S&P 500 dividend yields signal oversold?

By Colin Twiggs

July 9th, 2012 1:00 a.m. ET (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

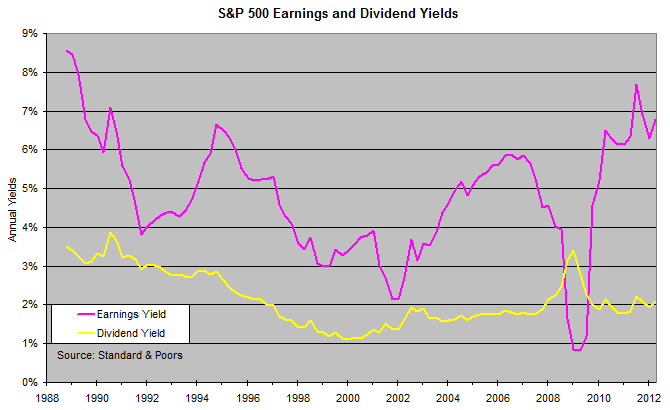

Historically the S&P 500 was considered overbought — and ripe for a bear market — when the dividend yield dropped below 3 percent. A surge in share buybacks in the past two decades, however, disrupted this relationship, with the dividend yield falling close to 1.0 percent in the Dotcom era.

What happens when we adjust for share buybacks?

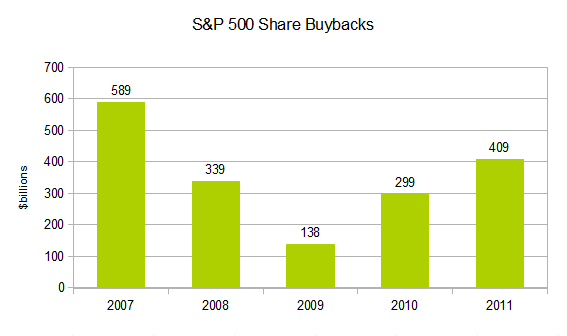

In 2011, S&P 500 share buybacks increased to $409.0 billion. With dividends of $298 billion*, that gives a total cash distribution (dividends and buybacks) of $707 billion for a yield of 5.44 percent. Right in the middle of the 5.0 to 6.0 percent range previously considered typical of an oversold market.

* S&P 500 market capitalization of $12,993 billion at June 29, 2012 multiplied by 2.29 percent

Unfortunately buybacks fluctuate wildly with the state of the market:

If we omit the highest and lowest readings, and take the average share buyback over the remaining 3 years, it amounts to $349 billion. That would give adjusted total cash distributions of $614 billion and an adjusted yield of 4.98 percent — still close to the oversold range.

Compare to Earnings Yield

The current reported earnings yield of 6.8 percent, however, is way below the highs (10 to 14 percent) of the 1970s and 80s. Current distributions (dividends plus buybacks) amount to 80 percent of current earnings. Payout ratios above 60 percent are considered unsustainable.

My conclusion is that earnings yield offers a more accurate measure of value. And reflects a market that is fairly valued — rather than overbought or oversold — especially when we consider the likelihood of earnings disappointments.

Sometimes adversity is what you need to face in order to become successful.

~ Zig Ziglar

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.