|

Next Update |

|

Incredible Charts version 4.0.3.211 will be released next

week. |

Trading Diary

June 5, 2004

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use.

USA

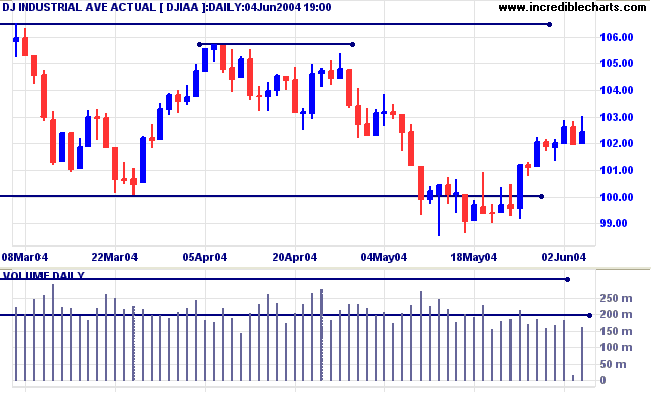

The Dow Industrial Average is still edging upwards but low

volume and Friday's weak close make the rally unconvincing.

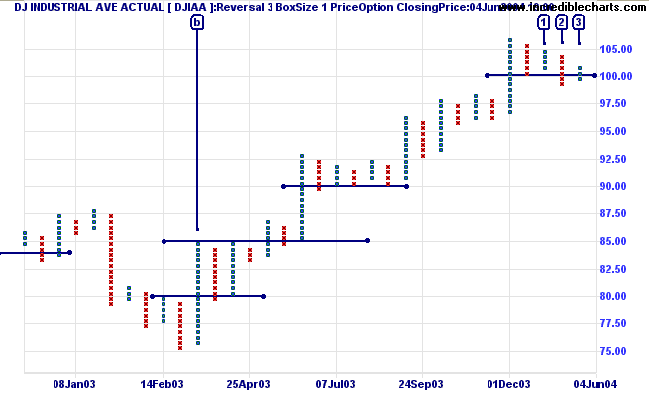

In the longer-term, the break below 10000 (at [2] on the P&F

chart) now appears to have been a false break, with the index

rallying back above resistance at [3]. A rally above the high of

[1] (at 10570) would signal resumption of the primary up-trend.

Failure to break above this level would be a bear signal.

Twiggs Money Flow (not shown) is still bearish.

Twiggs Money Flow (not shown) is still bearish.

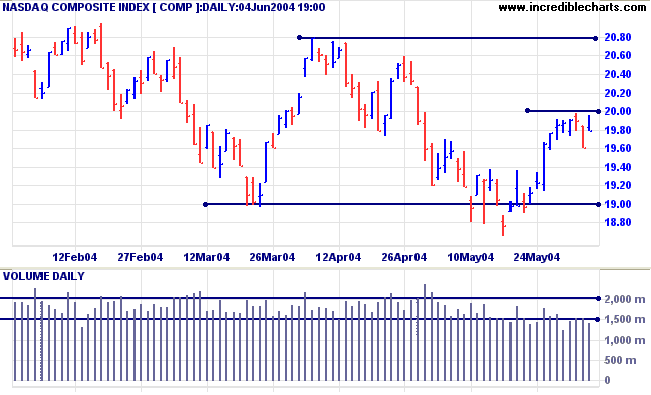

The Nasdaq Composite has encountered resistance at 2000

and lacks sufficient volume to penetrate this level.

Twiggs Money Flow continues to display a strong bear signal.

Twiggs Money Flow continues to display a strong bear signal.

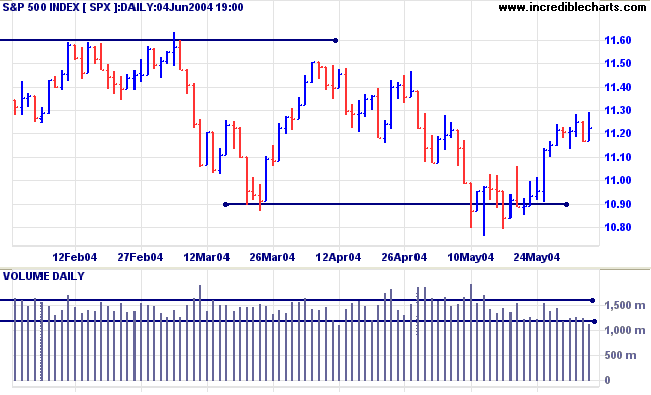

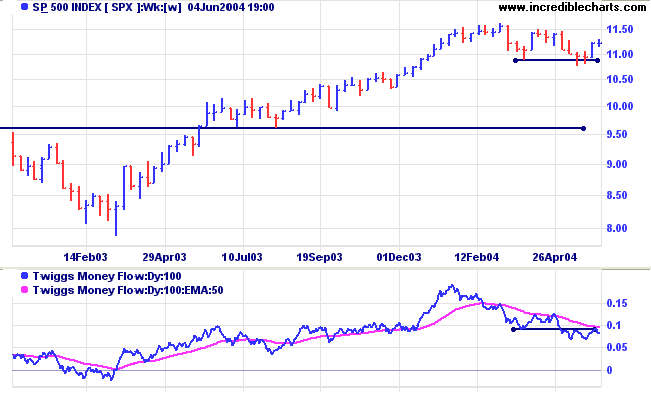

The S&P 500 is in a similar situation to the Dow:

consolidating on low volume after recovery above a key support

level (1090).

A clear break above resistance at 1150 would signal resumption of

the primary up-trend. Failure to break above this level would be

bearish.

Twiggs Money Flow continues to display a strong bear signal.

NYSE Bullish Percent Index

The Chartcraft Bullish Percent Index recovered to 62.07% but is still on Bear Alert status.

The Chartcraft Bullish Percent Index recovered to 62.07% but is still on Bear Alert status.

Treasury yields

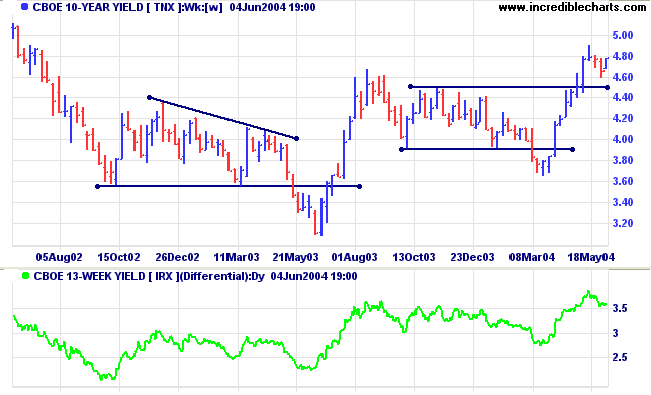

The yield on 10-year treasury notes appears to be consolidating above support at 4.50%. This would confirm the strength of the primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) at 3.6% reflects imminent rates increases.

The yield on 10-year treasury notes appears to be consolidating above support at 4.50%. This would confirm the strength of the primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) at 3.6% reflects imminent rates increases.

Gold

New York: Spot gold penetrated support at 390 before recovering to $390.60 shortly before Friday's close. A pull-back that respects support at 390 would signal a likely re-test of resistance at the previous 2004 highs. A break below support at 390 would indicate a bearish consolidation or slow down-trend.

New York: Spot gold penetrated support at 390 before recovering to $390.60 shortly before Friday's close. A pull-back that respects support at 390 would signal a likely re-test of resistance at the previous 2004 highs. A break below support at 390 would indicate a bearish consolidation or slow down-trend.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

ASX Australia

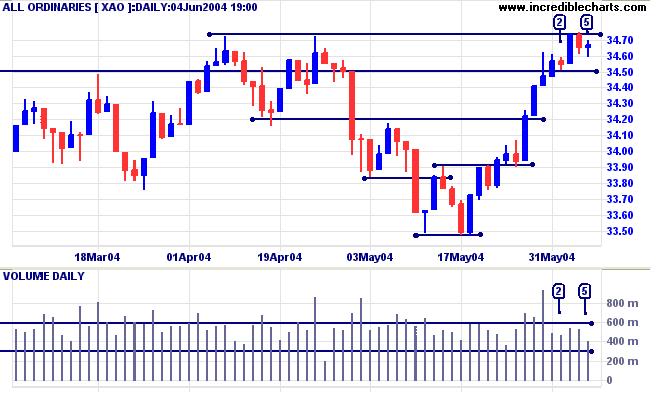

The All Ordinaries showed brief

consolidations at [2] and [5] on lower volume, after breaking

through resistance at 3450. This signals an absence of

selling pressure and we should see an attempt to establish a new

high in the next week.

The index is not yet out of the woods. I would

like to see a significant new high (as opposed to a marginal

break of one box) followed by confirmation in the form of a

pull-back that respects the new support level. Only then will I

be convinced that we are back in a strong bull

market.

Volume over the last few days appears light; and Twiggs Money Flow (not shown) continues to display a bearish divergence.

Volume over the last few days appears light; and Twiggs Money Flow (not shown) continues to display a bearish divergence.

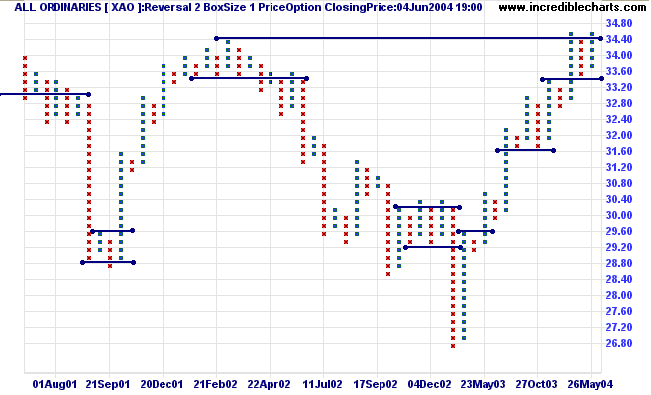

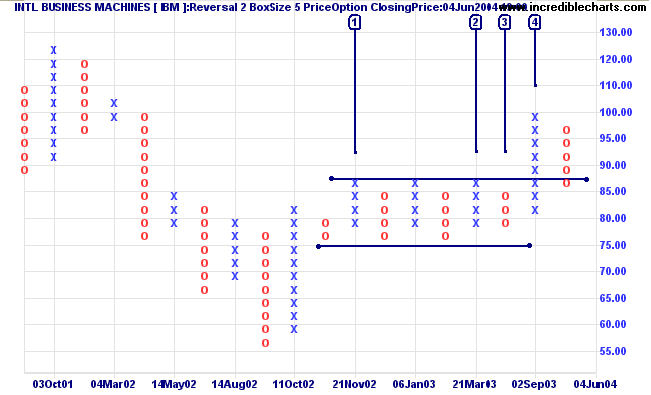

Point & Figure - Consolidation

Patterns

It is important to use a low reversal amount when scanning for consolidations. I find a reversal amount of 2 most useful for this purpose, being roughly equivalent to the method originally used by De Villiers & Taylor (The Point & Figure Method of Anticipating Stock Price Movements, 1933). Higher reversal amounts eliminate the narrow fluctuations found in most consolidations.

Narrow consolidations above and below support or resistance levels give important signals about buyer and seller behavior. I first discovered their importance when reading Schwager on Futures: Technical Analysis by Jack Schwager.

It is important to use a low reversal amount when scanning for consolidations. I find a reversal amount of 2 most useful for this purpose, being roughly equivalent to the method originally used by De Villiers & Taylor (The Point & Figure Method of Anticipating Stock Price Movements, 1933). Higher reversal amounts eliminate the narrow fluctuations found in most consolidations.

Narrow consolidations above and below support or resistance levels give important signals about buyer and seller behavior. I first discovered their importance when reading Schwager on Futures: Technical Analysis by Jack Schwager.

Consolidation at Resistance

In an up-trend we are likely to encounter consolidation in a narrow range above or below resistance:

In an up-trend we are likely to encounter consolidation in a narrow range above or below resistance:

- Consolidation below resistance indicates that buyers do not have sufficient strength to overcome selling pressure at the resistance level. But instead of being overwhelmed, with a resultant correction, they are buying up all available stock in a narrow band below resistance. Continued accumulation is likely to result in a shortage of available stock - and a consequent rise in price.

- Consolidation above resistance, after a breakout, also signals accumulation - and a subsequent price rise.

The subsequent pull-back has penetrated IBM's new support level.

A reversal above 80.00 would still be reasonably bullish:

continuing the sequence of higher lows.

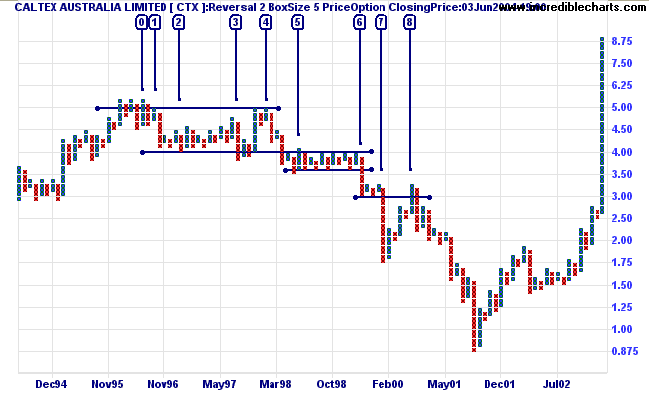

Consolidation at Support

The opposite occurs in a down-trend: consolidation is likely to occur at support levels.

The opposite occurs in a down-trend: consolidation is likely to occur at support levels.

- Consolidation above support indicates that sellers do not have sufficient strength to overcome buying pressure but, instead of being overwhelmed, they continue to sell stock in sufficient quantity to maintain price in a narrow band above support. Continued distribution is likely to result in a shortage of ready buyers (a surplus of stock) - and a consequent price fall.

- Consolidation after a breakout below support, signals that there are insufficient buyers to rally price above the new resistance level and are likely to give way under continued selling pressure.

The latest CTX rally is a good example of an upward spike,

explained in

last week's Trading Diary. My preferred strategy is to lock

in profits, with a sell-stop at the reversal point which would

start a new downward column.

Basic point and figure chart patterns are explained at the Trading Guide: P&F Chart Patterns.

Basic point and figure chart patterns are explained at the Trading Guide: P&F Chart Patterns.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

In this game, the market has to keep pitching,

but you don't have to swing.

You can stand there with the bat on your shoulder for six months until you get a fat pitch.

~ Warren Buffett

You can stand there with the bat on your shoulder for six months until you get a fat pitch.

~ Warren Buffett

Back Issues

Click here to access the Trading Diary Archives.

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.