Trading Diary

June 11, 2005

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

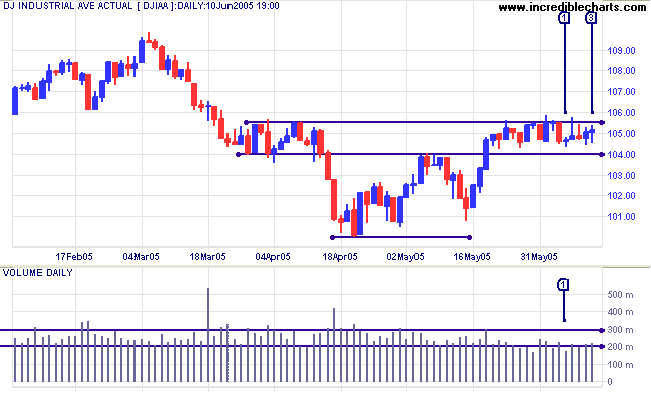

The Dow Industrial Average continues to consolidate in a narrow range between 10400 and 10550, signaling hesitancy. There is lack of both buying and selling pressure, with no trend movement and low trading volumes. An upside breakout is most likely, with a close above 10560 signaling a test of resistance at 10900/11000; while a close below 10400 is still a reasonable possibility and would signal a re-test of support at 10000.

The Dow Industrial Average continues to consolidate in a narrow range between 10400 and 10550, signaling hesitancy. There is lack of both buying and selling pressure, with no trend movement and low trading volumes. An upside breakout is most likely, with a close above 10560 signaling a test of resistance at 10900/11000; while a close below 10400 is still a reasonable possibility and would signal a re-test of support at 10000.

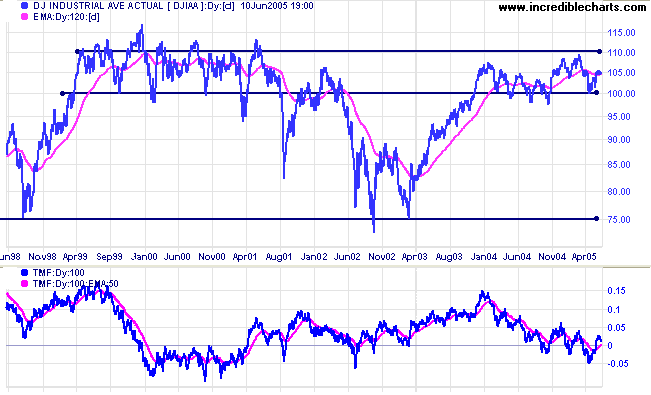

The last year has established strong support at 10000/9750. There

is also strong resistance at 11000/11500, shown by price action

from 1999 to 2001 and by recent highs in 2005. I expect to see a

lot more price action between these levels before there is a

clear breakout.

Twiggs Money Flow (100-day) signals short term accumulation, with a strong rise above the signal line, but the long-term outlook is bearish.

Twiggs Money Flow (100-day) signals short term accumulation, with a strong rise above the signal line, but the long-term outlook is bearish.

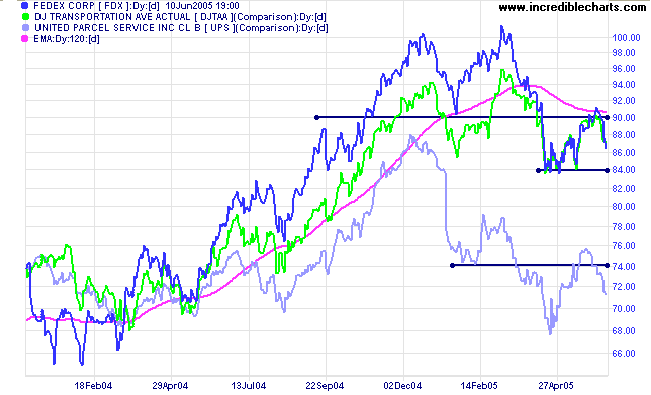

Three transport indicators all warn of a bearish outcome.

Fedex and UPS have both commenced primary

down-trends, while the Dow Transportation Average, having

given a weak bear signal in April, appears ready to follow suit.

Fedex will confirm that it is in a strong down-trend if it closes

below support at 84.00; UPS likewise, if it closes below its

April low.

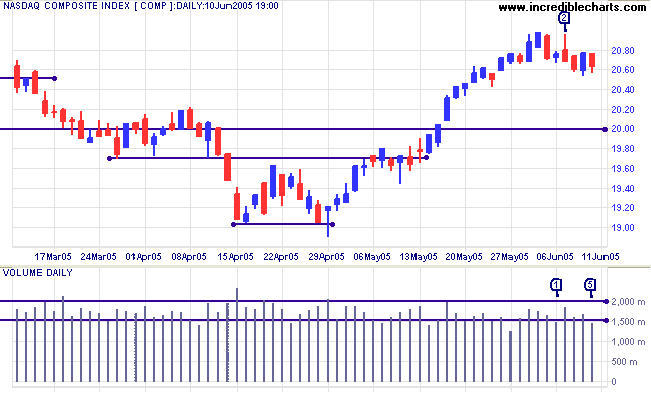

Trading volumes have dried up on the Nasdaq Composite,

with low activity especially noticeable at [1] and [5]. Monday's

attempted rally failed at [2] and the index appears headed for a

test of support at 2000/1900. A close below 1900 would

signal resumption of the primary down-trend; a close above 2180,

resumption of the primary up-trend.

The more speculative end of the market appears to be waiting for direction from the heavyweights.

The more speculative end of the market appears to be waiting for direction from the heavyweights.

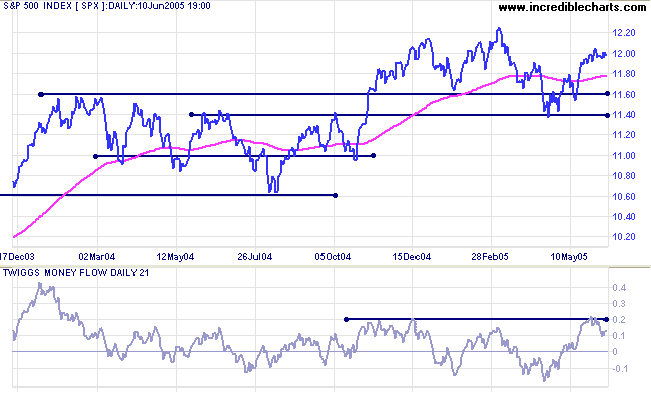

The S&P 500 is adopting a similar pattern to the Dow,

consolidating between 1190 and 1205 over the last two to three

weeks. A close above 1225 would signal resumption of the primary

up-trend. A downward breakout that holds above 1160 would still

be positive; while a close below 1140 would be a strong bear

signal, signaling continuation of the primary down-trend.

Twiggs Money Flow (21-day), displays some distribution over

the past two weeks but is still positive. A pull-back that holds

above the zero line would be a strong bull signal.

Treasury yields

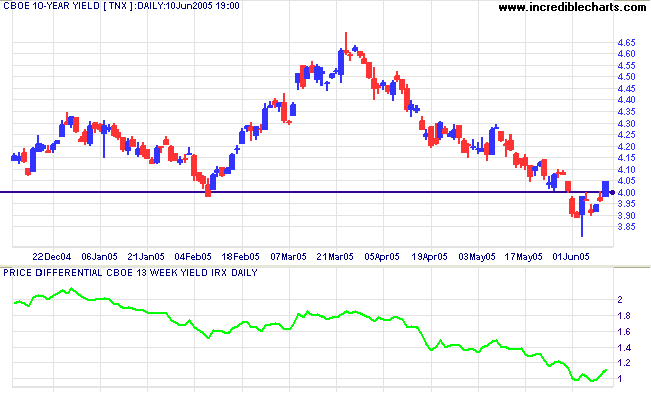

The yield on 10-year treasury notes rallied strongly on Friday, to above 4.0%, after a marginal break. If the new support level holds over the next few days, expect a test of resistance at 4.60%. T-bills (13-week) are testing resistance at 3.0%; so the yield differential (10-year T-notes minus 13-week T-bills) is just over 1.0% -- a further decline would be a long-term bear signal for equities.

The yield on 10-year treasury notes rallied strongly on Friday, to above 4.0%, after a marginal break. If the new support level holds over the next few days, expect a test of resistance at 4.60%. T-bills (13-week) are testing resistance at 3.0%; so the yield differential (10-year T-notes minus 13-week T-bills) is just over 1.0% -- a further decline would be a long-term bear signal for equities.

Gold

New York: Spot gold has started an intermediate up-trend, rallying to $426.90 on Friday. Expect a test of resistance at the April high of $435.70. Failure to breach this would be a bearish sign; confirmed if the metal then falls below support at $415.

New York: Spot gold has started an intermediate up-trend, rallying to $426.90 on Friday. Expect a test of resistance at the April high of $435.70. Failure to breach this would be a bearish sign; confirmed if the metal then falls below support at $415.

$415 is at the base of a large (6-month)

triangle; while the primary trend will reverse downward if

price falls below support at the February low of $410.

ASX Australia

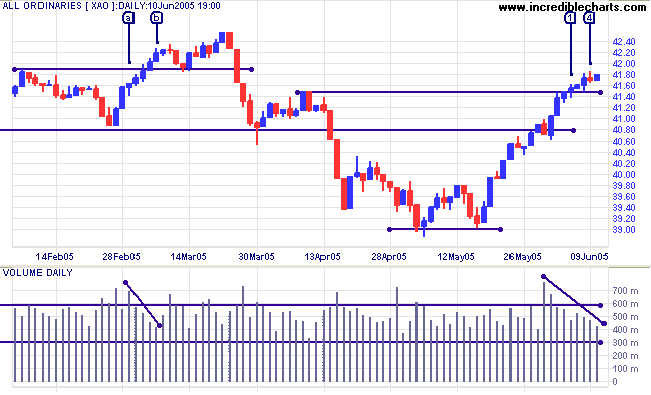

The All Ordinaries broke through resistance at 4140/4150 but the rally is running out of steam, with declining volume and a similar ascending flag pattern to early March 2005: [a] to [b]. This is where it gets interesting.

The All Ordinaries broke through resistance at 4140/4150 but the rally is running out of steam, with declining volume and a similar ascending flag pattern to early March 2005: [a] to [b]. This is where it gets interesting.

- If the index fails to break through resistance at 4255, we may see a sharp downward correction. One strong red candle could trigger a spate of selling.

- If the index breaks above 4255 and then retreats within a day or two (a false/marginal break), that would be an even stronger bear signal.

- The least likely scenario is a breakout followed by a pull-back that respects the new support level: a bullish signal.

Twiggs Money Flow (21-day) signals strong accumulation in the

intermediate term.

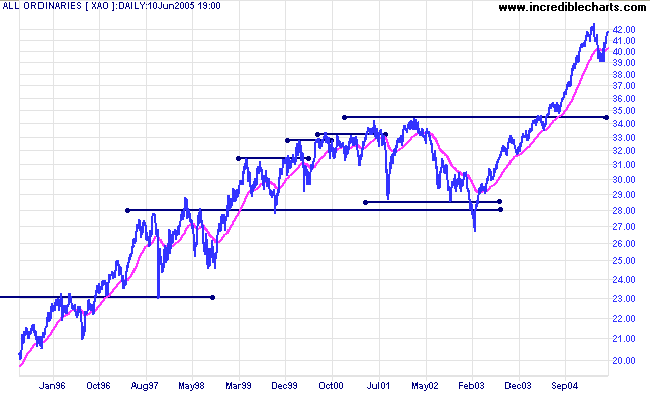

The most likely scenario is that we are at, or close to, a stage 3 top. My view is strongly influenced by two factors:

The most likely scenario is that we are at, or close to, a stage 3 top. My view is strongly influenced by two factors:

- the shape and extent of the previous rally, which resembles a spike; and

- the index is well above its previous support base.

For further assistance, read About

the Trading Diary.

Colin Twiggs

Engulfed by fear and suspicion,

we try desperately to invent ways out,

plan how to avoid

the obvious danger that threatens us so terribly.

Yet we're mistaken, that's not the danger ahead:

Another disaster, one we never imagined,

suddenly, violently, descends upon us,

and finding us unprepared - there's no time now -

sweeps us away.

~ C. P. Cavafy: Things Ended

we try desperately to invent ways out,

plan how to avoid

the obvious danger that threatens us so terribly.

Yet we're mistaken, that's not the danger ahead:

Another disaster, one we never imagined,

suddenly, violently, descends upon us,

and finding us unprepared - there's no time now -

sweeps us away.

~ C. P. Cavafy: Things Ended

Back Issues

Access the Trading Diary Archives.