after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 20, 2003

The Chartcraft NYSE Bullish % Indicator increased to 54% (January 17).

The euro rose to a three-year high against the dollar, reaching $1.068 in thin trading.

Gold

New York: Spot gold eased 50 cents to $US 355.80

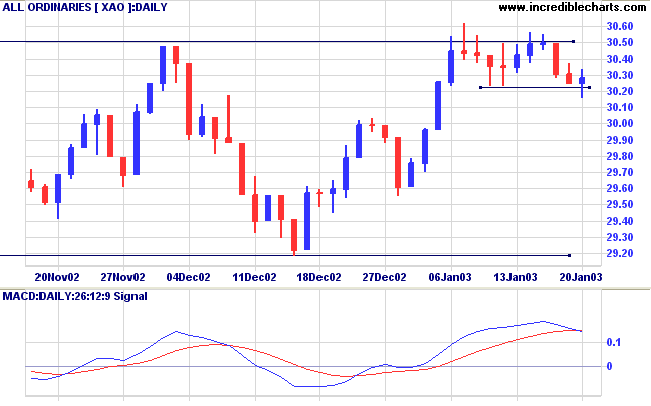

The index ranges between 2915 and 3050, forming a base.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) has crossed below its signal line; Twiggs Money Flow is neutral.

Last covered on November 08, 2002.

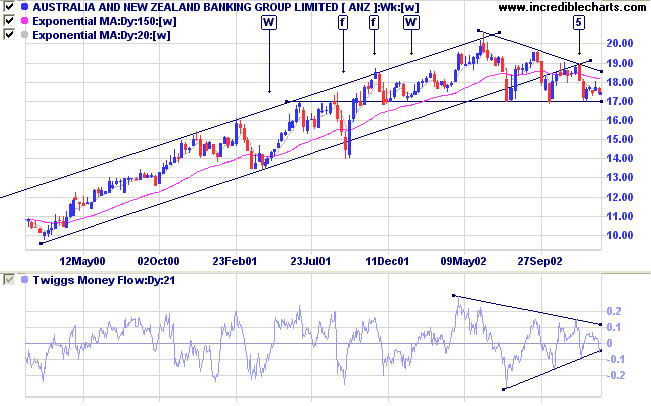

After a long stage 2 up-trend ANZ formed a stage 3 top in the form of a descending triangle (Note the double bottoms [W] - strong bull signals in an up-trend - and the false breaks of the trend channel at [f]). The bearish triangle pattern was confirmed when price respected the lower trendline at 5.

The stock has, so far, held above support at 17.00. If Twiggs Money Flow breaks below the triangle on the indicator slot, this will signal weakness and that a break below 17.00 may be imminent.

Relative Strength (price ratio: xao) and MACD are both weakening.

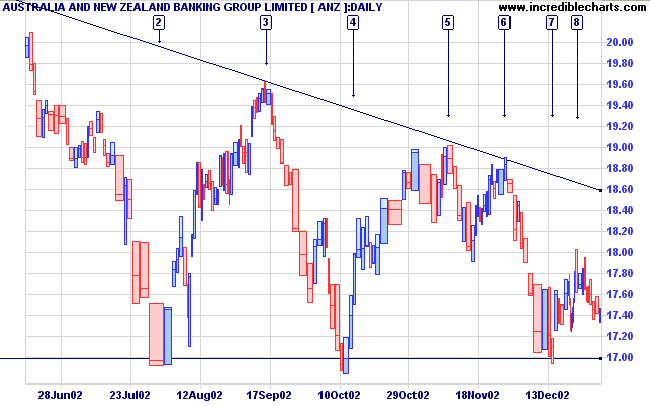

Apart from false breaks at [2], [4] and [7], price has respected the 17.00 support level (Note that the double bottoms are not as reliable in a top or in a down-trend).

Watch for a dry-up of volume, and daily range, on a short duration counter-rally.

For further guidance see Understanding the Trading Diary.

to make decisions, and tochoose between alternatives. He is distinguished from animals by his freedom

to do evil or to do good and to walk the high road of beauty or tread the low road of ugly degeneracy.

- Martin Luther King Jr. : The Measures of Man, 1959.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.