Trading Diary

July 25, 2002

The Chartcraft NYSE Bullish % Indicator has a reading of 24% (July 24). See Bullish % Index for more details.

The Nasdaq Composite slipped, closing 3.9% down at 1240. Primary and secondary cycles are in a down-trend.

The S&P 500 closed down 0.5% at 838.

Primary and secondary cycles trend downwards.

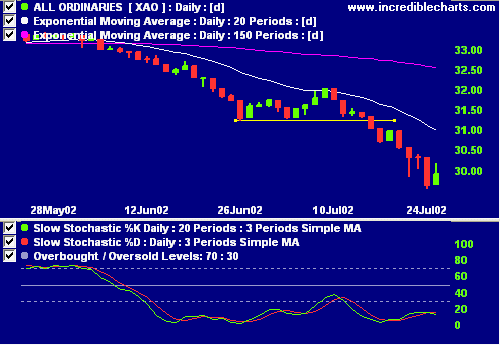

Trading Diary

The primary cycle and secondary cycles trend down. The next

support level is 2828, from September 2001

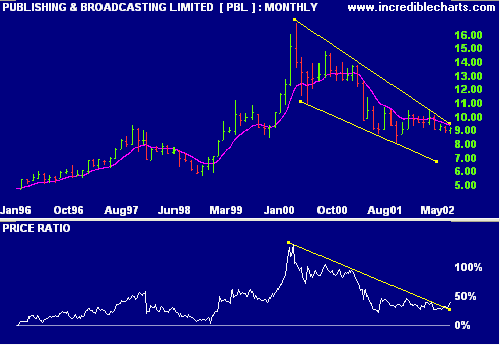

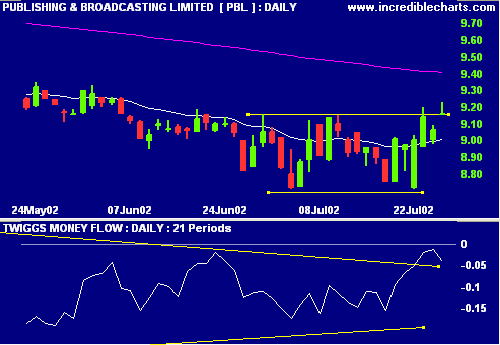

Publishing and Broadcasting Limited [PBL]

The PBL monthly chart shows a large falling wedge, a bullish

signal, while relative strength (price ratio: xao) appears to

be holding at current levels.

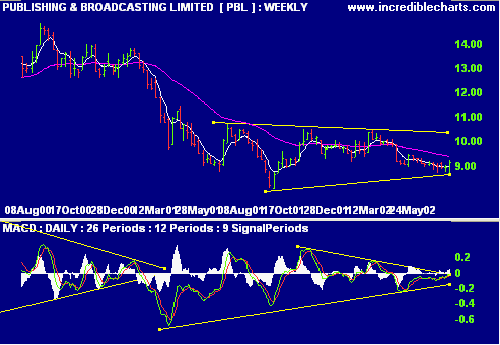

The weekly chart shows a smaller symmetrical triangle. MACD is strengthening.

The daily chart shows a short-term double bottom but with weak volume confirmation - Twiggs Money Flow has turned down below zero.

Nothing is illegal if a hundred businessmen decide to do it - Andrew Young.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.