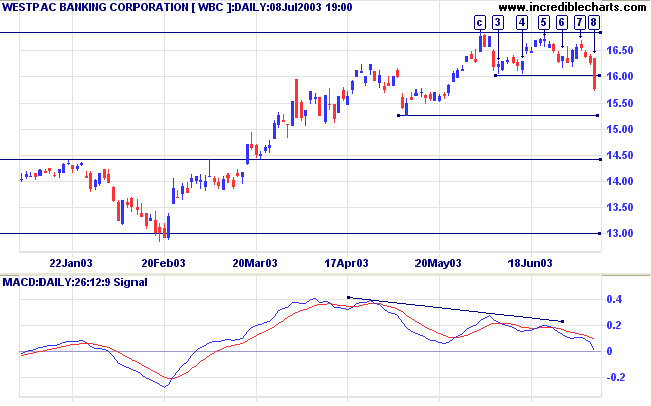

Price has failed to break through the resistance level after 3 attempts, at [c], [5] and [7].

The downward break at [8] is accompanied by strong volume.

The next support level is at 15.25. A close below this level may foreshadow a re-test of support at 13.00.

If WBC respects the support level, we will likely see further consolidation before another attempt at the 17.00 resistance level.

~ Anais Nin.

To highlight stocks in established up/down trends:

(1) Select a fast and slow moving average;

(2) Select the Bull or Bear signal;

(3) Enter 9999 as the time period;

(4) Sort the Return by clicking on the MA heading.

This will order all trending stocks from the longest, most established trends,

down to the the most recent crossovers.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.