We are planning to add Directional Movement/ADX to the list of Stock Screen filters

and welcome any comments or suggestions as to how the filter should be implemented.

Please post your comments at ADX on the Chart Forum.

Trading Diary

September 10, 2002

The Nasdaq Composite Index rallied 1.2% to close at 1320. The primary trend is down.

The S&P 500 added 7 points to close at 909. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 9).

Chips and automotive stocks lead a mild rally despite heightened terror alerts. (more)

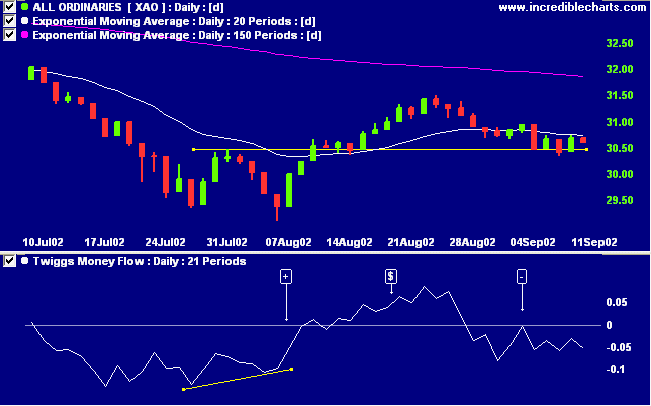

The primary trend is down.

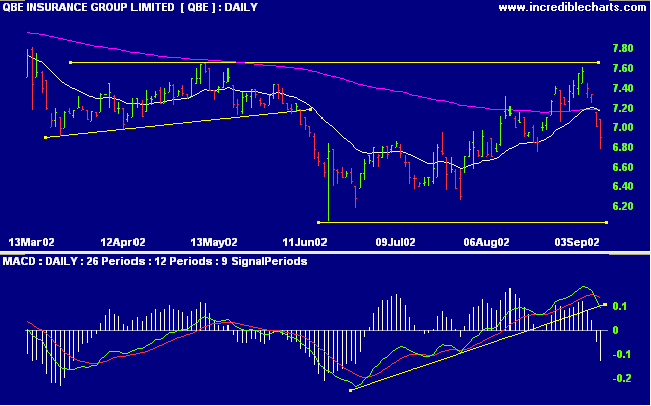

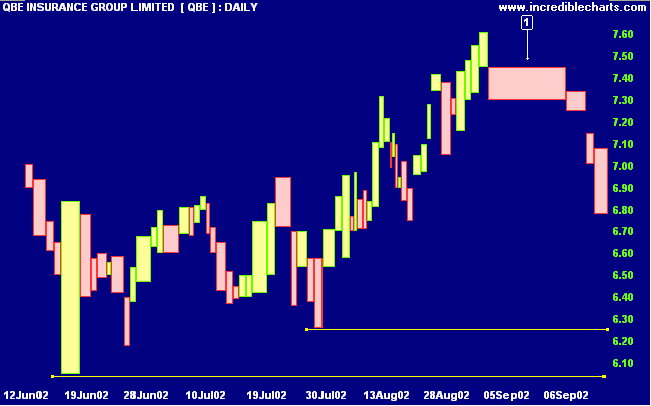

The insurance stock experienced a dramatic fall in September last year, entering a stage 4 down-trend. The 150-day moving average has now leveled out and the stock is showing signs of building a stage 1 base. MACD has risen steadily until price encountered resistance at 7.60 to 7.65.

You can lead a horse to water, but you can't make him drink - Anon.

You can lead a man to knowledge, but you can't make him think - Jerri Shinnaman.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.