To find out more about US indexes

Trading Diary

June 9, 2003

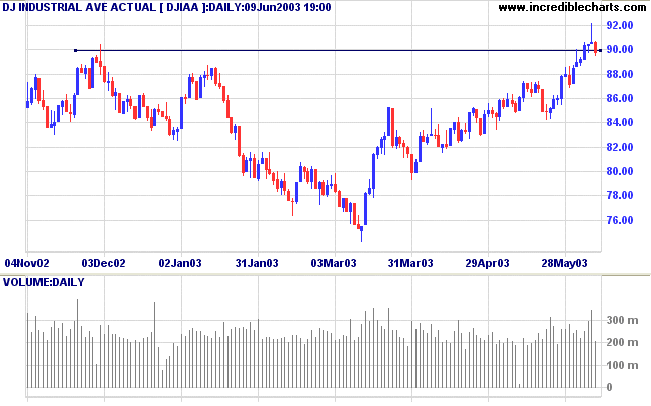

The Dow corrected back below the 9000 support level; closing down 0.9% at 8980 on lower volume. A false (marginal) break above resistance is a strong bear signal.

The intermediate trend is up.

The primary up-trend is up.

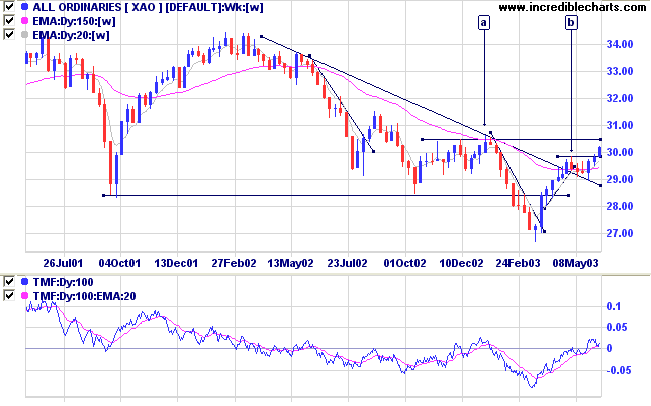

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

Intermediate: Long if the S&P is above 1000.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

The mortgage giant fired its president and chief financial officer for failing to cooperate with the audit committee reviewing past results. (more)

The mobile phone maker blames poor market conditions in China for weak results. (more)

Chancellor of the Exchequer Gordon Brown tells parliament that Britain is not ready to adopt the euro, but says that the decision will be reviewed in 2004. (more)

New York (17.50): Spot gold has declined to $US 361.30.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is down. A close above 3050 will signal an up-trend.

The monthly Coppock indicator has turned up below zero, signaling the start of a bull market.

Twiggs Money Flow (100) has crossed to above zero, signaling accumulation.

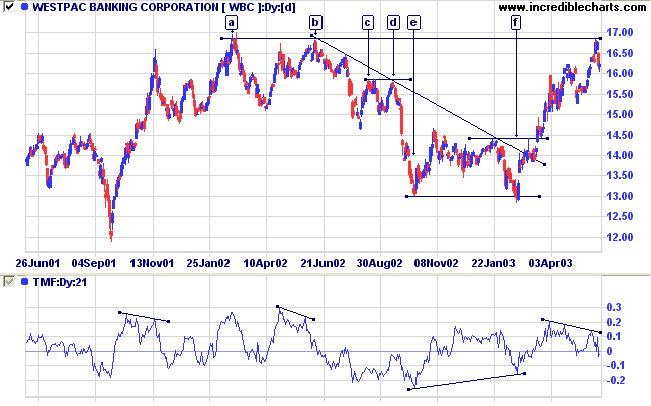

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above its signal line; and Twiggs Money Flow (21) signals accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Last covered on May 8, 2003.

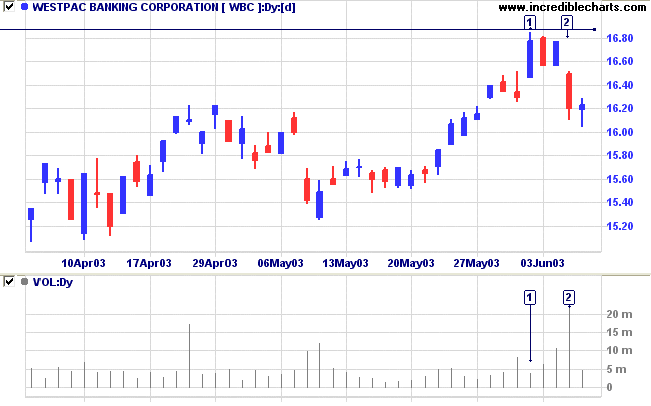

Westpac has pulled back strongly after testing resistance at 16.90.

Twiggs Money Flow (100) and Twiggs Money Flow (21) both show bearish divergences.

- [a]-[b] signaled the end of a primary up-trend;

- [c]-[d] gave a strong continuation signal in the down-trend;

- [e]-[f] signaled a reversal back to an up-trend (the false break at [f] strengthened the signal).

Volume strengthened on the pull-back, peaking with the downward gap at [2].

The doji candle on the following day indicates that the gap may have exhausted short-term momentum and another rally is likely.

If the rally is on thin volume and forms an equal or lower high, we may see the start of a secondary correction (intermediate down-trend).

A break above 16.90 would be bullish, but I would wait for a pull-back before taking further long entries.

The reason for failure in most cases is lack of perseverance.

- James Russell Miller.

Click here to access the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.