We plan to add 3 Directional Movement filters to the list of Stock Screen filters:

-

DI+ and DI- crossovers within x

number of days (where x is input by the

user).

-

ADX above or below x (as in %Price

Move - Minimum or Maximum values).

- ADX turns up or turns down.

Please post your comments at ADX on the Chart Forum.

Trading Diary

September 11, 2002

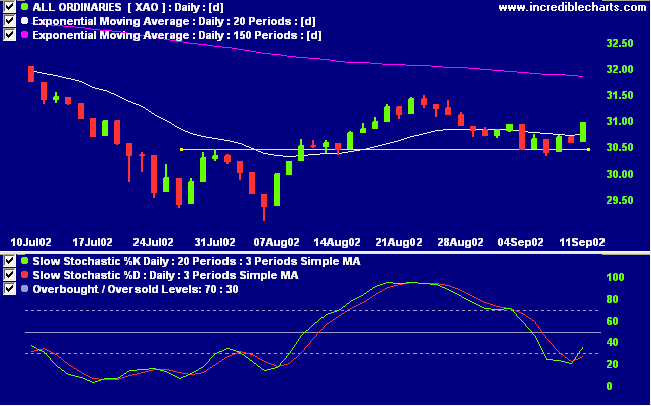

The Nasdaq Composite Index closed down 5 points at 1315. The primary trend is down.

The S&P 500 also showed uncertainty, closing unchanged at 909. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 10).

The Federal Reserve Beige Book report finds strong automobile and housing sales, contrasted with weak retail sales and manufacturing. (more)

The primary trend is down.

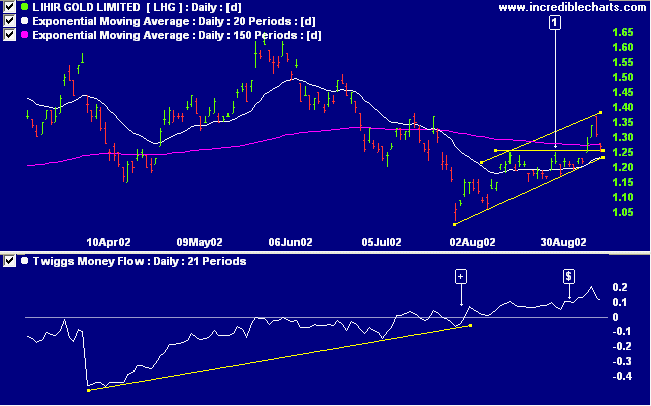

The spot gold price has retreated from its high of $US 321 on the 9th to close at $US 316.40 in New York. The short-trend is still upward but can be expected to encounter resistance at $US 324 to $US 327.

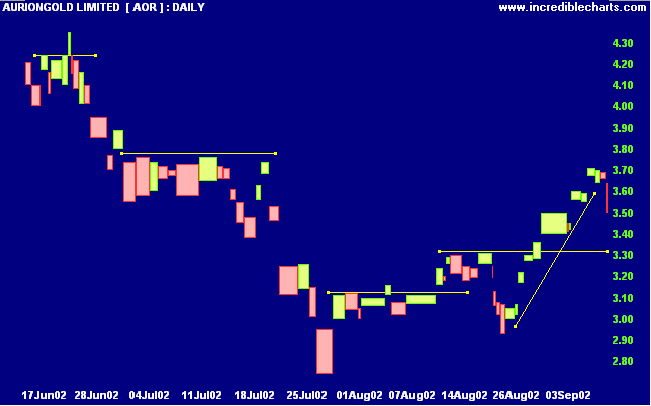

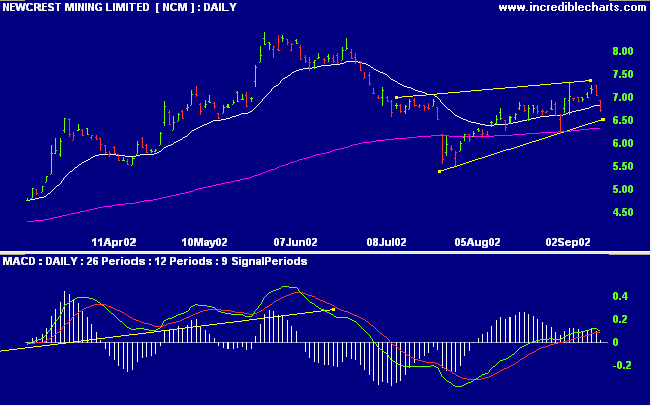

Local gold stocks have rallied off recent lows but now appear to be pulling back to the 20-day moving average, in line with the gold price.

Lihir Gold (LHG) started to trend upwards after a bullish divergence [+] on Twiggs money flow, but has now retreated to test support [1] at 1.25.

There's many a pessimist who got that way by financing an optimist

- Anonymous.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.