Trading Diary

November 15, 2002

Understanding the Trading Diary provides further guidance.

The primary trend will reverse (up) if the index rises above 9130.

The Nasdaq Composite Index formed another equal top, closing unchanged at 1411.

The primary trend will reverse (up) if the index breaks above 1426.

The S&P 500 closed up 5 points at 909.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 14).

Tech stocks struggled as Dell cautions that the outlook is unclear; Merrill Lynch downgrades Intel; and Gateway announces it is under investigation by the SEC. (more)

Gold

New York: Spot gold is up 250 cents at $US 320.30.

The primary trend will reverse if the index rises above 3150.

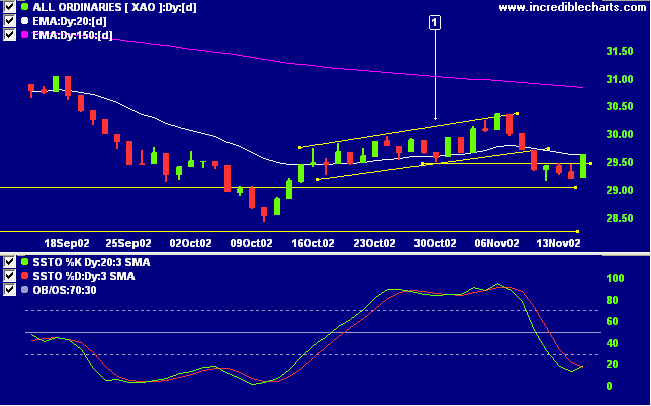

The Slow Stochastic (20,3,3) crossed above its signal line, MACD (26,12,9) is below, while Twiggs money flow signals distribution.

Last covered on July 25.

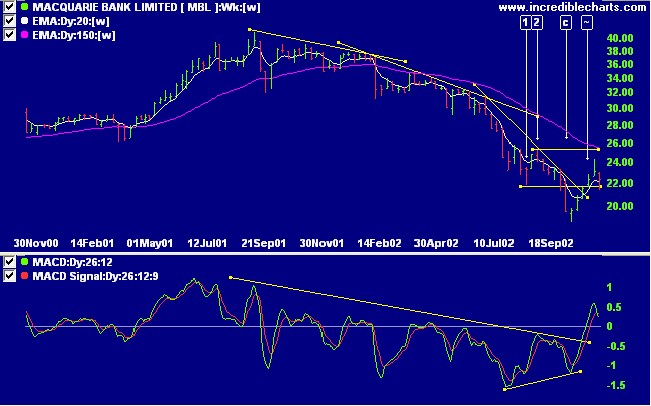

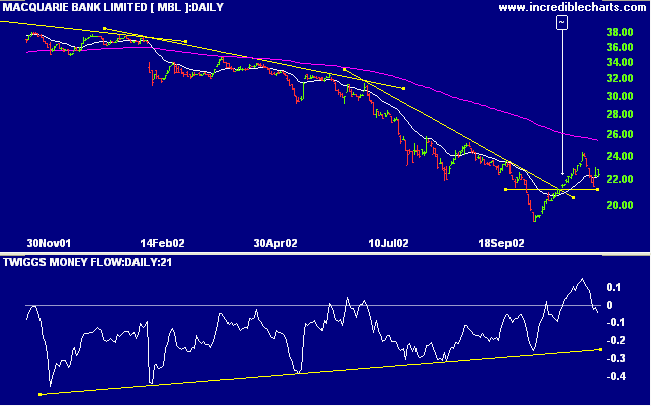

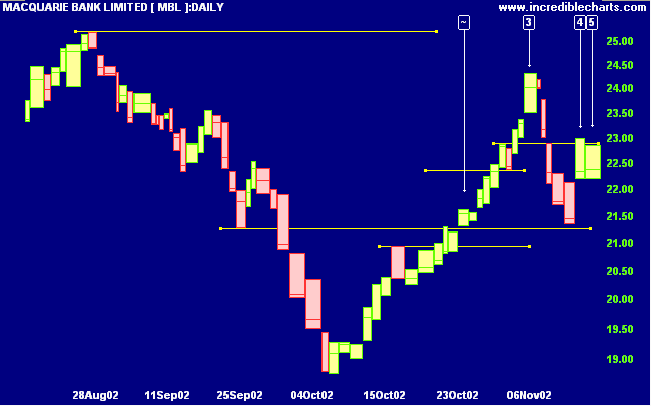

MBL experienced a stage 4 down-trend over the last year, accelerating into capitulation at [c]. Price subsequently recovered above the low of [1], at [~], signaling that the down-trend is weakening. MACD broke above the downward trend line after a bullish divergence.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is falling)

- Materials [XMJ] - stage 1 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is level)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 27 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

We are there to take other people's money before they take ours.

- Alan S. Farley, The Master Swing Trader

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.