The new version is now available. See What's New? for details.

Incredible Charts will automatically update to the new version when you log in.

To check that you have the latest version, select Help >> About on Incredible Charts menu.

Trading Diary

November 08, 2002

The Nasdaq Composite Index closed the upward gap from Monday, down 1.3% at 1359. The primary trend will reverse to up if the index breaks above 1426.

The S&P 500 lost 8 points to close at 894. The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 07).

The UN Security Council unanimously approved a resolution demanding unfettered access for UN weapons inspectors. (more)

The fast-food chain warns that it will miss 2002 earnings forecasts and close 175 under-performing restaurants.(more)

Gold

New York: Spot gold is up 20 cents at $US 321.00.

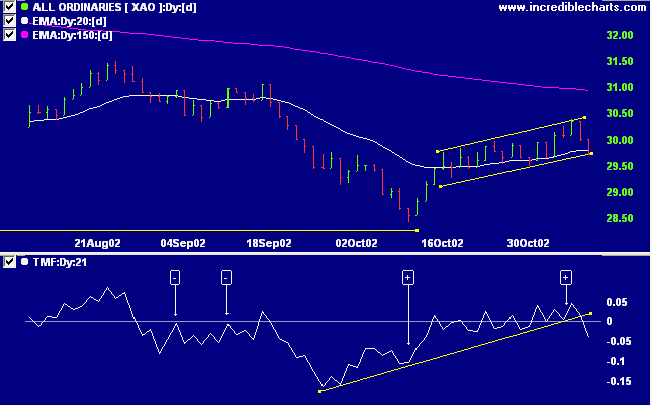

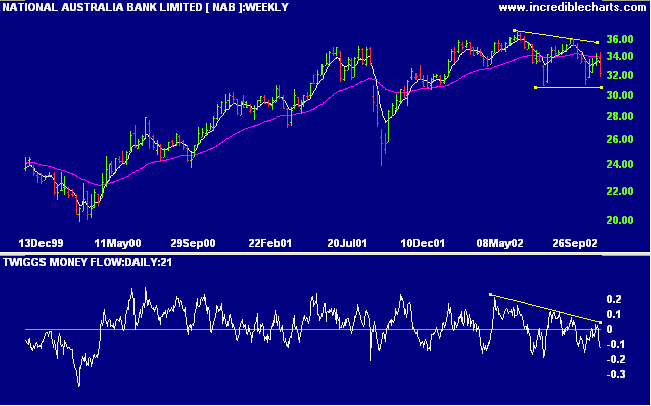

The Slow Stochastic (20,3,3) is below its signal line, MACD (26,12,9) is above, while Twiggs money flow has broken its trendline and signals distribution.

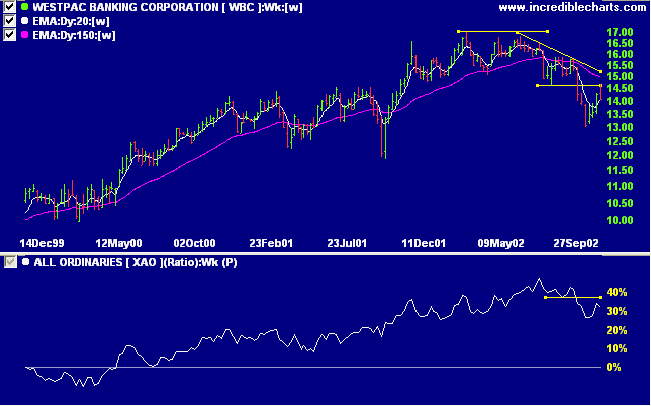

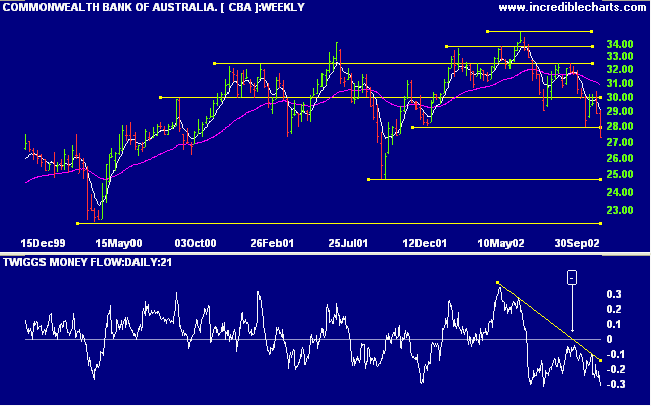

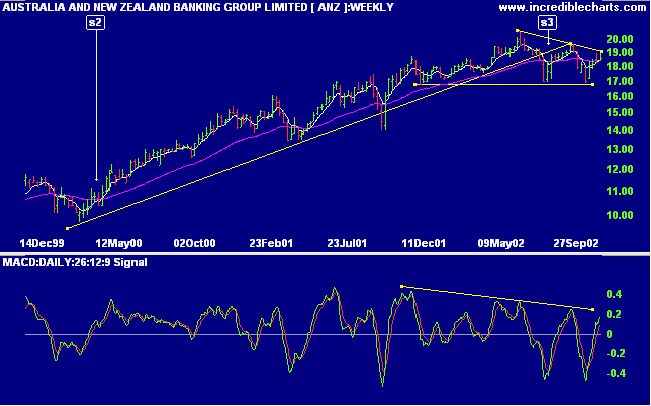

The big four banks have under-performed the market in the last month, after out-performing over the previous 2 years. Relative strength (price ratio: xao) is falling for three of the four, while two are in a stage 4 down-trend and the other two are in stage 3 tops.

Westpac Banking Corp [WBC] weekly chart displays declining relative strength and a stage 4 down-trend after completing a bearish descending triangle. The latest counter-trend has respected the lower border of the triangle signaling trend strength.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 1 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is level)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 49 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

- Health Care

- Highways and Rail Tracks

- Banks? and Diversified Financial Services

Wisdom, in short, whose lessons have been

represented as so hard to learn

by those who were never at her school, teaches us only to

extend a simple maxim

universally known and followed even in the lowest

life,

a little farther than that life carries it.

And this is not to buy at too dear a price.

Now, whoever takes this maxim abroad with him into the

grand market of the world,

and constantly applies it to honors, to riches, to

pleasures,

and to every other commodity which that market

affords,

is, I will venture to affirm, a wise man;

and must be so acknowledged in the worldly sense of

the word:

for he makes the best of bargains,

since in reality he purchases everything at the price

of a little trouble,

and carries home all the goods I have mentioned,

while he keeps his health, his innocence and his

reputation,

the common prices which are paid for them by others,

entire and to himself.

- Henry Fielding: Tom Jones (1749).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.