Trading Diary

November 13, 2002

The Nasdaq Composite Index gained 0.9%% to close at 1361. The primary trend will reverse (up) if the index breaks above 1426.

The S&P 500 closed unchanged at 882. The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 12).

Iraq agrees to the return of UN weapons inspectors but the US and Britain are skeptical. (more)

Gold

New York: Spot gold dropped sharply on the news from the UN and is down 510 cents at $US 318.80.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines, while Twiggs money flow has given a bearish signal [-], reversing below zero.

Last covered on September 11.

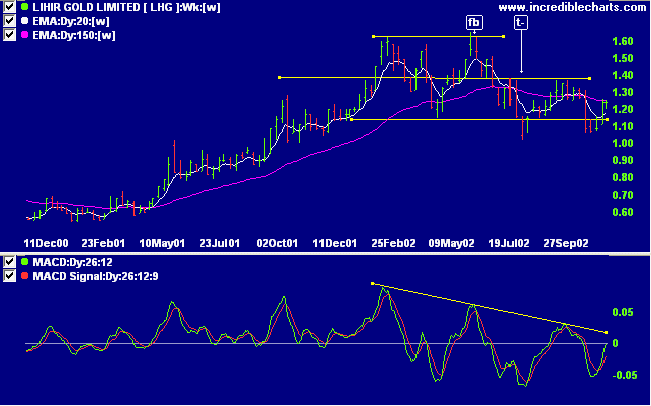

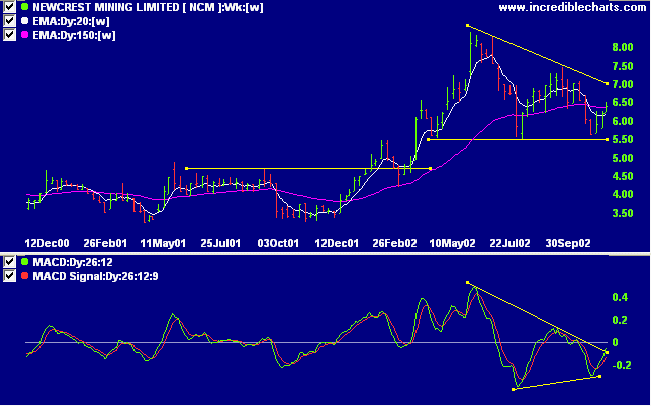

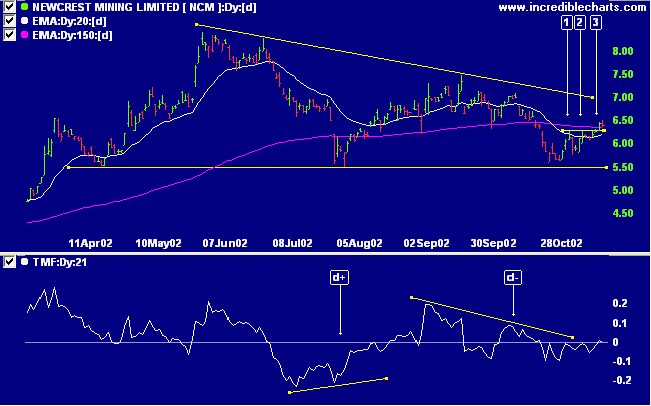

Several gold stocks have formed bearish patterns on the weekly charts.

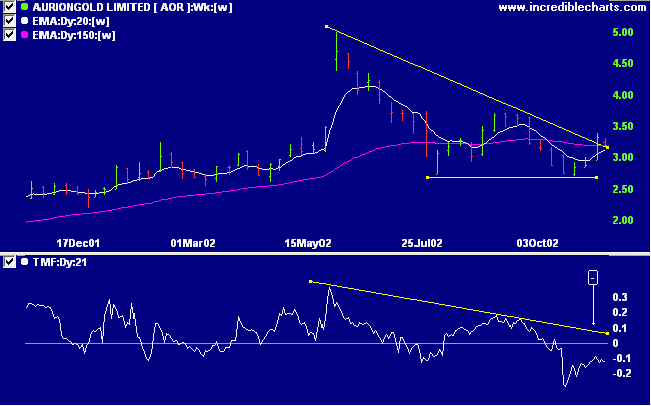

AOR has formed a descending triangle. The upward break in the last two weeks appears to be a false break: Twiggs money flow signals distribution and displays a bearish peak below the zero line. Relative strength (price ratio: xao) is falling and MACD is bearish.

A fall below 5.50 will be a strong bear signal.

I've certainly learned a lot.

- Thomas A. Edison

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.