The next version of Incredible Charts will enable users to screen their own watchlists.

Trading Diary

October 30, 2002

The Nasdaq Composite Index gained 2% to close at 1326. The primary trend will reverse if the index breaks above 1426.

The S&P 500 is also ranging, gaining 8 points to close at 890. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 36% (October 29).

IT services company EDS posted a slight drop in revenue but a 59% fall in third-quarter profits. (more)

New York: Spot gold was last down 80 cents at $US 315.90.

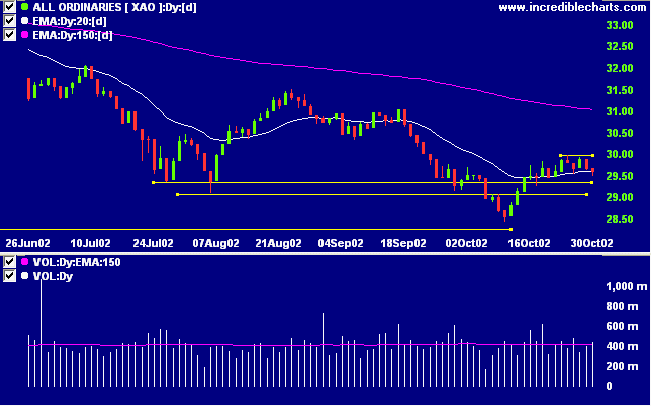

The Slow Stochastic (20,3,3) is below its signal line, MACD is above, while Twiggs money whipsaws around the zero line.

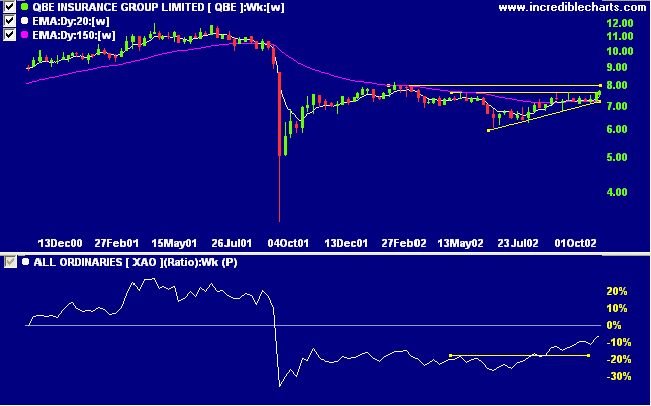

Last covered on October 7, 2002.

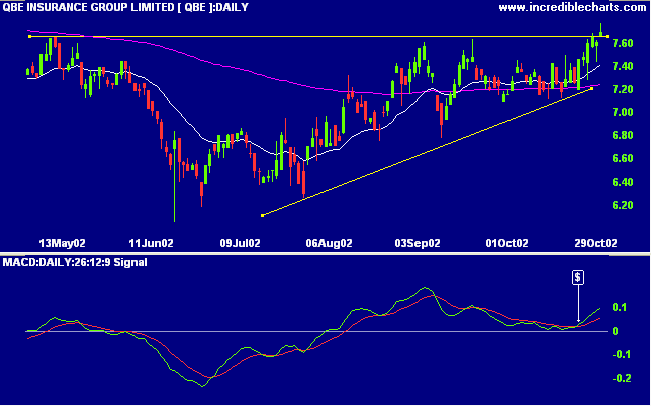

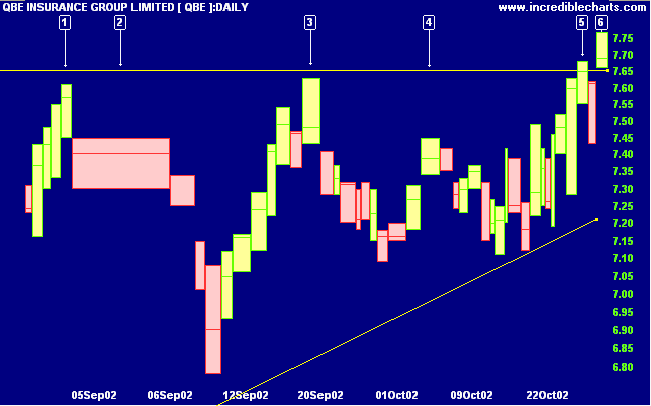

After its dramatic fall in 2001, QBE rallied to 8.00 before forming a bottom above 6.00 in the form of an ascending triangle. Relative strength (price ratio: xao) is rising.

We come now to the region dominated by the powers of intellect. War is the realm of uncertainty . . . . War is the realm of chance. . . . Two qualities are indispensable: first, an intellect that, even in the darkest hour, retains some glimmerings of the inner light which leads to truth; and second, the courage to follow this faint light wherever it may lead. The first of these qualities is described by the French term, coup d'oeil; the second is determination.

Prussian military thinker Claus von Clausewitz, translated from Vom Kriege ("On War") (1831).

Napoleon first described coup d’oeil: “There is a gift of being able to see at a glance the possibilities offered by the terrain …"

Clausewitz explained it as "...the quick recognition of a truth that the mind would ordinarily miss or would perceive only after long study and reflection."

Traders require similar traits.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.