Use Help >>About to check that you have the latest update. The new version offers:

-

A Price

Ratio (relative strength) indicator that applies to all

securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 07, 2002

The primary trend is down.

The Nasdaq Composite Index shed 1.8% to close at 1119.

The primary trend is down.

The S&P 500 has broken below support at 800 and is testing July lows, closing 15 points down at 785.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 30% (October 4).

The decision by JP Morgan to cut 4000 (20%) of its workforce may be the forerunner of staff cuts in an overweight US brokerage industry. (more)

New York: The spot gold price is unchanged at $US 322.10.

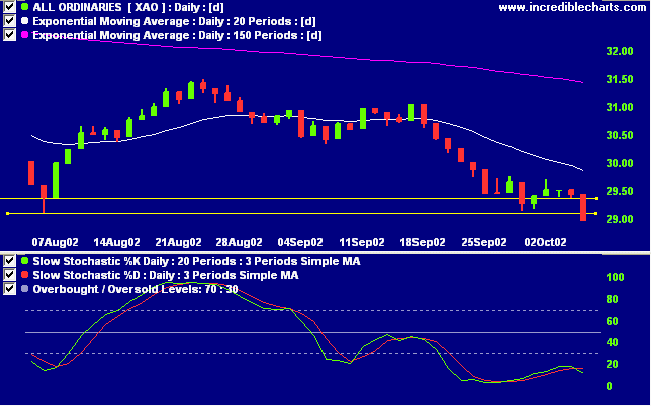

Slow Stochastic (20,3,3) has crossed to below its signal line, to join MACD (26,12,9). Twiggs money flow signals distribution.

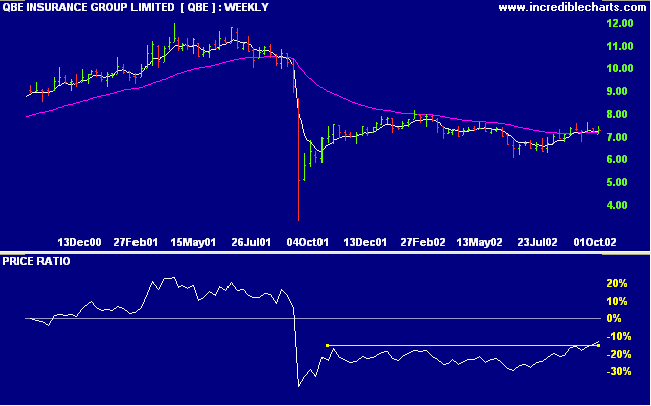

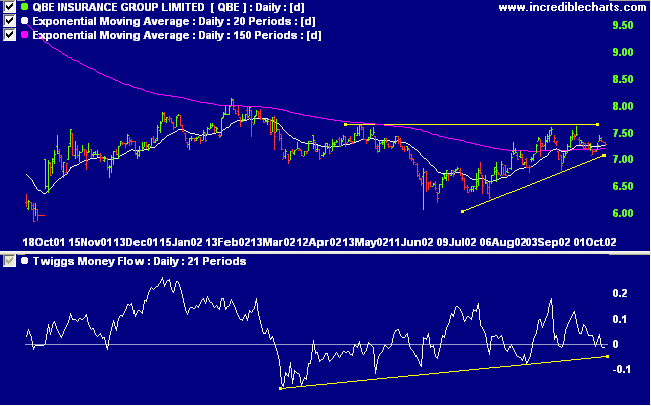

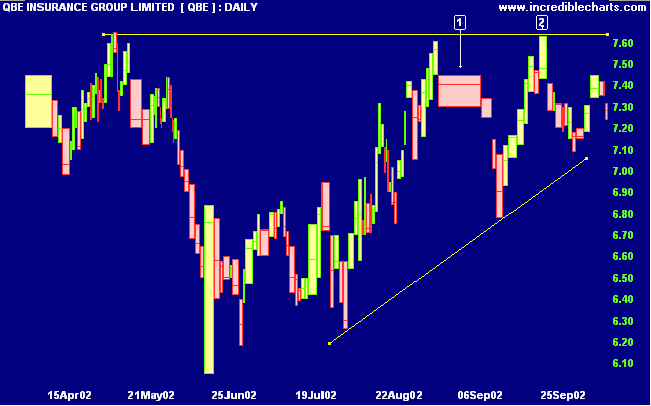

After a disastrous fall in September 2001, QBE has entered a stage 1 base, with relative strength (price ratio: xao) rising. The 150-day exponential moving average has leveled after a long decline.

The shaded areas on the equivolume chart depict closing prices: the lighter shade is above the close in an up-trend, and below the close in a down-trend.

To be a successful trader, you have to be able to admit mistakes .... the person who can easily admit to being wrong is the one who walks away a winner.

Victor Sperandeo - The New Market Wizards by Jack Schwager

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.